2

World Bank Fast Payments Toolkit

Glossary of terms

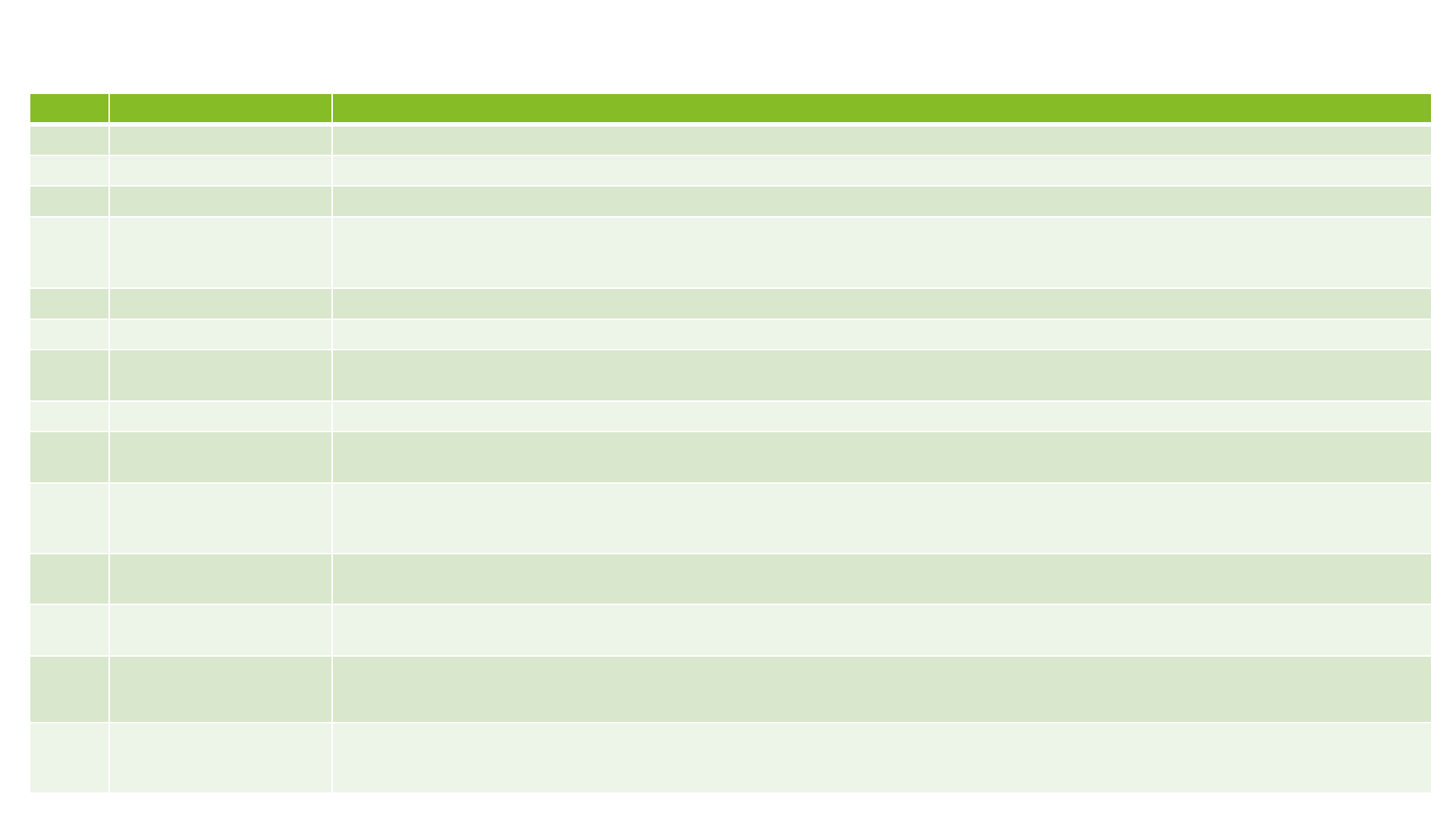

S. No. Term Definition

1 GDP Gross Domestic Product at current price

2 Income Category Classification as per World Bank based on Gross National Income (GNI) per capita

3 CPMI Committee on Payments and Market Infrastructure

4 FPS

As per CPMI, fast payment System is defined as payments in which the transmission of the payment message and the

availability of final funds to the payee occur in real time or near-real time and on as near to a 24-hour and 7-day (24/7) basis

as possible

5 Oversight Regulating or governing body supervising the payments system

6 Operator Institutions responsible for the operation of the payment system

7 Alias

Alternative to bank account numbers for increased convenience of the customer. For e.g., mobile number, national

identification number

8 Access Channels Modes used by customer to initiate transaction on FPS. For e.g., branch, internet, mobile

9

Individual Payment

Type

Person to person (P2P) – Payment between individuals for non-business purposes

10

Business Payment

Type

Person to Business (P2B) – Payment from an individual to a business entity

Business to Person (B2P) – Payment from a business entity to an individual

Business to Business (B2B) – Payment between two business entities

11

Government

Payment Type

Person/Business to Government (P/B2G) – Payment from person/Business to a government institution

Government to Person/Business (G2P/B) – Payment from government institution to a person or business entity

12 Credit transfers

Credit transfers are payment instruments based on payment orders or possibly sequences of payment orders made for the

purpose of placing funds at the disposal of the payee

13 Direct Debits

Direct debits are payment instruments in which the transaction is pre-authorized, and funds are blocked in account for a debit

to be initiated at a future date. In direct debits, payer’s account is debited on execution of mandate by merchant or payee

14 E-money

E-money is a prepaid value stored electronically, which represents a liability of the e-money issuer (a bank, an e-money

institution or any other entity authorized or allowed to issue e-money in the local jurisdiction), and which is denominated in a

