2023 National Trade Estimate Report on

FOREIGN TRADE

BARRIERS

UNITED STATES TRADE REPRESENTATIVE

ACKNOWLEDGEMENTS

The Office of the United States Trade Representative (USTR) is responsible for the preparation of this

report. U.S. Trade Representative Katherine C. Tai gratefully acknowledges the contributions of all USTR

staff to the writing and production of this report and notes, in particular, the contributions of Laura Buffo,

Teresa Howes, Daniel Leibowitz, Amy Morris, and Andrew O’Neil.

Thanks are extended to partner Executive Branch members of the Trade Policy Staff Committee (TPSC).

The TPSC is composed of the following Executive Branch entities: the Departments of Agriculture, State,

Commerce, Defense, Energy, Health and Human Services, Homeland Security, Interior, Justice,

Transportation, and Treasury; the Environmental Protection Agency; the Office of Management and

Budget; the Council of Economic Advisers; the Council on Environmental Quality; the U.S. Agency for

International Development; the Small Business Administration; the National Economic Council; the

National Security Council; and, the Office of the United States Trade Representative; as well as non-voting

member the U.S. International Trade Commission. In preparing the report, substantial information was

solicited from U.S. Embassies.

Office of the United States Trade Representative

Ambassador Katherine C. Tai

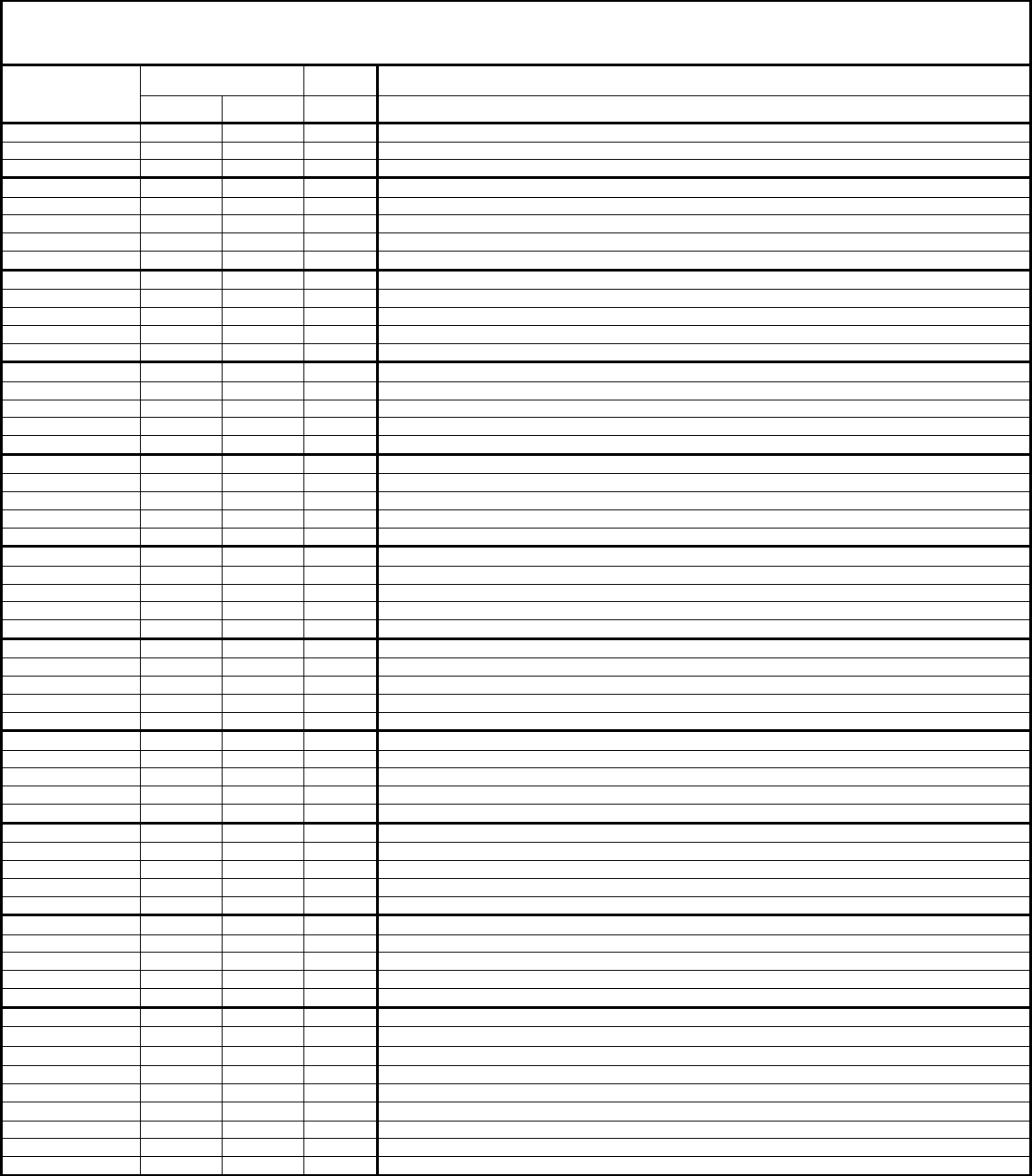

LIST OF FREQUENTLY USED ACRONYMS

APHIS .......................................................................... Animal and Plant Health Inspection Service,

U.S. Department of Agriculture

CVA ............................................................................. WTO Customs Valuation Agreement

DOL ............................................................................. U.S. Department of Labor

EU

1

............................................................................... European Union

FDA ............................................................................. Food and Drug Administration, U.S. Department of

Health and Human Services

FTA .............................................................................. Free Trade Agreement

GATT ........................................................................... General Agreement on Tariffs and Trade

GATS ........................................................................... WTO General Agreement on Trade in Services

GI ................................................................................. Geographical Indication

GPA ............................................................................. WTO Agreement on Government Procurement

G20 ............................................................................... Group of Twenty

HS ................................................................................ Harmonized System

HTS .............................................................................. Harmonized Tariff Schedule

ICT ............................................................................... Information and Communication Technology

IP .................................................................................. Intellectual Property

MFN ............................................................................. Most-Favored-Nation

MOU ............................................................................ Memorandum of Understanding

MRL ............................................................................. Maximum Residue Limit

OECD ........................................................................... Organization for Economic Cooperation and

Development

SBA .............................................................................. U.S. Small Business Administration

SME ............................................................................. Small and Medium-Sized Enterprise

SPS ............................................................................... Sanitary and Phytosanitary

TBT .............................................................................. Technical Barriers to Trade

TFA .............................................................................. WTO Trade Facilitation Agreement

TIFA ............................................................................. Trade and Investment Framework Agreement

TRQ ............................................................................. Tariff-Rate Quota

USAID ......................................................................... U.S. Agency for International Development

USDA ........................................................................... U.S. Department of Agriculture

USTR ........................................................................... United States Trade Representative

VAT ............................................................................. Value-Added Tax

WTO ............................................................................ World Trade Organization

1

Unless specified otherwise, all references to the European Union refer to the EU-27.