currency backed by an authority

3

World Bank Fast Payments Toolkit

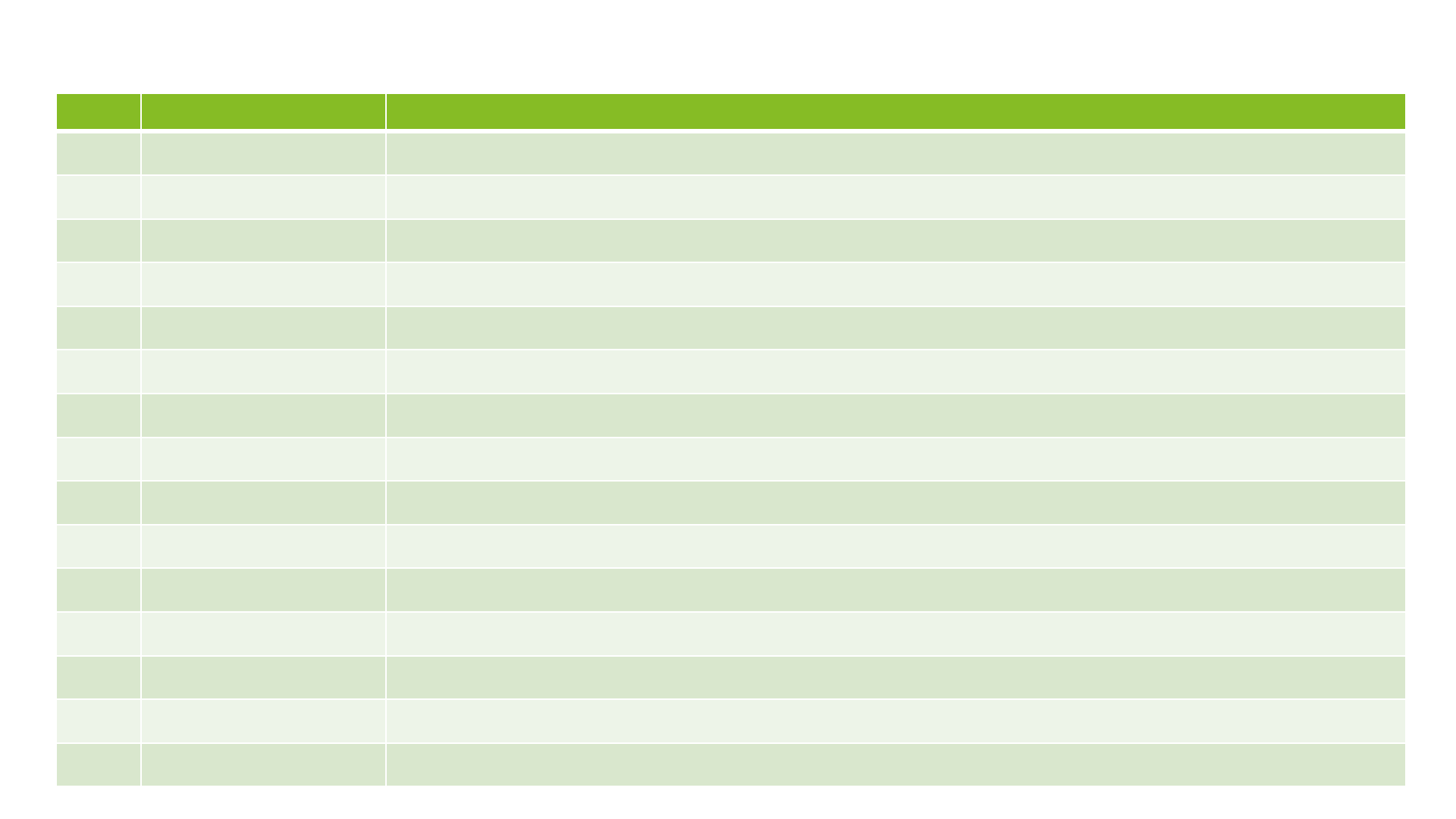

S.No. Term Expanded form

1 ABA American Bankers Association

2 CUNA Credit Union National Association

3 ICBA Independent Community Bankers of America

4 FDIC Federal Deposit Insurance Corporation

5 FFIEC Federal Financial Institutions Examination Council

6 FRB Board of Governors of the Federal Reserve System

7 NACHA National Automated Clearing House Association

8 NAFCU National Association of Federally-Insured Credit Unions

9 OCC Office of the Comptroller of the Currency

10 RTGS Real-time Gross Settlement

11 RTP Real time Payments

12 SIFMU Systemically Important Financial Market Utility

13 TCH The Clearing House

14 TLS

Transport Layer Security

15 TPSP

Third Party Service Provider

Abbreviations

4

World Bank Fast Payments Toolkit

Select parameters

Source : World Bank – 2019, Income Category: World Bank – June 2019

Others – World Bank 2017

* For age >15 years

GDP

GDP – $21.42 trillion

Income Category

High

Population

328.23 million

Access to mobile phone*

94.86%

Access to internet*

90.40%

Bank account*

93.12%

Branches per 100,000

adult

31.46

Made or received digital

payment in last 1 year*

91.10%

Received government wages

or transfer in account*

64.98%

5

World Bank Fast Payments Toolkit

How to read this report

• This deep dive report relates to the RTP system in USA

• It has been developed based on primary interviews with key stakeholders such as regulators, operators and participants in the

system as well as by leveraging secondary sources

• Key secondary sources include TCH website and RTP playbooks

• The table below presents a legend to assist readers as they navigate through different sections of the report

Legend

The green box with the adjacent icon indicates section/sub-section summary across the report. Reader may choose to

read through this for a high-level overview on the selected topic

The first slide of every section includes a chapter summary to provide readers with an overview of the section contents

6

World Bank Fast Payments Toolkit

Table of Contents

Slide number

A.

Executive Summary

8

B.

Detailed Report

1 Overview

1.1.

Background and Objectives | RTP 11

1.2.

System Development | RTP 12

1.3.

Key Milestones | RTP 13

1.4.

Background and Objectives | FedNow 14

1.5.

System Development | FedNow 15

2

Business and Operating Model

2.1.

FPS Structure 17

2.2.

Participants 18-20

2.3.

Payment Instruments and Payment Types 21

2.4.

Access Channels, Agent Network and Aliases 22

2.5.

Scheme Pricing and Fee Structure 23

2.6.

Use Cases / Services

24

3

User Adoption

25

4

Technical Details and Payment Process

4.1.

Technical Details (Messaging Format, QR Codes, APIs and Customer Authentication) 27-28

4.2.

Payment Process (Customer Registration, Transaction Fulfilment, Liquidity Management and Settlement) 29-32

5

Governance Framework

5.1.

Legal and Regulatory Aspects 35-36

5.2.

Risk Management 37-39

5.3.

Dispute Resolution and Customer Complaints 40

6 Annexure

6.1.

Key Features 42

A. Executive Summary

8

World Bank Fast Payments Toolkit

RTP | USA FPS

• RTP is a real-time electronic fund transfer system operating on 24*7 basis. It was

launched in November 2017

• The Clearing House (TCH) is the owner and operator of RTP. TCH Supervisory Board

and TCH Managing Board have appointed RTP Business Committee to oversee and

govern the system

• RTP’s development was primarily a market driven initiative. In 2014, TCH announced

Future Payments Initiative, this initiative paved the way for system development. RTP

enables consumers, businesses and government agencies to make real-time payments

in American Dollars

• TCH collaborated with Vocalink for the system development. The implementation of

the RTP network took approximately 30 months

Key features of RTP system are:

• Users can make RTP payments via traditional and alternate delivery channels

(Branch, ATM, internet or mobile banking platforms)

• Currently, the RTP system supports use cases/services like Bulk/Batch payments,

Bill Payments, Merchant Payments, Request to Pay and Recurring Payments

• TCH is currently collaborating with participating institutions to promote the usage of

bill payments. US Faster Payments Council has a working group that is looking at the

possibility of enabling QR payments using real time payments, including the RTP

network

• Real time payments

• Separation of technical

connection and settlement

mechanism

• Operates 24x7x365

• ISO 20022 messaging

standard

• Real time gross settlement

• Fraud detection services

Source: TCH | Primary Interviews

B. Detailed Report

10

World Bank Fast Payments Toolkit

1. Overview

Chapter Summary:

• Future Payments Initiative was announced in 2014 by The Clearing House that paved

the way for development of RTP system

• The guiding principles of RTP system include Ubiquity, Adaptability, Extensibility and

Global Compatibility

• RTP system was a market driven initiative as TCH worked closely with industry associations

to develop a system that would fulfil payment needs in an increasingly digital economy

• TCH partnered with Vocalink for system development. It took approximately 12 months

to assess business requirements and 18 months to develop RTP system and on-board

initial six participants

• RTP system core infrastructure is based on Vocalinks’s Instant Payment Service and

resembles the basic architecture used in the FPS in Singapore and Thailand

• Access model for RTP system has been customized to meet the requirements of the USA

market. It separates technical connection and settlement mechanism and allows

several approaches to participants for connecting with the system

Chapter sections:

1.1. Background & Objectives

1.2. System Development

1.3. Key Timelines

Source: TCH | Primary Interviews

11

World Bank Fast Payments Toolkit

1.1. Background and Objectives | RTP

RTP system is the first new core payments infrastructure in the USA in the last 40 years. It was launched by The Clearing House (TCH) in

November 2017. RTP is a real time, 24*7 payment and messaging system that allows immediate fund transfers through accounts at financial

institutions. The Clearing House, payments consortium of 25 banks and various technology companies, is the owner and operator of the RTP

system.

RTP system was built for financial institutions of all sizes and serves as a platform for innovation allowing financial institutions to deliver new

products and services to their customers. Financial Institutions can integrate into the RTP network directly, through Third-Party Service

Providers, Bankers’ Banks and Corporate Credit Unions.

• The Clearing House

launched the RTP

network in

November 2017 to

bring real-time

payments to the

USA

• RTP system was a

market driven

initiative as TCH

worked closely with

industry association

to identify consumer

and business cases

with need for the

real time payments

• The guiding

principles of RTP

system include

Ubiquity,

Adaptability,

Extensibility and

Global

Compatibility

In 2014, The Clearing House launched its Future Payments Initiative based on the recommendations from its supervisory board, which

consists of several industry leaders from financial institutions. The aim of this initiative was to develop a strategic view of RTP based on an

extensive study of payment needs in an increasingly digital economy. Through this review, TCH assessed several aspects surrounding RTP:

• TCH worked closely with industry associations including the Federal Reserve, NACHA, ABA, ICBA, NAFCU, CUNA and TCH banks to

identify consumer and business cases with the greatest need for RTP that represent the best incremental value for customers

• The Future Payments initiative considered the experience and lessons learnt from other countries who had already established

their own real-time payments system

• TCH also reviewed ways in which a potential RTP system for the U.S. could maintain and improve the safety and soundness of existing

payment systems

RTP system was a market driven initiative as TCH worked closely with industry associations to develop a

system that would fulfil payment needs in an increasingly digital economy

Source: TCH | Primary Interviews

TCH has developed a safe, sustainable, standards-based RTP system that is inclusive of all the financial institutions (FIs) in the USA. RTP

system includes extensible messaging and robust security and allows FIs to develop creative and innovative products for their customers.

The guiding principles followed by TCH for development of the system include the following:

Ubiquity – Accessible to FIs of all sizes and charter

types in order to reach the vast majority of U.S. account

holders

Extensibility – Rich, flexible messaging functionality to

support innovative value-added products

Adaptability – Able to adapt as expectations and risk

environment inevitably change over time

Global Compatibility – Use of international global

standards to facilitate future interoperability & to ease

the implementation burden for multinational FIs

12

World Bank Fast Payments Toolkit

1.2. System Development | RTP

Based on the findings from Future Payments Initiative, TCH announced a multiyear initiative to build a ubiquitous RTP system for the

USA. Faster payments Task Force was formed to identify and assess approaches for implementing safe, ubiquitous, faster payments

capabilities in the USA. TCH had submitted the design of the RTP system for an independent evaluation. RTP's proposed design met all

the 36 assessment criteria identified by the task force.

Infrastructure Setup – Key decisions

• RTP system resembles the basic architecture used in the FPS in Singapore and Thailand. However, it has undergone extensive

modifications to meet the local market requirements in particular settlement mechanism, access model and non-payment messages

(request to pay, request to confirmation, etc.)

• Access model separates technical connection and settlement mechanism. This model was adopted keeping in mind the complexity of USA

market. It allows all the financial institutions to connect with the using several approaches

• Network connectivity is via MPLS or Secure VPN. In addition to the security provided by the MPLS or Secure VPN connection, MQ

Transport Layer Security (TLS) is utilized and each message is digitally signed to ensure authenticity in accordance with ISO 20022

• Real time gross settlement (RTGS) mechanism was chosen for final settlement for ensuring the settlement finality