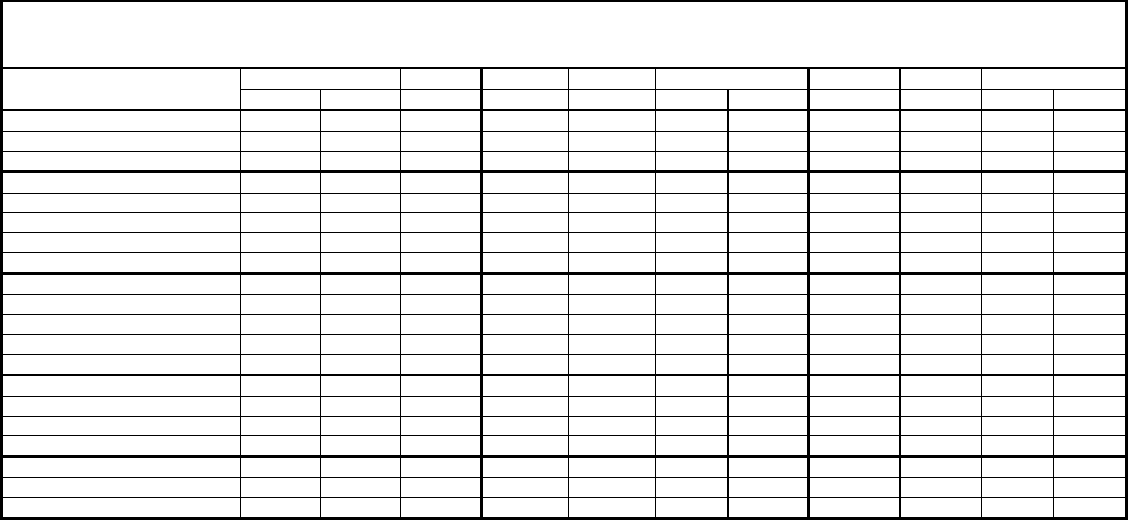

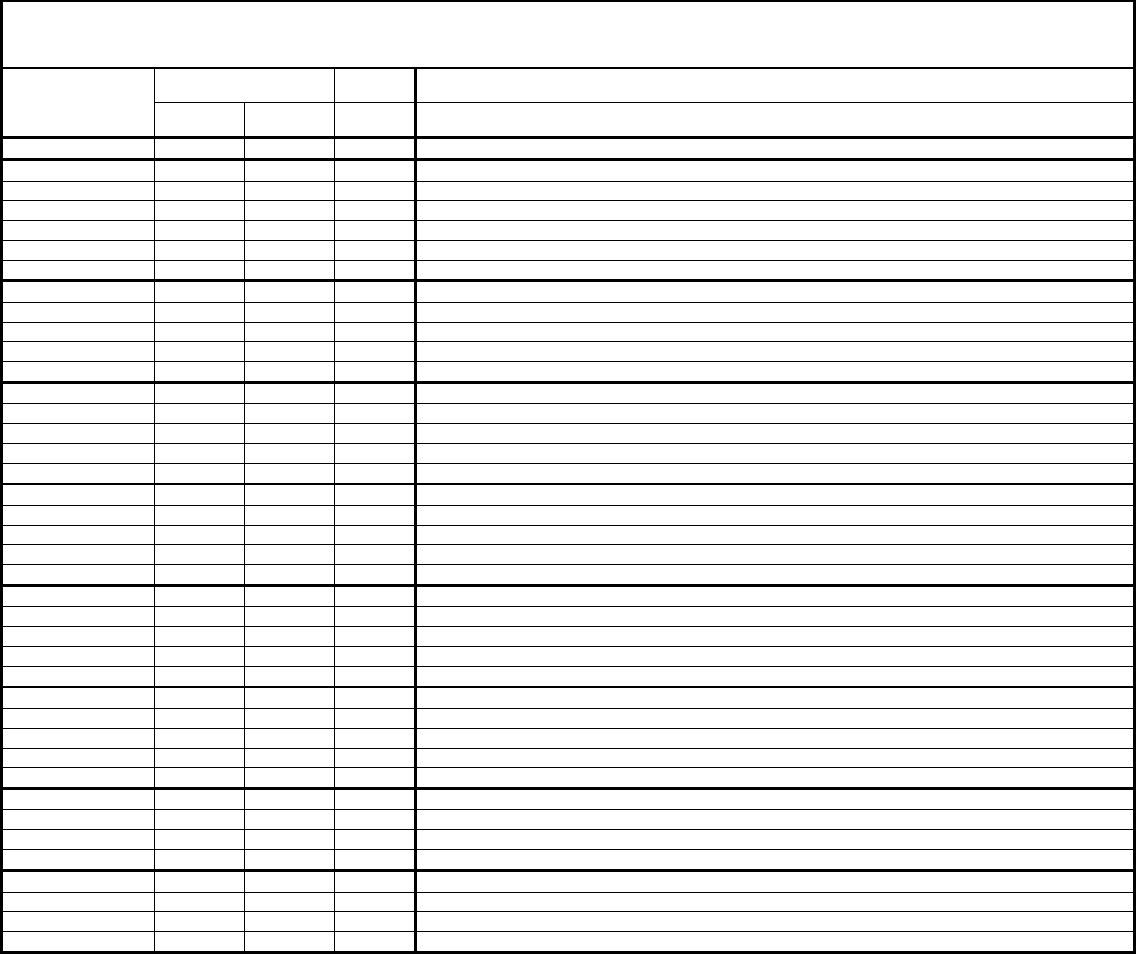

TABLE OF CONTENTS

FOREWORD ................................................................................................................................................ 1

ALGERIA ..................................................................................................................................................... 5

ANGOLA ...................................................................................................................................................... 9

ARAB LEAGUE ........................................................................................................................................ 13

ARGENTINA ............................................................................................................................................. 19

AUSTRALIA .............................................................................................................................................. 25

BAHRAIN .................................................................................................................................................. 29

BANGLADESH ......................................................................................................................................... 33

BOLIVIA .................................................................................................................................................... 39

BRAZIL ...................................................................................................................................................... 43

BRUNEI DARUSSALAM ......................................................................................................................... 49

CAMBODIA ............................................................................................................................................... 53

CANADA ................................................................................................................................................... 57

CHILE ......................................................................................................................................................... 63

CHINA ........................................................................................................................................................ 65

COLOMBIA ............................................................................................................................................. 107

COSTA RICA ........................................................................................................................................... 111

COTE D’IVOIRE ..................................................................................................................................... 115

DOMINICAN REPUBLIC ....................................................................................................................... 121

ECUADOR ............................................................................................................................................... 125

EGYPT ...................................................................................................................................................... 131

EL SALVADOR ....................................................................................................................................... 137

ETHIOPIA ................................................................................................................................................ 141

EUROPEAN UNION ............................................................................................................................... 147

GHANA .................................................................................................................................................... 179

GUATEMALA ......................................................................................................................................... 187

HONDURAS ............................................................................................................................................ 191

HONG KONG .......................................................................................................................................... 195

INDIA ....................................................................................................................................................... 197

INDONESIA ............................................................................................................................................. 211

ISRAEL .................................................................................................................................................... 229

JAPAN ...................................................................................................................................................... 231

JORDAN ................................................................................................................................................... 245

KENYA .................................................................................................................................................... 249

KOREA ..................................................................................................................................................... 257

KUWAIT .................................................................................................................................................. 265

LAOS ........................................................................................................................................................ 269

MALAYSIA ............................................................................................................................................. 273

MEXICO ................................................................................................................................................... 279

MOROCCO .............................................................................................................................................. 285

NEW ZEALAND ...................................................................................................................................... 289

NICARAGUA........................................................................................................................................... 291

NIGERIA .................................................................................................................................................. 295

NORWAY................................................................................................................................................. 303

OMAN ...................................................................................................................................................... 307

PAKISTAN ............................................................................................................................................... 311

PANAMA ................................................................................................................................................. 319

PARAGUAY ............................................................................................................................................ 323

PERU ........................................................................................................................................................ 325

THE PHILIPPINES .................................................................................................................................. 329

QATAR ..................................................................................................................................................... 339

RUSSIA .................................................................................................................................................... 345

SAUDI ARABIA ...................................................................................................................................... 359

SINGAPORE ............................................................................................................................................ 367

SOUTH AFRICA...................................................................................................................................... 369

SWITZERLAND ...................................................................................................................................... 375

TAIWAN .................................................................................................................................................. 379

THAILAND .............................................................................................................................................. 385

TUNISIA .................................................................................................................................................. 395

TURKEY .................................................................................................................................................. 399

UKRAINE................................................................................................................................................. 409

UNITED ARAB EMIRATES ................................................................................................................... 415

UNITED KINGDOM ............................................................................................................................... 423

URUGUAY............................................................................................................................................... 429

VIETNAM ................................................................................................................................................ 431

APPENDIX I ............................................................................................................................................ 443

APPENDIX II ........................................................................................................................................... 447

FOREIGN TRADE BARRIERS | 1

FOREWORD

SCOPE AND COVERAGE

The 2023 National Trade Estimate Report on Foreign Trade Barriers (NTE) is the 38th report in an annual

series that highlights significant foreign barriers to U.S. exports, U.S. foreign direct investment, and U.S.

electronic commerce. This document is a companion piece to the President’s 2023 Trade Policy Agenda

and 2022 Annual Report, published by the Office of the United States Trade Representative (USTR) on

March 1, 2023.

In accordance with section 181 of the Trade Act of 1974, as amended by section 303 of the Trade and Tariff

Act of 1984 and amended by section 1304 of the Omnibus Trade and Competitiveness Act of 1988, section

311 of the Uruguay Round Trade Agreements Act, and section 1202 of the Internet Tax Freedom Act,

USTR is required to submit to the President, the Senate Finance Committee, and appropriate committees

in the House of Representatives, an annual report on significant foreign trade barriers. The statute requires

an inventory from the previous calendar year of the most important foreign barriers affecting U.S. exports

of goods and services, including agricultural commodities and U.S. intellectual property; foreign direct

investment by U.S. persons, especially if such investment has implications for trade in goods or services;

and U.S. electronic commerce. Such an inventory enhances awareness of these trade restrictions, facilitates

U.S. negotiations aimed at reducing or eliminating these barriers, and is a valuable tool in enforcing U.S.

trade laws and strengthening the rules-based system.

The NTE Report is based upon information compiled within USTR, the Departments of Commerce and

Agriculture, and other U.S. Government agencies, as well as U.S. Embassies and supplemented with

information provided in response to a notice published in the Federal Register, and by the trade advisory

committees.

This Report discusses key export markets for the United States, covering 60 countries; the European Union;

Taiwan; Hong Kong, China; and, the Arab League. As always, omission of particular countries and barriers

does not imply that they are not of concern to the United States.

The NTE Report covers significant barriers, whether they are consistent or inconsistent with international

trading rules. Tariffs, for example, are an accepted method of protection under the General Agreement on

Tariffs and Trade 1994. Even a very high tariff does not violate international rules unless a country has

made a commitment not to exceed a specified rate, i.e., a tariff binding. Nonetheless, it would be a

significant barrier to U.S. exports, and therefore covered in the NTE Report. Measures not consistent with

international trade agreements, in addition to serving as barriers to trade and causes of concern for policy,

are actionable under U.S. trade law as well as through the World Trade Organization and free trade

agreements. Since early 2020, there were significant trade disruptions as a result of temporary trade

measures taken directly as a result of the COVID-19 pandemic.

Trade barriers elude fixed definitions, but may be broadly defined as government laws and regulations or

government-imposed measures, policies, and practices that restrict, prevent, or impede the international

exchange of goods and services; protect domestic goods and services from foreign competition; artificially

stimulate exports of particular domestic goods and services; fail to provide adequate and effective

protection of intellectual property rights; unduly hamper U.S. foreign direct investment or U.S. electronic

commerce; or impose barriers to cross-border data flows. The recent proliferation of data localization and

other such restrictive technology requirements is of particular concern to the United States.

2 | FOREIGN TRADE BARRIERS

The NTE Report classifies foreign trade barriers in 14 categories, as follows:

• Import policies (e.g., tariffs and other import charges, quantitative restrictions, import

licensing, pre-shipment inspection, customs barriers and shortcomings in trade facilitation or

in valuation practices, and other market access barriers);

• Technical barriers to trade (e.g., unnecessarily trade restrictive or discriminatory standards,

conformity assessment procedures, labeling, or technical regulations, including unnecessary or

discriminatory technical regulations or standards for telecommunications products);

• Sanitary and phytosanitary measures (e.g., measures relating to food safety, or animal and plant

life or health that are unnecessarily trade restrictive, discriminatory, or not based on scientific

evidence);

• Government procurement (e.g., closed bidding and bidding processes that lack transparency);

• Intellectual property protection (e.g., inadequate patent, copyright, and trademark regimes;

trade secret theft; and inadequate enforcement of intellectual property rights);

• Services (e.g., prohibitions or restrictions on foreign participation in the market, discriminatory

licensing requirements or standards, local-presence requirements, and unreasonable restrictions

on what services may be offered);

• Digital trade and electronic commerce (e.g., barriers to cross-border data flows, including data

localization requirements, discriminatory practices affecting trade in digital products,

restrictions on the supply of Internet-enabled services, and other restrictive technology

requirements);

• Investment (e.g., limitations on foreign equity participation and on access to foreign

government-funded research and development programs, local content requirements,

technology transfer requirements and export performance requirements, and restrictions on

repatriation of earnings, capital, fees and royalties);

• Subsidies, especially export subsidies (e.g., subsidies contingent upon export performance, and

agricultural export subsidies that displace U.S. exports in third country markets) and local

content subsidies (e.g., subsidies contingent on the purchase or use of domestic rather than

imported goods);

• Competition (e.g., government-tolerated anticompetitive conduct of state-owned or private

firms that restricts the sale or purchase of U.S. goods or services in the foreign country’s

markets or abuse of competition laws to inhibit trade; and fairness and due process concerns

by companies involved in competition investigatory and enforcement proceedings in the

country);

• State-owned enterprises (e.g., actions by SOEs and by governments with respect to SOEs

involved in the manufacture or production of non-agricultural goods or in the supply of services

that constitute significant barriers to, or distortions of, U.S. exports of goods and services, U.S.

investments, or U.S. electronic commerce, which may negatively affect U.S. firms and

workers. These actions include subsidies and non-commercial advantages provided to and

from SOEs; and practices with respect to SOEs that discriminate against U.S. goods or services,

FOREIGN TRADE BARRIERS | 3

or actions by SOEs that are inconsistent with commercial considerations in the purchase and

sale of goods and services);

• Labor (e.g., concerns with failures by a government to protect internationally recognized

worker rights

2

or to eliminate discrimination in respect of employment or occupation, in cases

where these failures influence trade flows or investment decisions in ways that constitute

significant barriers to, or distortions of, U.S. exports of goods and services, U.S. investment,

or U.S. electronic commerce, which may negatively affect U.S. firms and workers);

• Environment (e.g., concerns with a government’s levels of environmental protection,

unsustainable stewardship of natural resources, and harmful environmental practices that

constitute significant barriers to, or distortions of, U.S. exports of goods and services, U.S.

investment, or U.S. electronic commerce, which may negatively affect U.S. firms or workers);

and,

• Other barriers (e.g., barriers or distortions that are not covered in any other category above or

that encompass more than one category, such as bribery and corruption, or that affect a single

sector).

The prevalence of corruption is a consistent complaint from U.S. firms that trade with or invest in other

economies. Corruption takes many forms and affects trade and development in different ways. In many

countries and economies, it affects customs practices, licensing decisions, and the award of government

procurement contracts. If left unchecked, bribery and corruption can negate market access gained through

trade negotiations, frustrate broader reforms and economic stabilization programs, and undermine the

foundations of the international trading system. Corruption also hinders development and contributes to

the cycle of poverty. The Foreign Corrupt Practices Act prohibits U.S. companies from bribing foreign

public officials, and numerous other domestic laws discipline corruption of public officials at the State and

Federal levels. The United States continues to play a leading role in addressing bribery and corruption in

international business transactions and has made real progress over the past quarter century building

international coalitions to fight bribery and corruption.

Pursuant to Section 1377 of the Omnibus Trade and Competitiveness Act of 1988, USTR annually reviews

the operation and effectiveness of U.S. telecommunications trade agreements to make a determination on

whether any foreign government that is a party to one of those agreements is failing to comply with that

government’s obligations or is otherwise denying, within the context of a relevant agreement, “mutually

advantageous market opportunities” to U.S. telecommunication products or services suppliers. The NTE

Report highlights both ongoing and emerging barriers to U.S. telecommunication services and goods

exports from the annual review called for in Section 1377.

TRADE IMPACT OF FOREIGN BARRIERS

Trade barriers or other trade distorting practices affect U.S. exports to a foreign market by effectively

imposing costs on such exports that are not imposed on goods produced in the importing market. Estimating

the impact of a foreign trade measure on U.S. exports of goods requires knowledge of the additional cost

the measure imposes on them, as well as knowledge of market conditions in the United States, in the foreign

2

Internationally recognized worker rights include the right of association, the right to organize and bargain collectively, a

prohibition on the use of any form of forced or compulsory labor, a minimum age for the employment of children, and a

prohibition on the worst forms of child labor, and acceptable conditions of work with respect to minimum wages, hours of work,

and occupational safety and health.