•

The Clearing House partnered with Vocalink for the development

of RTP system

•

An RFP was issued for vendor selection for which TCH received

response from 3 service providers. After the selection process laid out

by TCH, Vocalink was on-boarded for system development in

December 2015

•

As development of the RTP system was a market driven initiative, the

system development cost has been paid by the financial institutions

owning The Clearing House

Development Process Implementation Timelines

• TCH announced the

development of the

RTP system based

on findings from its

Future Payments

Initiative

• Vocalink was on-

boarded for

development of RTP

system after a

vendor selection

process

• System development

timelines were

approximately 30

months as RTP was

launched in

November 2017

Development

Cost

• Technical costs involved in the

system development were not high

though cost of deployment for

participant was significant ranging up

to $2 billion

Development

Timelines

• 12 months defining the requirement

of the system in collaboration with

market participants

• 12 months for system development

and 6 months for testing and on

boarding initial six participants

Source: TCH | Primary Interviews

13

World Bank Fast Payments Toolkit

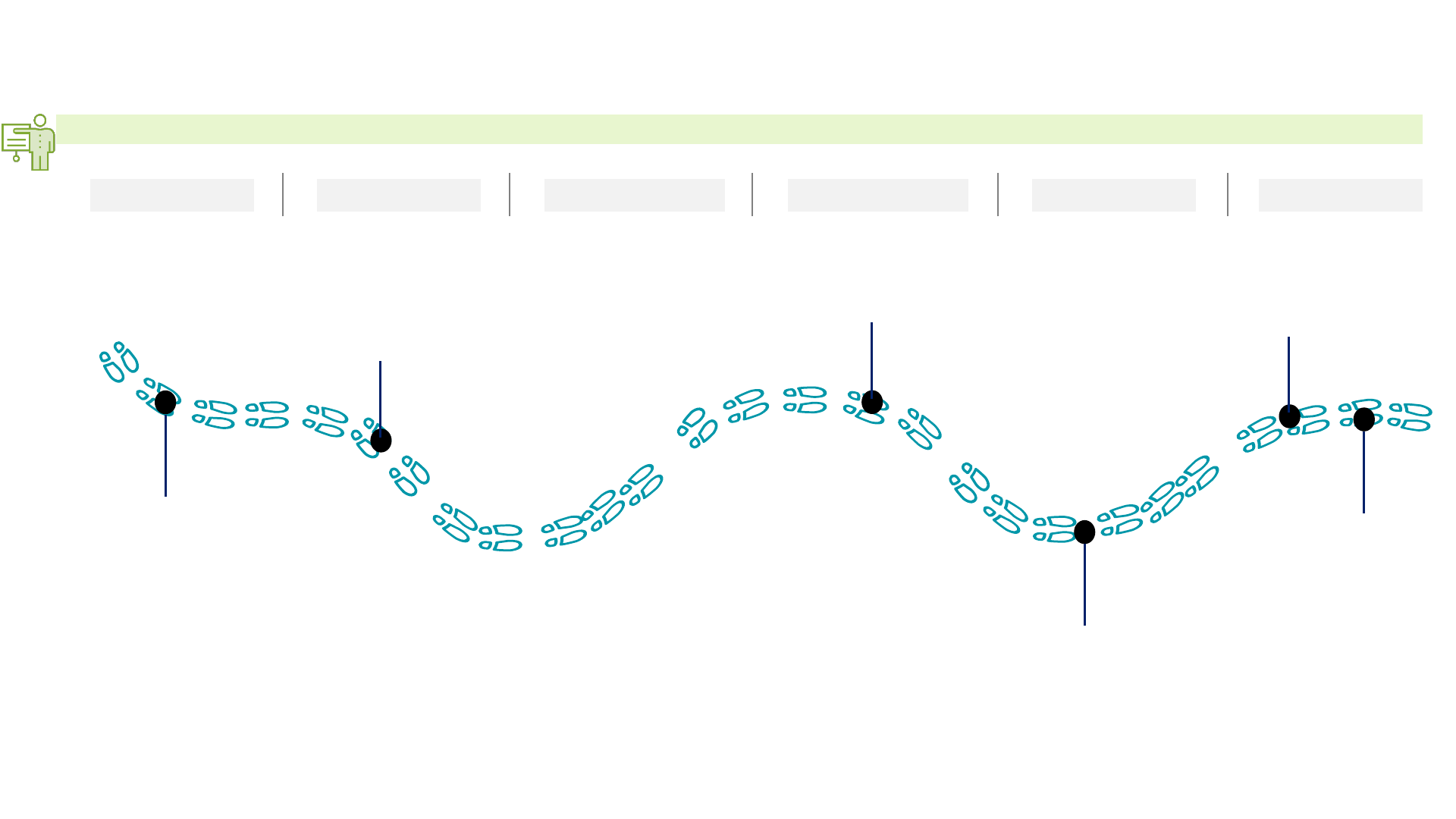

1.3. Key Milestones | RTP

TCH launched

its Future

Payments

Initiative

Vocalink

was on

boarded for

the system

development

Note: Above list is not exhaustive

With its launch in 2017, RTP is a relatively new system. There is a scope of several milestones as the system progresses ahead in its lifecycle journey

2014 2015

2017

2018 2019

RTP was

launched in

November

2017

TCH forms an

RTP Advisory

Committee to

gather additional

input

FirstBank

joins the RTP

network

Wells Fargo

declares it will

offer RTP to

corporate

customers

2016

Source: TCH | News Articles

14

World Bank Fast Payments Toolkit

1.4. Background and Objectives | FedNow

Federal Reserve announced on August 5

th

, 2019, that it will build and operate a real-time payments system called FedNow. Key drivers

for development of the FedNow are prevailing market conditions as well as future market outlook. Federal Reserve also worked on policy

considerations in case of its involvement in real time payments. Policy considerations by Federal Reserve are as follows:

• System should recover cost in the long run

• Service has to provide clear public benefit

• Service should be one that other providers alone cannot be expected to provide with reasonable effectiveness, scope, and equity

While there weren’t RTP specific gaps which prompted development of FedNow, the Federal Reserve Board’s assessment determined that in

case there would only be a single fast payments solution in the USA, it would face significant challenges, including achieving nationwide

reach.

• Federal Reserve

worked on policy

considerations for

its involvement in

real time payments.

Federal Reserve

Board’s assessment

determined that a

single FPS solution

in the USA would

face significant

challenges, including

achieving nationwide

reach.

• The key drivers for

development of

FedNow were

Accessibility,

Safety and

Efficiency

Objectives

FedNow

Accessibility: Federal Reserve looked at accessibility to real time payments in case it operates the fast payments settlement service.

There are 10k+ financial institutions in the USA, which are quite diverse in terms of geography, size and type of customers served.

FedNow would be accessible by all these financial institutions and hence would provide nationwide reach

Safety: Having an additional fast payments settlement service in addition to RTP would ensure resiliency in case one service faces any

crisis situations. Also, as the Federal Reserve is the Central Bank, it would be able to provide liquidity and continuity in case of any

crisis or natural disasters

Efficiency: With FedNow as the core infrastructure, other financial institutions would be able to build modern and innovative service on

top of this infrastructure. Having another fast payments settlement service would also provide a healthy competition just like other

payment services operating in the USA. This would also ensure reduced pricing and enhanced service quality.

Source: Primary Interviews

FedNow service is intended to be a platform which would enable FIs to develop innovative use cases / services. This service is primarily

meant to facilitate real time interbank settlement. FedNow would also enable certain use cases / services based on input received from the

industry participants. For example: Request to Pay service to enable convenient online bill payments, etc. Over time, participants and their

partners would develop the uses cases/services desired by the end users. Federal Reserve will work with participants to supplement those

service.

15

World Bank Fast Payments Toolkit

1.5. System Development | FedNow

Source: Primary Interviews

• The Federal Reserve carried out public benefit analysis and put out a

public notice for comments on features and functionality that this

service should have. Based on the feedback from this public notice,

the Federal Reserve will develop functionality of the FedNow system

• Going forward, the Federal Reserve has also constituted the FedNow

community consisting of stakeholders from private sector to provide

insights and inputs for the development of FedNow

Infrastructure Setup

• FedNow is expected to go live by 2023 or 2024

• Before the launch of the system, pilot testing will be conducted with

FIs. The detailed timelines will be put in place by Federal Reseve

Implementation Timelines

• FedNow would be a completely new system. Settlement mechanism

would be based on credit and debit of master accounts held by FIs

with the Federal Reserve. FedNow is currently scheduled to be

launched in 2023 or 2024.