4 | FOREIGN TRADE BARRIERS

market imposing the measure, and in third country markets. In practice, such information often is not

available.

In theory, where sufficient data exist, an approximate impact of tariffs on U.S. exports could be derived by

obtaining estimates of supply and demand price elasticities in the importing market and in the United States.

Typically, the U.S. share of imports would be assumed constant. When no calculated price elasticities are

available, reasonable postulated values would be used. The resulting estimate of lost U.S. exports would

be approximate, depend on the assumed elasticities, and would not necessarily reflect changes in trade

patterns with third country markets. Similar procedures might be followed to estimate the impact of

subsidies that displace U.S. exports in third country markets.

The estimation of the impact of non-tariff measures on U.S. exports is far more difficult, since no readily

available estimate exists of the additional cost these restrictions impose. Quantitative restrictions or import

licenses limit (or discourage) imports and thus are likely to raise domestic prices, much as a tariff does.

However, without detailed information on price differences between markets and on relevant supply and

demand conditions, it would be difficult to derive the estimated effects of these measures on U.S. exports.

Similarly, it would be difficult to quantify the impact on U.S. exports (or commerce) of other foreign

practices, such as government procurement policies, nontransparent standards, or inadequate intellectual

property rights protection.

The same limitations apply to estimates of the impact of foreign barriers to U.S. services exports.

Furthermore, the trade data on services exports are extremely limited in detail. For these reasons, estimates

of the impact of foreign barriers on trade in services also would be difficult to compute. With respect to

investment barriers, no accepted techniques for estimating the impact of such barriers on U.S. investment

flows exist. The same caution applies to the impact of restrictions on electronic commerce.

To the extent possible, the NTE Report endeavors to present estimates of the impact on U.S. exports, U.S.

foreign direct investment, or U.S. electronic commerce of specific foreign trade barriers and other trade

distorting practices. In some cases, stakeholder valuations estimating the effects of barriers may be

contained in the NTE Report. The methods for computing these valuations are sometimes uncertain.

Hence, their inclusion in the NTE Report should not be construed as a U.S. Government endorsement of

the estimates they reflect. Where government-to-government consultations related to specific foreign

practices were proceeding at the time of this NTE Report’s publication, estimates were excluded, in order

to avoid prejudice to these consultations.

March 2023

FOREIGN TRADE BARRIERS | 5

ALGERIA

TRADE AGREEMENTS

The United States–Algeria Trade and Investment Framework Agreement

The United States and Algeria signed a Trade and Investment Framework Agreement (TIFA) on July 13,

2001. This Agreement is the primary mechanism for discussions of trade and investment issues between

the United States and Algeria.

IMPORT POLICIES

Tariffs and Taxes

In May 2020, Algeria issued a decree to exempt from customs duties and value-added taxes (VAT) medical

devices, pharmaceutical products, and testing equipment imported to combat the COVID-19 pandemic.

Tariffs

Algeria is not a Member of the World Trade Organization (WTO), but is a WTO Observer. Goods imported

into Algeria face a range of tariffs, from zero percent to 200 percent. Algeria’s average Most-Favored-

Nation (MFN) applied tariff rate was 19 percent in 2021 (latest data available). Algeria’s average MFN

applied tariff rate was 23.6 percent for agricultural products and 18.2 percent for non-agricultural products

in 2021 (latest data available).

Goods facing the highest rates are those for which equivalents are manufactured in Algeria. Citing the need

to encourage local production and ease pressure on the country’s foreign exchange reserves, Algeria

adopted in January 2019 and implemented in April 2019 temporary additional safeguard duties (DAPs) of

30 percent to 200 percent on a list of more than 1,000 manufactured and agricultural goods, with the 200

percent rate applied to ten tariff lines covering cement products under the Harmonized System heading

25.23. The items in Algeria’s customs code that remain duty free are generally European Union (EU)-

origin goods that are used in manufacturing and are exempt from tariffs under the 2006 EU–Algeria

Association Agreement.

Non-Tariff Barriers

Import Bans and Import Restrictions

Since January 2009, Algeria’s Ministry of Health has restricted the import of a number of generic

pharmaceutical products and medical devices. In 2015, the Ministry of Health published a list of 357

generic pharmaceutical products banned from importation. The list became invalidated when authority

over pharmaceutical imports transferred from the Ministry of Health to the Ministry of Pharmaceutical

Industry in 2022. Since 2007, Algeria has banned the importation of used medical equipment unless the

government grants a special exception. Algeria has applied the regulation broadly to block the re-

importation of machinery sent abroad for maintenance under warranty, even for equipment owned by state-

run hospitals.

Algeria bans most types of used machinery from entry, except for refurbished assembly line equipment

used in domestic industries.

6 | FOREIGN TRADE BARRIERS

In February 2021, the Ministry of Commerce issued a schedule establishing a seasonal ban for individual

agricultural products. The schedule adjusted a year-round restriction on almond imports to a seasonal ban

covering June through August. In September 2021, Algeria restricted the import of animal products such

as tuna, yogurt, ice cream, liquid egg yolks, lambswool, camel hair, corned beef, live bait for fishing, and

non-food products such as baseball bats. In October 2021, Algeria restricted the import of additional

products for which there is minimal demand and for agricultural products not elsewhere specified or

indicated in Algeria’s tariff schedule. At the time, Algeria did not specify whether the restrictions on these

products are seasonal, and whether they extend beyond 2023, as is the case for import restrictions on

almonds. Algeria justified these decisions as necessary to reduce the country’s import bill and to combat

fraud.

In August 2021, the Ministry of Finance instructed banks to suspend the processing of accounts for

importers of products intended for resale starting at the end of October 2021 unless importers complied

with a March 2021 decree requiring them to update their import registration to include only one category

of product per company. The Ministry of Finance subsequently communicated implementation instructions

to the Ministry of Commerce’s National Center of Commerce Registry (CNRC) but not to importers

themselves. Importers must approach the CNRC individually to seek guidance regarding their particular

situation rather than rely on publicly available information.

Quantitative Restrictions

In August 2020, Algeria released a new Book of Specifications concerning the automotive industry. The

Book of Specifications covers automobiles, buses, trucks, construction equipment, and motorcycles. It

establishes an import quota of up to 200,000 vehicles per year, with an annual cap of $2 billion. Due to

customs duties, the VAT, and other taxes, vehicles cost more than double the market rates when purchased

by individuals overseas and imported into Algeria. While the import quota on kits for assembly of

passenger vehicles is set at zero, the regulation indicated that Algeria would set a new quota for automotive

companies that receive authorization to engage in local assembly or manufacturing. As of December 2022,

Algeria had not granted authorizations to import under the 2020 regime, and no new cars for sale in

dealerships have been imported since the regime was announced. A provision in the October 2022

Complementary Finance Law permits those residing in Algeria to import used cars which are three years

old or less, however purchasers are required to use their own foreign currency to do so.

In 2020, Algeria established a maximum annual import volume benchmark of four million metric tons of

bread (common) wheat. The Algerian President announced in August 2021 that the state grains agency

(OAIC) would be the country’s exclusive wheat importer to counteract alleged “illicit practices” by private

importers. In practice, the OAIC was already the sole buyer of wheat, reselling the commodity on the

domestic market at subsidized prices. In 2022, the Algerian President announced that the OAIC will have

the exclusive right to import pulses as well. However, Algeria has not codified the OAIC’s role as the sole

buyer of wheat and pulses.

Customs Barriers and Trade Facilitation

Clearing goods through Algerian Customs continues to be a problem facing some companies. Delays can

take weeks or months, in many cases without explanation. In addition to a certificate of origin, Algeria

requires all importers to provide certificates of conformity and quality from an independent third party.

Algerian Customs requires shipping documents be stamped with a “Visa Fraud” note from the Ministry of

Commerce, indicating that the goods have passed a fraud inspection before the goods are cleared. Many

importations also require authorizations from multiple ministries, which frequently causes additional

delays, especially when the regulations do not clearly specify which ministry’s authority is being exercised.

FOREIGN TRADE BARRIERS | 7

Storage fees at Algerian ports of entry are high, and the fees double if goods are stored for longer than 10

days.

Regulations introduced in October 2017 require importers to deposit with a bank a financial guarantee equal

to 120 percent of the cost of the import 30 days in advance. This requirement burdens small and medium-

sized importers that often lack sufficient cash flow.

Local Content Requirements

The 2020 Book of Specifications for the automotive industry increased domestic content requirements in

vehicle production. Minimum domestic content integration rates for domestic assembly plants will be 35

percent in 2023, 40 percent in 2024, and 50 percent thereafter. Additionally, the Book of Specifications

mandates that automotive importers be 100 percent Algerian-owned.

SANITARY AND PHYTOSANITARY BARRIERS

Algeria bans the production, importation, distribution, or sale of seeds that are the products of

biotechnology. There is an exception for biotechnology seeds imported for research purposes.

Algeria maintains strict animal health certificates for animals and animal products, dairy and dairy products,

as well as processed products of animal origin. In 2021, the U.S. Department of Agriculture (USDA) Food

Safety and Inspection Service (FSIS) submitted a letter requesting that Algeria accept the USDA 9060-5

export certificate for U.S. meat and poultry products. The USDA has not received a response. As of

December 2022, U.S. and Algerian veterinary authorities were continuing to negotiate export certificates

to allow importation of U.S. bovine semen, beef cattle, dairy breeding cattle, and beef and poultry meat and

meat products.

GOVERNMENT PROCUREMENT

Since August 2015, all ministries and state-owned enterprises (SOEs) are required to purchase domestically

manufactured products whenever available. Procurement of foreign goods are permitted only with special

ministerial authorization and if a locally made product cannot be identified. Algeria requires approval from

the Council of Ministers for expenditures in foreign currency that exceed DZD 10 billion (approximately

$72 million).

As Algeria is not a Member of the WTO, it is neither a Party to the WTO Agreement on Government

Procurement nor an observer to the WTO Committee on Government Procurement.

INTELLECTUAL PROPERTY PROTECTION

Algeria remained on the Watch List in the 2022 Special 301 Report. Algeria has taken some positive steps

to improve intellectual property (IP) protection and enforcement, including increasing coordination on IP

enforcement and engaging in capacity building and training efforts. However, concerns remain, including

the lack of an effective mechanism for the early resolution of potential pharmaceutical patent disputes,

inadequate judicial remedies in cases of patent infringement, the lack of administrative opposition in

Algeria’s trademark system, and the need to increase enforcement efforts against counterfeiting and piracy.

In addition, Algeria does not provide an effective system for protecting against the unfair commercial use

or unauthorized disclosure of undisclosed test or other data generated to obtain marketing approval for

pharmaceutical products.

8 | FOREIGN TRADE BARRIERS

BARRIERS TO DIGITAL TRADE AND ELECTRONIC COMMERCE

Since 2018, Algeria requires electronic commerce platforms conducting business in Algeria to register with

the government and to host their websites from a data center located in Algeria. Such localization

requirements impose unnecessary costs on service suppliers and disproportionately burden small firms by

requiring redundant storage systems.

Algeria imposes a maximum value per transaction of DZD 100,000 (approximately $720) on citizens’

purchases of goods from outside the country using international credit cards. In addition, Algerian foreign

exchange regulations prohibit the use of certain online payment processors to transfer money from one

account to another.

INVESTMENT BARRIERS

In 2020, Algeria lifted its longstanding requirement that Algerian individuals or entities own at least 51

percent of all projects involving foreign investments (known as the 51/49 rule). However, the 2021 Finance

Law re-imposed the 51 percent requirement, with retroactive application to foreign companies already

established in Algeria and owning more than 49 percent of operations in strategic sectors such as energy,

mining, defense, transportation and infrastructure, and pharmaceuticals, as well as for activities involving

raw materials and importers of goods for resale in Algeria. In July 2022, the Algerian Government enacted

an investment law that called for the creation of Invest Algeria, a one-stop shop for prospective investors

to register in-country.

STATE-OWNED ENTERPRISES

SOEs comprise about two-thirds of the Algerian economy by market value. The national oil and gas

company, Sonatrach, is the most prominent SOE, but SOEs are present in all sectors of the economy. SOEs

leverage their position in the market to gain advantage over privately owned competitors. For example,

state-owned telecommunications provider Algerie Telecom holds a monopoly over all undersea data cable

traffic in and out of Algeria, offering services at a considerable advantage over private companies operating

in the telecommunications sector.

FOREIGN TRADE BARRIERS | 9

ANGOLA

TRADE AGREEMENTS

The United States–Angola Trade and Investment Framework Agreement

The United States and Angola signed a Trade and Investment Framework Agreement (TIFA) on May 19,

2009. This Agreement is the primary mechanism for discussions of trade and investment issues between

the United States and Angola.

IMPORT POLICIES

Tariffs and Taxes

Tariffs

Angola’s average Most-Favored-Nation (MFN) applied tariff rate for all products was 10.9 percent in 2021

(latest data available). Angola’s average MFN applied tariff rate was 21.6 percent for agricultural products

and 9.1 percent for non-agricultural products in 2021 (latest data available). Angola has bound 100 percent

of its tariff lines in the World Trade Organization (WTO), with an average WTO bound tariff rate of 59.1

percent and average bound rates of 52.7 percent for agricultural products and 60.1 percent for non-

agricultural products.

In response to the COVID-19 pandemic, as of March 27, 2020, the General Tax Administration of Angola

allows all medicines and biosafety material to be imported duty free.

Taxes

The 2022 State Budget reduced the Industrial/Withholding Tax rate, which is levied on incidental services,

from 15 percent to 6.5 percent. The reduction is only applicable for 2022 and subject to review for 2023.

It also reduced the value-added tax (VAT) from a standard rate of 14 percent to 7 percent for certain food

products, goods, and services, such as hotels.

Non-Tariff Barriers

Import Restrictions

Presidential Decree No. 23/19 of January 2019 appears aimed to restrict the importation of certain products

unless the importer can demonstrate that the product is not available domestically. The Decree currently

includes more than 54 products, mainly agricultural goods, and applies to any imports that compete with

goods produced in the Luanda-Bengo special economic zone. Impacted products include poultry, maize

flour, and diapers. As of December 31, 2022, importers had observed minimal enforcement of the Decree

and had not reported restrictions on obtaining import licenses; however, importers remain concerned that

the Decree, if fully implemented, would have negative impacts on trade. In 2022, the United States

continued to raise concerns about the Decree with Angola bilaterally and in the WTO Council for Trade in

Goods, the WTO Committee on Market Access, and the WTO Committee on Agriculture.

10 | FOREIGN TRADE BARRIERS

SANITARY AND PHYTOSANITARY BARRIERS

Angola has not introduced a risk management program for veterinary and sanitary control purposes.

Therefore, consignments of imports classified in Chapters 2 to 23 of the Harmonized System (including

animal and vegetable products and foodstuffs) must be laboratory tested prior to entry into Angola and

accompanied by a health certificate.

Agricultural Biotechnology

Angola does not allow the use of agricultural biotechnology in production, and imports containing

genetically engineered (GE) components are limited to food aid and scientific research. Angola also

prohibits the importation of viable GE grain or seed. The Ministry of Agriculture and Forestry requires

importers to present documentation certifying that their goods do not include biotechnology products.

Importation of GE food is permitted when it is provided as food aid, but the product must be milled before

it arrives in Angola. The Ministry of Agriculture and Forestry allows biotechnology imports for scientific

research, subject to regulation and controls.

GOVERNMENT PROCUREMENT

Despite revisions to increase transparency in the Public Procurement Law that entered into force on January

22, 2021, stronger implementation of the law to make government procurement more transparent remains

important. Angolan civil society and business leaders note the government’s continued regular use of direct

public contract awards through tenders by pre-qualification, closed bidding or simplified contracting for a

regular and select few companies without the observation of public tenders in various sectors.

Companies that have participated in recent public tenders described the processes as fair and transparent

for bidders. In some instances, companies have had difficulty responding to all requirements described in

tenders that were “unclear.” In other instances, companies have complained of direct awards occurring

after a tender was announced, particularly in the health sector.