• The Federal Rerserve has requested information and currently in

process of examining the proposals sent by the vendors. Meanwhile,

Federal Reserve has completed drafting of ISO message flows,

specifications for industry feedback, established FedNow community

and drafted business requirements for the system

Development Process

• The Federal Reserve is open to exploring the message exchange

model in the future but that is the one that would require

participation by TCH. The initial launch of the FedNow service will be

intended to facilitate routing interoperability

• The Federal Reserve is committed to working towards compatible

standards and operating procedures with the existing private-sector

service, which will enable interoperability through the model of

payment routing, and has initiated discussions on this subject with

the existing private-sector service toward that end

Interoperability

16

World Bank Fast Payments Toolkit

2. Business and Operating Model

Chapter Summary:

• TCH is the owner and operator of RTP system. RTP Business Committee has been

appointed for overseeing the system activities

• RTP allows every federally insured depository institution in the USA to become a

participant in the system. These institutions can connect with the system directly or

through a third-party service provider (TPSP)

• RTP enables consumers, businesses and government agencies in the USA to make

payments in American Dollars between accounts, e-wallets of the participating financial

institutions

• RTP doesn’t support aliases for completion of payments on its core infrastructure, though

third-party PSPs can enable aliases through their application for the end users

• RTP supports form-factor neutrality and allows transactions across both traditional and

alternate delivery channels

• Agent networks (assisted mode of transfer) are not supported in RTP network

• RTP system follows same pricing structure for all participants with no volume discounts,

no volume commitments and no monthly minimums to ensure that financial institutions of

all sizes participate on the same terms

• RTP Participants are free to decide on charges levied to end users

• RTP supports multiple use cases/services like Request to Pay, Merchant Payments,

Bill Payments, Bulk/Batch Payments and Standing Orders

Chapter sections:

2.1. FPS Structure

2.2. Participants

2.3. Payment Instruments and Payment Types

2.4. Aliases, Access Channels & Agent Networks

2.5 Scheme Pricing and Fee Structure

2.6 Use Cases/Services

Source: TCH | Primary Interviews

17

World Bank Fast Payments Toolkit

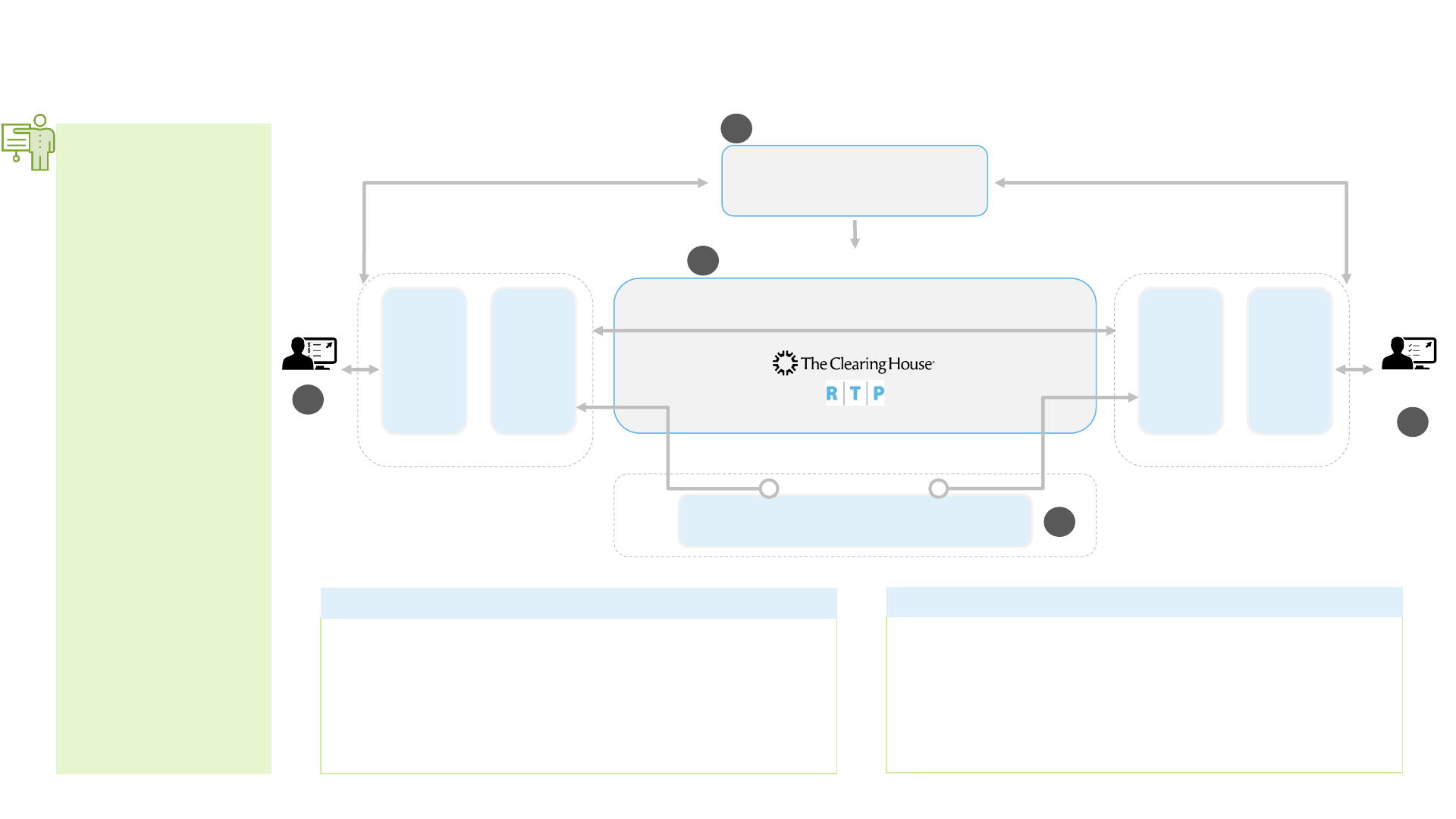

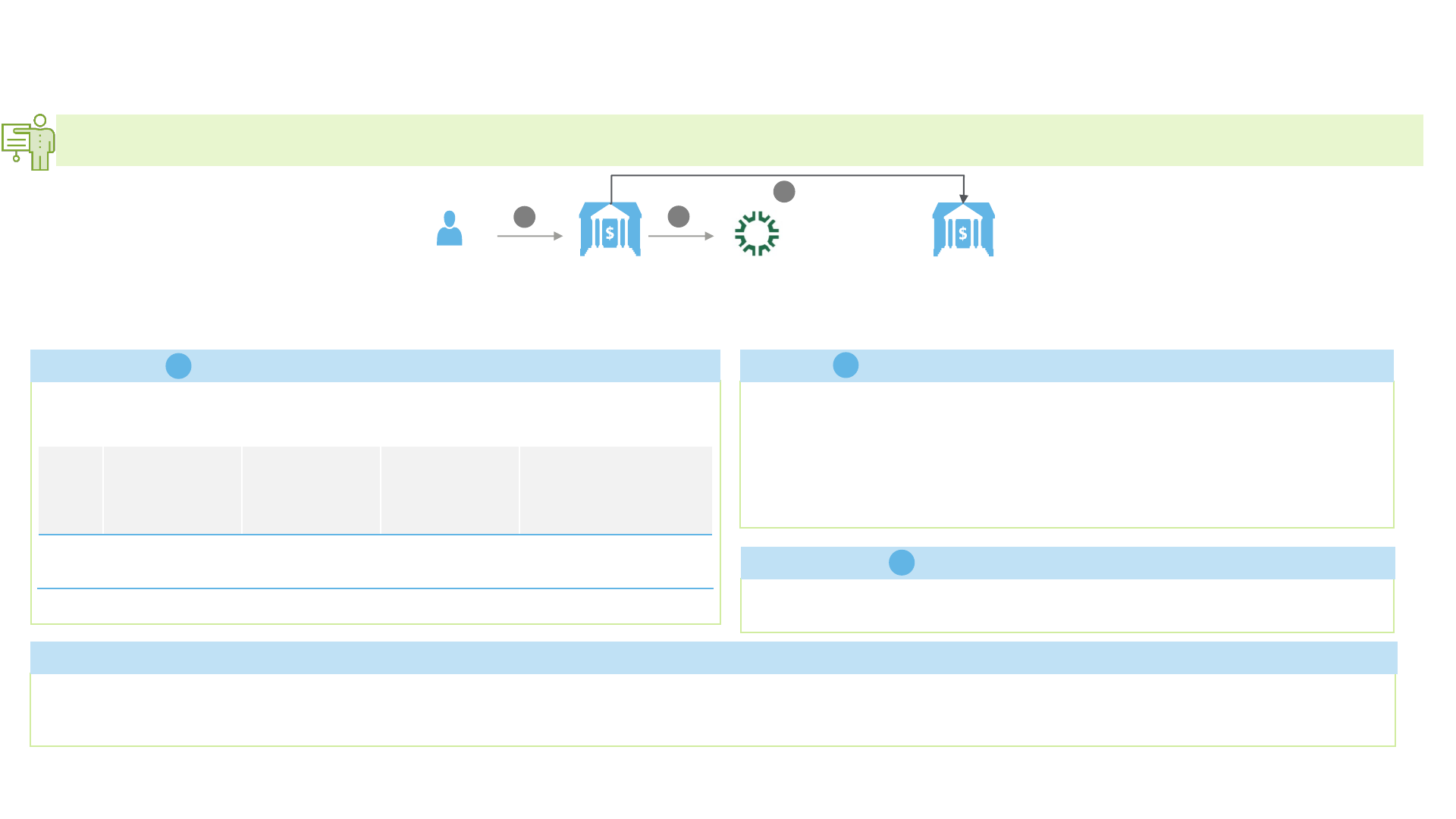

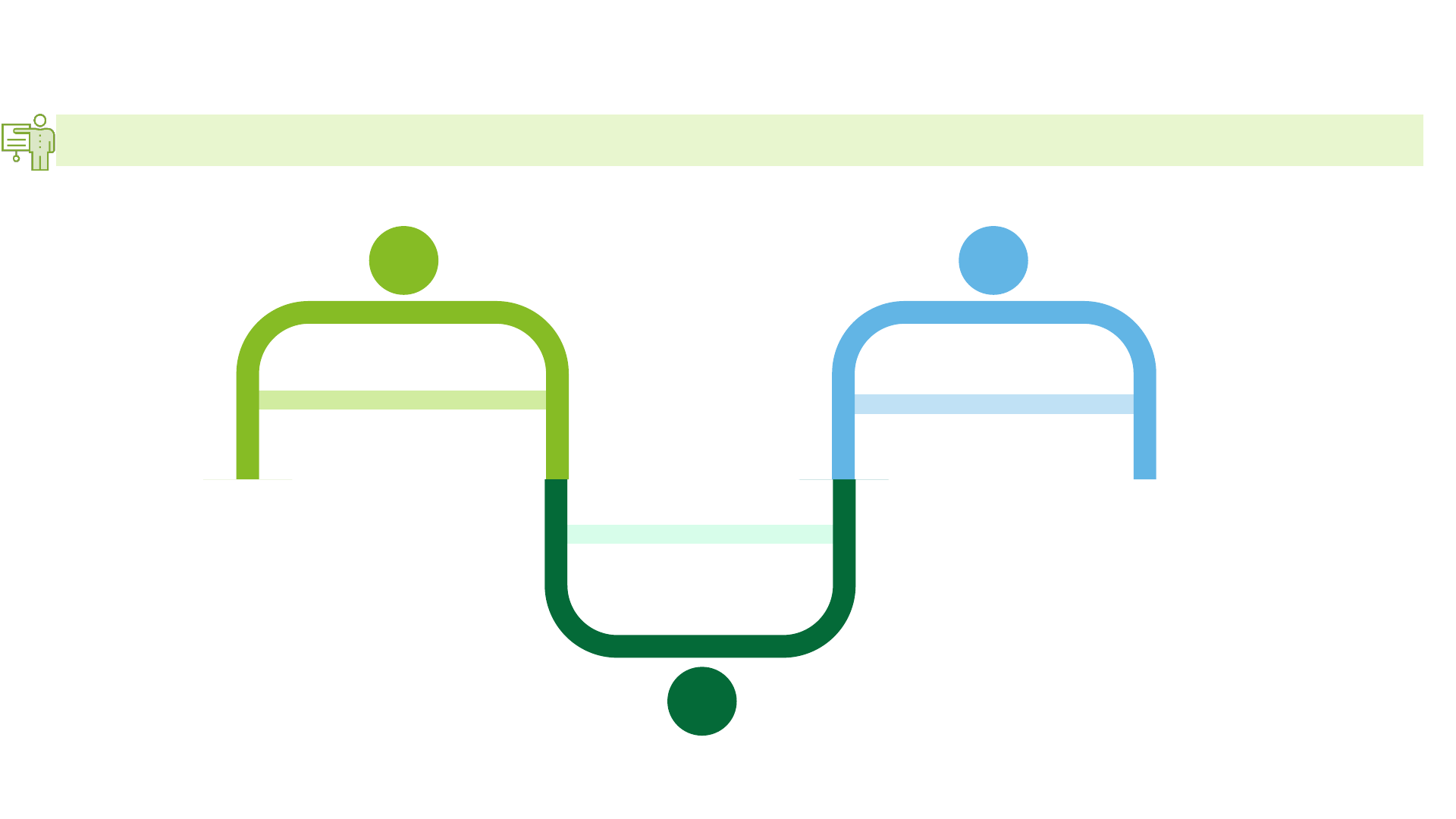

2.1. FPS Structure

• The Clearing House

(TCH) is the owner

operator and

overseer of RTP

system.