Angola is neither a Party to the WTO Agreement on Government Procurement nor an observer to the WTO

Committee on Government Procurement.

OTHER BARRIERS

Bribery and Corruption

While levels of corruption and bribery have declined, corruption remains prevalent in Angola for reasons

including an inadequately trained civil service, a highly centralized bureaucracy, a lack of funding to

improve capacity, and a lack of uniform implementation of anticorruption laws.

The Criminal Law and Criminal Procedure Codes (Law No. 38/20 and Law No. 39/20) entered into force

on February 9, 2021. Notable changes include corporate criminal liability, harsh penalties for corruption

of public officials, criminalization of private corruption, and provisions for seizure of proceeds of a crime,

among others. The law also contains provisions that criminalize bribery of national and foreign public

officials; seek an appropriate balance between immunities and the ability to effectively investigate,

prosecute, and adjudicate offences; enhance cooperation within local law enforcement authorities; and,

designate a central anticorruption authority.

Enforcement of anticorruption laws remains poor. The United States and the international community have

engaged in anticorruption initiatives to help Angola attain its anticorruption objectives. For instance, the

FOREIGN TRADE BARRIERS | 11

U.S. Department of State is funding the Financial Services Volunteer Corps (FSVC), a project that supports

Angolan civil society and independent media to increase public awareness and support for anticorruption

and transparency reform. FSVC is also implementing a U.S. Agency for International Development

(USAID) regional program that provides technical assistance, training, and mentoring at key government

institutions to improve public financial management, enhance oversight, and reduce fraud, waste, and abuse

of state resources.

Export Taxes

In December 2019, a revised customs tariff code entered into force, which, among other things, eliminated

the five percent export tax on crude ores.

Foreign Exchange

Angola’s dependence on oil and gas production means that activity in the sector heavily influences the

availability of foreign exchange. Foreign exchange availability has recently improved in major economic

sectors but remains inadequate for individuals and small businesses.

Business Licensing

In October 2021, the National Assembly approved Law No. 26/21, which revoked the Law of Commercial

Activities No. 1/07 of May 2007. Under Law No. 26/21, the authority to license business activity, which

previously rested with the Ministry of Commerce and, since July 2021, with provincial governments and

municipal administrations, was transferred to the Angolan President. The law also expands business

licensing eligibility. Commercial stakeholders have expressed concern that the transfer of authority could

create dependence on higher governmental powers to authorize commercial activity.

FOREIGN TRADE BARRIERS | 13

ARAB LEAGUE

The 22 Arab League members are the Palestinian Authority and the following countries: Algeria, Bahrain,

Comoros, Djibouti, Egypt, Iraq, Kuwait, Jordan, Lebanon, Libya, Mauritania, Morocco, Oman, Qatar,

Saudi Arabia, Somalia, Sudan, Syria, Tunisia, the United Arab Emirates, and Yemen. The effect of the

Arab League’s boycott of Israeli companies and Israeli-made goods (originally implemented in 1948) on

U.S. trade and investment in the Middle East and North Africa varies from country to country. On occasion,

the boycott can pose a barrier (because of potential legal restrictions) for individual U.S. companies and

their subsidiaries doing business in certain parts of the region. However, for many years, efforts by various

Arab League members to enforce the boycott have had an extremely limited practical effect overall on U.S.

trade and investment ties with many key Arab League countries. About half of the Arab League members

are also Members of the World Trade Organization (WTO), and are thus obligated to apply WTO

commitments to all current WTO Members, including Israel. To date, no Arab League member, upon

joining the WTO, has invoked the right of non-application of WTO rights and obligations with respect to

Israel.

In 2020, the United Arab Emirates, Bahrain, Morocco, and Sudan announced normalization agreements

with Israel as part of the Abraham Accords initiative. The normalization agreements include an intent to

expand formal trade and investment ties, among other economic operations, between these Arab League

countries and Israel. Egypt and Jordan, having earlier signed peace treaties with Israel, have long engaged

in formal bilateral trade with Israel and published official statistics regarding that trade. Currently, such

statistics from other Arab League members either are not published at all or are not regularly updated.

The United States has long opposed the Arab League boycott, and U.S. Government officials from a variety

of agencies frequently have urged Arab League member governments to end it. The U.S. Department of

State and U.S. embassies in relevant Arab League host capitals take the lead in raising U.S. concerns related

to the boycott with political leaders and other officials. The U.S. Departments of Commerce and Treasury

and the Office of the United States Trade Representative (USTR) monitor boycott policies and practices of

Arab League members, and, aided by U.S. embassies, lend advocacy support to firms facing boycott-related

pressures.

The Arab League boycott of Israel was the impetus for the creation of U.S. antiboycott authorities during

the 1970s. U.S. antiboycott laws (the 1976 Tax Reform Act (TRA) and the Anti-boycott Act of 2018, Part

II of the Export Control Reform Act of 2018, 50 U.S.C. Sections 4801-4852 (ECRA)), prohibit U.S. firms

from taking certain actions with the intent to comply with foreign boycotts that the United States does not

sanction. As a practical matter, foreign countries’ boycotts of Israel, as reflected in government directives,

laws, and regulations, continue to be the principal boycotts with which U.S. companies are concerned. The

ECRA’s antiboycott provisions are implemented by Part 760 of the Export Administration Regulations, 15

CFR Parts 770-774 (EAR). The Department of Commerce’s Office of Antiboycott Compliance (OAC)

oversees enforcement of Part 760, which prohibits certain types of conduct by U.S. persons (including

businesses) undertaken in support of any unsanctioned foreign boycott maintained by a country against a

country friendly to the United States. Prohibited activities include, inter alia, agreements by U.S.

companies to refuse to do business with a boycotted country, furnishment by U.S. companies of information

about business relationships with a boycotted country, and implementation by U.S. companies of letters of

credit that include boycott terms. The TRA’s antiboycott provisions, administered by the Department of

Treasury and the Internal Revenue Service, deny certain foreign tax benefits to companies that agree to

requests from boycotting countries to participate in certain types of boycotts.

The U.S. Government’s efforts to oppose the Arab League boycott include alerting appropriate officials in

the boycotting countries to the presence of prohibited boycott requests and the adverse impact of those

14 | FOREIGN TRADE BARRIERS

requests on U.S. firms and on Arab League members’ ability to expand trade and investment ties with the

United States. In this regard, OAC officials periodically visit Arab League members to consult with

appropriate counterparts on antiboycott compliance issues. These consultations provide technical

assistance to those counterparts to identify language in commercial documents that may constitute or be

related to prohibited and/or reportable boycott requests under Part 760 of the EAR.

Boycott activity can be classified according to three categories. The primary boycott prohibits the

importation of goods and services from Israel into the territory of Arab League members. This prohibition

may conflict with the obligation of Arab League members that are also Members of the WTO to treat

products of Israel on a Most-Favored-Nation basis. The secondary boycott prohibits individuals, companies

(both private and public sector), and organizations in Arab League members from engaging in business

with U.S. firms and firms from other countries that contribute to Israel’s military or economic development.

Such foreign firms may be placed on a boycott list maintained by the Central Boycott Office (CBO), a

specialized bureau of the Arab League. In the past, the CBO has often provided this list to Arab League

member governments for their use in implementing national boycotts. The tertiary boycott prohibits

business dealings with U.S. and other firms that do business with companies on the boycott list.

Individual Arab League member governments decide whether, or to what extent, to implement boycotts

against Israel through national laws or regulations. Enforcement of such boycotts varies widely among

them. Some Arab League member governments, in particular Syria and Lebanon, have consistently

maintained that only the Arab League as a whole can entirely revoke the boycott it called for. Other member

governments support the view that adherence to a boycott of Israel is a matter of national discretion; thus,

a number of governments have taken steps to dismantle various aspects of their national boycotts. The U.S.

Government has on numerous occasions indicated to Arab League member governments that their officials’

attendance at periodic CBO meetings is not conducive to improving trade and investment ties with the

United States and within the region. Attendance of Arab League member government officials at CBO

meetings varies; a number of governments have responded to U.S. officials that they only send

representatives to CBO meetings in an observer capacity or to push for additional discretion in national

enforcement of the CBO-drafted company boycott list.