• TCH is owned by the

consortium of

commercial banks

and technology

companies in the

USA and is

responsible for

overseeing the day-

to-day operations

and maintenance of

the system

Sending

Customer

Receiving

Customer

Bank

Channels

Payment

Gateways

RTR Participants

Overlay Services

Payment

Gateway

Bank

Channels

RTR Participants

Payment Exchange

& Notification

Settlement

Request

& Notification

Settlement

Notification

Interbank Clearing and Settlement Services

(Real-time settlement)

Real Time Rail Utility

i

ii

iii

iv

v

Additional

3

rd

-party

services

Source: TCH | Primary Interviews

• Board of Governors of the Federal Reserve System (FRB),

Office of the Comptroller of the Currency (OCC) and the

Federal Deposit Insurance Corporation (FDIC) jointly

regulate TCH and services provided by it.

• These institutions are not responsible for direct supervision

of RTP system. RTP Business committee is responsible to

govern the RTP system

• TCH is owned by consortium of commercial banks and

technology companies in the USA

• It is responsible for overseeing the day-to-day operations

and maintenance of the system

Regulators

The Clearing House (TCH)

18

World Bank Fast Payments Toolkit

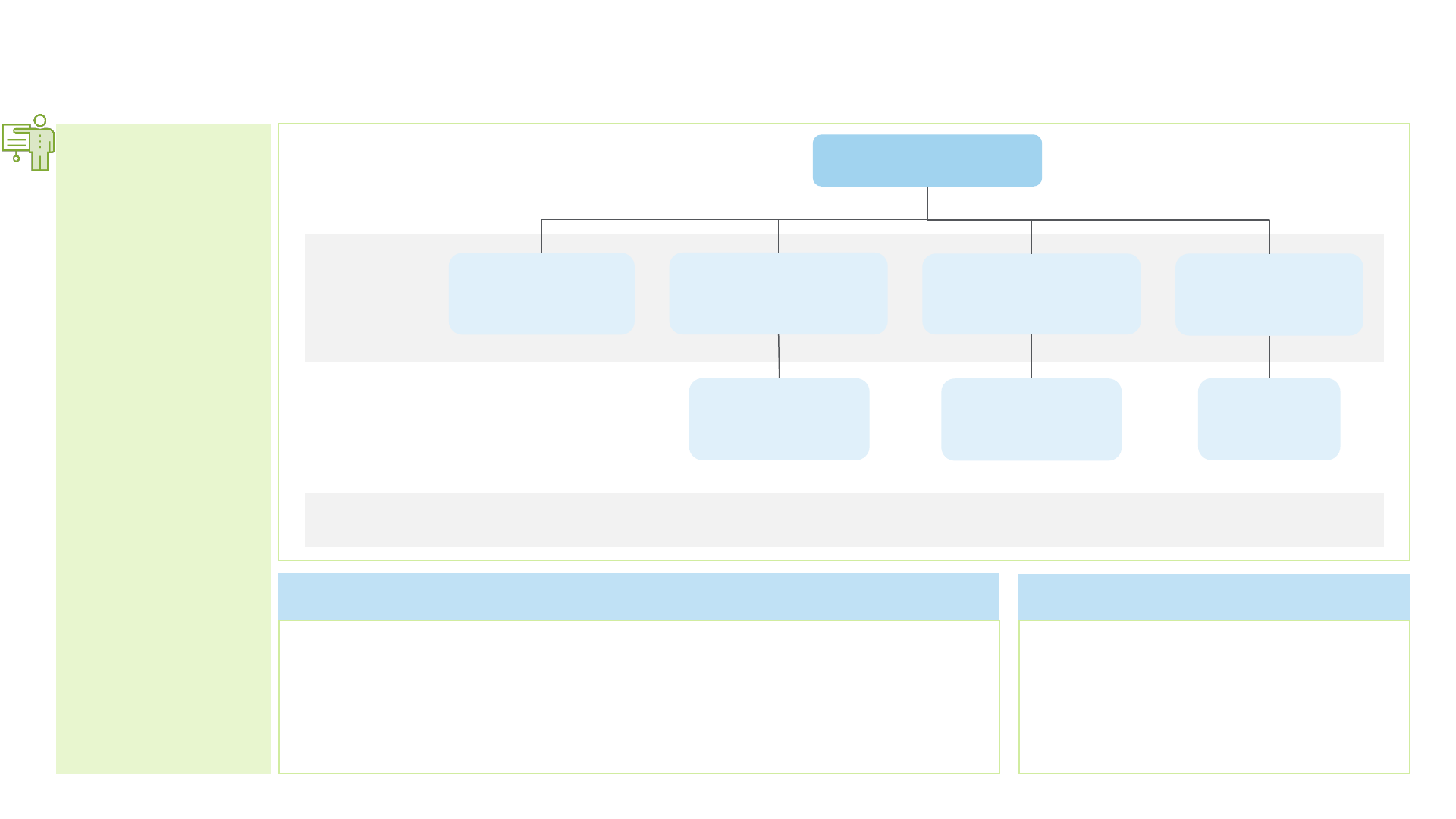

2.2. Participants (1/3)

Requirements for Participants

• To become a direct participant in RTP system, financial institutions have to meet the

following requirements:

• Comply with the business and operating rules set by the TCH

• Undergo technical assessment

• Financial institutions connecting indirectly through TPSPs also have to undergo

certification process for connecting with the system

Membership Statistics

• As of November 2020, there are 63

participant banks and credit unions in

the RTP system

• Other service providers:

• 19 Third Party Service Providers (TPSPs)

• 4 funding agents

• RTP allows every

federally insured

depository

institutions in the

USA to connect with

the system. These

institutions can

either directly

connect with the

system or through

TPSPs

• Prospective

Participants need to

comply with the

business and

operating rules

and undergo

technical

assessment to

connect with the

system

RTP

Financial

Institutions

Third Party Service

Providers (TPSPs)

Direct

Connection

Corporate Credit

Unions

Bankers Banks

Financial

Institutions

Credit Unions

Community

Banks

Participants can connect as either funding participants or non-funding participants. Non-funding participants have to appoint funding

providers or funding manager to fulfil their settlement obligations.