The current situation in individual Arab League members is as follows:

ALGERIA: Algeria does not maintain diplomatic, cultural, or direct trade relations with Israel, although

indirect trade reportedly takes place. The country has legislation in place that in general supports the Arab

League boycott, but there are no specific provisions relating to the boycott and government enforcement of

the primary aspect of the boycott is reportedly sporadic. Algeria appears not to enforce any element of the

secondary or tertiary aspects of the boycott. However, regulations issued by individual government

agencies have at times banned contact with Israeli companies and entities, effectively barring the entry of

Israeli products.

COMOROS, DJIBOUTI, AND SOMALIA: None of these countries have taken steps to effectively

enforce a boycott against Israel.

EGYPT: Egypt has not enforced any aspect of the boycott since 1980, pursuant to its peace treaty with

Israel. In past years, Egypt has included boycott language drafted by the Arab League in documentation

related to tenders funded by the Islamic Development Bank.

IRAQ: As a matter of policy, Iraq does not adhere to the Arab League boycott. Most Iraqi ministries and

state-owned enterprises have agreed not to comply with or have rescinded regulations enforcing the boycott,

following a 2009 Council of Ministers decision to cease boycott-related implementation practices.

However, individual Iraqi Government officials and ministries continue to violate that policy. The Ministry

FOREIGN TRADE BARRIERS | 15

of Health’s procurement arm (Kimadia) was among the government entities that still issued boycott-related

requests.

Officials from the Departments of State and Commerce, and USTR continue to engage with their respective

interlocutors to ensure Iraqi officials are committed to investigating instances of boycott-related language

in contracts and tenders.

JORDAN: Jordan formally ended its enforcement of any aspect of the boycott when it signed the

Jordanian-Israeli peace treaty in 1994. Jordan signed a trade agreement with Israel in 1995 and later an

expanded trade agreement in 2004. While some elements of Jordanian society continue to oppose

improving political and commercial ties with Israel as a matter of principle, government policy has sought

to enhance bilateral commercial ties.

LEBANON: Since June 1955, Lebanese law has prohibited all individuals, companies, and organizations

from directly or indirectly contracting with Israeli companies and individuals, or buying, selling, or

acquiring in any way products produced in Israel. This prohibition is by all accounts widely adhered to in

Lebanon. Ministry of Economy officials have reaffirmed the importance of the boycott in preventing Israeli

economic penetration of Lebanese markets.

LIBYA: Prior to its 2011 revolution, Libya did not maintain diplomatic relations with Israel and had a law

in place mandating adherence to the Arab League boycott. The Qadhafi regime enforced the boycott and

routinely inserted boycott-related language in contracts with foreign companies and maintained other

restrictions on trade with Israel. The Libyan Government of National Unity has not articulated a stance on

the Arab League boycott, and the status of pre-2011 revolution laws requiring local firms to comply with

the boycott is unclear.

The United States will continue to monitor Libya’s treatment of boycott-related issues.

MAURITANIA: Mauritania does not enforce any aspect of the boycott despite freezing diplomatic

relations with Israel in March 2009 in response to Israeli military engagement in Gaza.

MOROCCO: Morocco agreed to normalize relations with Israel in August 2020. Morocco and Israel

signed a Joint Declaration re-establishing diplomatic relations on December 22, 2020. In January 2021,

Morocco and Israel agreed to establish joint working groups to promote cooperation in a variety of areas,

including investments, transportation, environment, energy, and tourism. Prior to the normalization

agreement, Morocco did not enforce the boycott consistently. Moroccan law contained no specific

references to the Arab League boycott and the government did not enforce any aspect of it. In recent years,

Morocco reportedly has been Israel’s third largest trading partner in the Arab world, after Jordan and Egypt.

Moroccan officials have reported that they are exploring new areas of economic cooperation with Israeli

officials. U.S. firms have not reported boycott-related obstacles to doing business in Morocco. Moroccan

officials do not appear to attend CBO meetings.

PALESTINIAN AUTHORITY: All foreign trade involving Palestinian producers and importers must be

managed through Israeli authorities. The Palestinian Authority agreed not to enforce the Arab League

boycott in a 1995 letter to the U.S. Government, and the Palestinian Authority has adhered to this

commitment. Various groups that advocate for Palestinian interests in different countries continue to call

for boycotts and other actions aimed at restricting trade in goods produced in Israeli West Bank settlements.

SUDAN: Sudan and Israel announced a normalization agreement in October 2020 that would include

Sudan renouncing the boycott. In 2021, Sudan repealed the boycott, publishing the repeal in the Sudan

Registry. This move ends Sudan’s official adherence to the boycott.

16 | FOREIGN TRADE BARRIERS

SYRIA: Traditionally, Syria was diligent in implementing laws to enforce the Arab League boycott. The

country maintained its own boycott-related list of firms, separate from the CBO list. Syria’s boycott

practices have not had a substantive impact on U.S. businesses due to U.S. economic sanctions imposed on

the country since 2004. The ongoing and serious political unrest within the country since 2011 has further

reduced U.S. commercial interaction with Syria.

TUNISIA: Upon the establishment of limited diplomatic relations with Israel, Tunisia terminated its

observance of the Arab League boycott. Since the 2011 Tunisian revolution, there has been no indication

that Tunisian Government policy has changed with respect to the boycott.

YEMEN: Although Yemen renounced observance of the secondary and tertiary aspects of the boycott in

1995, in the years since, Yemen has continued to enforce the primary boycott and certain aspects of the

secondary and tertiary boycotts. Ongoing political turmoil in the country has made it impossible to ascertain

current official Yemeni attitudes toward the boycott.

GULF COOPERATION COUNCIL: In September 1994, the Gulf Cooperation Council (GCC) member

countries (Bahrain, Kuwait, Oman, Qatar, Saudi Arabia, and the United Arab Emirates) announced that

they would no longer adhere to what they consider to be the secondary and tertiary aspects of the boycott,

eliminating a significant trade barrier to U.S. firms. In December 1996, the GCC countries recognized the

total dismantling of the boycott as a necessary step to advance peace and promote regional cooperation in

the Middle East and North Africa. Despite this commitment to dismantle the boycott, commercial

documentation containing boycott-related language continues on occasion to surface in certain GCC

member countries and to impact business transactions.

The situation in individual GCC member countries is as follows:

Bahrain: As part of its 2020 normalization agreement with Israel, Bahrain agreed to expand already robust

bilateral economic ties, including through establishment of direct flights between the two countries.

Bahrain participated in the September 15, 2020, commemoration in Washington, D.C. of the Abraham

Accords, and signed the Abraham Accords Declaration with the United States and the UAE. Unlike the

UAE, Bahrain did not formally rescind the 1963 Israeli Products Boycott Law, which remains listed in

Bahrain’s Official Gazette. Responding to U.S. and international banks seeking legal certainty, the Central

Bank of Bahrain issued a circular on August 30, 2021, assuring banks that no legal restrictions prevent

economic engagement with Israeli entities. Initial reactions to the circular, which has not been publicized

in the Official Gazette, from banking sector and other business community contacts were positive, with

most expressing optimism that the new guidance addressed the concerns of legal ambiguity and clarified

the removal of all Israeli Boycott Law restrictions. Since the official start of normalization in October 2020,

Bahrain and Israel signed a joint communique and several sectoral memoranda of understanding, which

were subsequently ratified by both governments’ legislative bodies. In February 2022, the Israeli prime

minister became the first Israeli official at that level to visit Bahrain.

Kuwait: Kuwait continues to recognize the 1994 GCC decision and no longer adheres to what they consider

to be the secondary or tertiary aspects of the boycott. Kuwait claims to have eliminated all direct references

to the boycott in procurement documentation as of 2000. Kuwait has a three-person boycott office, which

is part of the General Administration for Customs. Although Kuwaiti officials reportedly regularly attend

CBO meetings, since 2016, Kuwait has refrained from establishing barriers to trade, investment, or

commerce that are directed against U.S. persons operating or doing business in Israel, with Israeli entities,

or in any territory controlled by Israel.

FOREIGN TRADE BARRIERS | 17

Oman: Boycott-related language rarely appears in tender documents, reflecting Omani Government

officials’ professed commitment to ensuring that such language not be included. Officials have removed

boycott-related language when the language is brought to their attention. Omani customs processes Israeli-

origin shipments entering with Israeli customs documentation, although Omani firms typically avoid

marketing consumer products that can be identified as originating from Israel. Oman’s Ministry of Foreign

Affairs prohibits its diplomatic missions from taking part in Arab League boycott meetings.

Qatar: Qatar has a boycott law, but the extent to which the government enforces it is unclear. Although

Qatar renounced implementation of the boycott of U.S. firms that do business in Israel (the secondary and

tertiary boycott) in 1994, U.S. firms and their subsidiaries continue to report receiving boycott-related

requests from public Qatari companies. In those instances, U.S. companies have made efforts to substitute

alternative language. An Israeli trade office opened in Qatar in May 1996, but Qatar ordered the closure of

that office in January 2009 in protest against Israeli military action in Gaza. Despite this closure, Qatar

continues to allow trade with Israel and allows Israelis to visit the country. Qatar permits the entry of Israeli

business travelers who obtain a visa in advance.

Saudi Arabia: Saudi Arabia, in recognition of the 1994 GCC decision, renounced enforcement of the

secondary and tertiary boycott. Senior Saudi Government officials from relevant ministries have requested

that U.S. officials keep them informed of any allegations that Saudi entities are seeking to enforce these

aspects of the boycott. Saudi entities have expressed a willingness to substitute non-boycott-related

language in commercial documents. In the years since 2018, Saudi Arabia has permitted direct flights from

foreign countries to Israel to transit Saudi airspace.

The United Arab Emirates: As part of its August 2020 normalization agreement with Israel, the UAE issued

a decree ending the UAE’s adherence to the Arab League boycott. Since that announcement, the two

countries have rapidly established commercial connections, opening direct trade, phone, mail, banking, and

passenger flight connections. The UAE has clarified to the U.S. Department of Treasury that the August

2020 Decree confirms that there is no Emirati law or legislation that stipulates any boycott of Israel, its

nationals, or its companies, and no Emirati law or legislation that requires a boycott of companies or

individuals that do business with Israel, or imposes restrictions on other trading partners’ companies or

individuals that do business with Israel. Prior to the normalization agreement, the UAE had been one of

the leading sources of prohibited boycott requests. The Department of State and interagency partners have

engaged UAE officials in detail on the boycott repeal, with UAE officials unequivocally confirming that

UAE participation in the boycott has been terminated. U.S. Government officials will continue to engage

the UAE on the issue.

FOREIGN TRADE BARRIERS | 19

ARGENTINA

TRADE AGREEMENTS

The United States–Argentina Trade and Investment Framework Agreement

The United States and Argentina signed a Trade and Investment Framework Agreement (TIFA) on March

23, 2016. This Agreement is the primary mechanism for discussions of trade and investment issues between

the United States and Argentina.

IMPORT POLICIES

Tariffs and Taxes

Tariffs

Argentina’s average Most-Favored-Nation (MFN) applied tariff rate was 13.4 percent in 2020 (latest data

available). Argentina’s average MFN applied tariff rate was 10.3 percent for agricultural products and 13.9

percent for non-agricultural products in 2020 (latest data available). Argentina has bound 100 percent of

its tariff lines in the World Trade Organization (WTO), with an average WTO bound tariff rate of 31.8

percent.

Argentina is a founding member of the Southern Common Market (MERCOSUR), formed in 1991, which

also comprises Brazil, Paraguay, and Uruguay. MERCOSUR’s Common External Tariff (CET) ranges

from zero percent to 35.0 percent ad valorem and averages 12.5 percent. In July 2022, MERCOSUR

countries agreed to a 10 percent reduction of the CET for over 80 percent of product lines. Any good

imported into Argentina (not including free trade zones) is subject to the payment of the CET to Argentina’s

customs authority. If the product is then re-exported to another MERCOSUR country, the CET must be

paid again to the second country. MERCOSUR approved a Common Customs Code (CCC) in 2010 and

launched a plan to eliminate the double application of the CET within MERCOSUR in 2021. However,

only Argentina has ratified the CCC, and it has not taken effect.

Taxes

Argentina maintains a variety of taxes on, and tax exemptions for, imported goods. On December 23, 2019,

the Argentine Congress passed Public Emergency Law 27541, raising to 3 percent the rate of the statistical

tax, a fee charged on goods imported for consumption. Temporary imports, inputs used to produce goods

for export, and imported goods for scientific and technological research are exempted from this tax.

Pursuant to Decree 901/2021, the 3 percent statistical tax rate was extended until December 31, 2024.

Argentina’s tax collection processes burden imports by effectively requiring advance payment of income

taxes. When goods are imported, Argentina collects a percentage of the value of imports as income tax

withholding to be applied to the importer’s income taxes. The advance value-added tax (VAT), ranging

from 10 percent to 20 percent, is paid by the importer, unless the goods are for personal use. In addition,

the importer is responsible for an income tax withholding of 6 percent to 11 percent of the value of the

imported goods. Further, there is an additional advance VAT rate of 20 percent for imports of consumer

goods and 10 percent for imports of capital goods. Although some of these taxes on importation are

reconciled after importation, in practice that takes a significant amount of time. In Argentina’s inflationary

environment this advance payment system disproportionately burdens imports.

20 | FOREIGN TRADE BARRIERS

Argentina also uses its tax system to incentivize local production and use of local inputs. For example,

Resolution 599-E/2016, pursuant to Law 27263, provides tax credits to automotive manufacturers for the

purchase of locally-produced automotive parts and accessories incorporated into specific types of vehicles.

The tax credits range from 4 percent to 15 percent of the value of the purchased parts. In another example,

imports of used capital goods are subject to higher taxes if there is local production of those inputs.

Non-Tariff Barriers

Import Bans

Argentina prohibits the importation of many used capital goods. Under the Argentina–Brazil Bilateral

Automobile Pact, Argentina bans the importation of used self-propelled agricultural machinery unless it is

imported to be rebuilt in-country. Argentina also prohibits the importation and sale of used or retreaded

tires (but in some cases allows remolded tires); used or refurbished medical equipment, including imaging

equipment; and, used automotive parts.

Argentina generally restricts or prohibits the importation of any remanufactured good, such as

remanufactured automotive parts, earthmoving equipment, medical equipment, and information and

communication technology products. In the case of remanufactured medical goods, imports are further

restricted by the requirement that the importer of record must be the end user, such as a hospital, doctor, or

clinic. These parties are generally not accustomed to importing and are not typically registered as importers.

Import Restrictions

Domestic legislation requires compliance with strict conditions on the entry of those used capital goods that

are not prohibited from being imported, as follows: (1) used capital goods can only be imported directly

by the end user; (2) overseas reconditioning of goods is allowed only if performed by the original

manufacturer and third-party technical appraisals are not permitted; (3) local reconditioning of the good is

subject to technical appraisal to be performed only by the state-run Institute of Industrial Technology,

except for aircraft-related items; (4) imported used capital good cannot be transferred (sold or donated) for

a period of four years; and, (5) except for a short list of products exempted by Decree 406/2019, and

regardless of where the reconditioning takes place, the Argentine Customs Authority requires the

presentation of a “Certificate of Import of Used Capital Goods” at the time of importation.

Resolution 909/1994 places restrictions on the importation of certain used goods for consumption, such as

parts and components that are not used in the manufacture of other products. The current list imposes

import tariffs or other restrictions on goods including electronic and recording equipment; railroad vehicles

and other railroad parts; optic, photography, and filming equipment; tractors; buses; aircraft; and, ships.

Under the “Por una Argentina Inclusiva y Solidaria - PAIS” tax, goods and services billed in foreign

currency or that involve international transportation by air, land (except to countries that border Argentina),

or water, and sold in Argentina (through a physical or online point of sale) are subject to a 30 percent tax.

This affects services supplied by travel and tourism agencies for international travel, as well as the

importation of products from online retailers. Decree 99/2019 also sets a lower rate of eight percent for