Source: TCH | Primary Interviews

Indirect

Connection

19

World Bank Fast Payments Toolkit

2.2. Participants (2/3)

• There are four

participant

categories defined

as per RTP

participation rules –

Funding participant,

Non-Funding

Participant,

Receiving participant

and Sending

Participant

• Both financial

institutions and

TPSPs undergo

certification testing

to verify the

requirements for

handling both

payment and non-

payment message

Regulatory Considerations

Onboarding Process

Certification testing to verify the

technical requirements for handling

both payment and non-payment

message

Interoperability

TPSPs must also certify all the FIs

connecting through it or the core

banking solution (in case of large

TPSP)

Documentation (participants

must enter into a participation

agreement with TCH

For participation in RTP, interested

depository institution must communicate

intention to TCH

• Transfers between banks and non-

banks participants are allowed

Only a depository institution is eligible to become a Participant in the RTP System. These

institutions should have ability to connect with the system either directly or through a TPSP that

has been approved by TCH, in accordance with RTP Operating Rules and the RTP Technical

Specifications.

Bankers’ Banks and Corporate Credit Unions may provide connections to the RTP network as well

as liquidity management services for financial institutions that may not want to connect directly

to the RTP system.

There are four participant categories defined as per RTP participation rules:

• Funding participant: Funding participant becomes a party to the RTP Prefunded Balance

Account Agreement with the Prefunded Balance Account Bank Agreement and requests and

receives disbursements from the Prefunded Balance Account to its Federal Reserve account.

In case it is a sending participant, it is required to fulfil prefunding obligations. Funding

participant is required to

• Maintain a reserve or clearing account with a Federal Reserve Bank

• Be accepted as a funding participant by TCH and the prefunded balance account bank

• Non-funding participant: Non funding participant has to designate a Funding Agent to act

on its behalf to prefund in accordance with these RTP Participation Rules and the RTP

Operating Rules

• Receiving participant: Participant that holds the Receiver’s Account and that receives a

Payment Message

• Sending participant: Participant that holds the Sender’s Account and initiates a Payment

Message

A participant must be (i) either a funding participant or a non-funding participant, and (ii)

a receiving participant. A participant also may be a sending participant

Source: TCH | Primary Interviews

Connectivity

• Due to the high number of Financial

Institutions in the USA, ease of

connectivity is critical for all FIs. Using

TPSP’s technical connection, small FIs

that are able to connect with the

system through TPSPs. This

connectivity option was an added

incentive for smaller FIs to join.

20

World Bank Fast Payments Toolkit

2.2. Participants (3/3)

• TCH, funding

participants and

funding agents enter

into an agreement

with the Prefunded

Balance Account

Bank

• This joint

prefunded balance

account is used for

the purpose of

supporting the

operations of the

RTP System

• RTP Operating Rules

also establish

requirements for

Third-Party Service

Providers

Regulatory Considerations

RTP Prefunded Balance Account Agreement is an agreement that TCH, funding participants and funding agents enter into with the

Prefunded Balance Account Bank. The joint prefunded balance account is used for the purpose of supporting the operations of the RTP

System. According to this agreement:

• All the funds deposited in prefunded balance account are payable exclusively in accordance with the instructions of TCH, which acts as

agent on behalf of all funding participants and funding agents

• Prefunded Balance Account is only used in support of RTP activities. Participants and funding providers can maintain excess liquidity for

only in case of reasonably anticipated liquidity needs for their or their non-funding participants’ RTP Payments

• Funding agent become a party to the Prefunded Balance Account Agreement. It is either a Funding Manager (provides prefunded

requirement, supplemental funding and requests disbursements for its non-funding participant); or a Funding Provider (depository

institutions that have their own current prefunded position and provides funding for non-funding participants through it)

Source: TCH | Primary Interviews

Participants can designate a third-party service provider to act on its behalf as agent to send and receive transmissions of Payment

Messages, Payment Message Responses, and Non-payment Messages, using the TPSP’s technical connection.

Requirements for Third-Party Service Providers are:

• It must be designated by one or more Participants to act as a Third-Party Service Provider in accordance with procedures established by

TCH

• It must satisfy the applicable provisions of the RTP Information Security Standards and Requirements and the RTP Technical

Specifications, as certified by the Participant in accordance with procedures established by TCH

Use of Third-Party Service Providers

21

World Bank Fast Payments Toolkit

2.3. Payment Instruments and Payment Types

• RTP allows credit

transfer and e-

wallets as payment

instruments. Direct

Debits are not

supported for RTP

payments

• RTP enables

consumers,

businesses and

government

agencies in the

USA to make

payments in

American Dollar

between accounts of

the participating

depository

institutions

• Credit transfer limit

on the RTP network

is currently

$100,000

Payment Instruments Supported

• RTP supports credit transfer and e-wallets as payment instruments. TCH supports Venmo (which is a

wallet) to use RTP for instant money transfer to a consumer’s account

• Account to account interoperability is supported in RTP through credit transfer. The design principle

of RTP network is based on ‘Credit Push’ meaning that the customer authorizes the debit each time

Interoperability

Payment

Types

Individual

GovernmentBusiness

• Sending Participants are allowed to establish a lower transaction limit for

their senders. Receiving Participants are not allowed to establish a lower

transaction limit for their receivers

Credit transfer limit on the RTP network is currently $100,000

Transaction

Limit

Payment Types and Transaction Limit

✓

✓

✓

Transaction Currency

American

Dollar

(USD)

Credit Transfer

E-money

✓

✓

Direct Debit

Source: TCH | Primary Interviews

22

World Bank Fast Payments Toolkit

2.4. Aliases, Access Channels and Agent Networks

Aliases

• RTP system inherently doesn’t support use of aliases or proxies for

payments. Though the network allows third parties to enable alias or proxy

payments

• PayPal & Venmo currently use the RTP network for transfers to their clients

bank or credit union accounts using aliases. TCH has entered into partnerships

with payment service providers Zelle to provide settlement services. Currently,

integration of RTP and Zelle is under progress. Zelle allows use of mobile

number or email address as aliases

• There are no plans to launch RTP’s own social alias/proxy service because

the market is already well served and existing alias/proxy services might

transition to RTP payments to clear and settle transactions

• The RTP network will support tokenization of account numbers which could

be a way to allow payment originators and payment service providers to replace

account numbers with tokens that cannot be used to debit accounts, nullifying

the threat of data breach

• RTP supports form-factor neutrality and allows transactions

across both traditional and alternate delivery channels

• RTP network is core payment system and doesn’t deploy any

end user applications. It can support payments through

proximity-based channels. Though currently there are no end

user applications supporting payments through QR and NFC

• Agent networks (assisted mode of transfer) are not supported in

RTP system

RTP doesn’t have its own aliasing service though third-party application can enable use of aliases for RTP payments. RTP allows transactions though both

traditional and alternate delivery channels. It does not support payments through agent networks

Access channels and Agent Networks

Source: Primary Interviews

ATMBranch Mobile

Banking/Apps

Internet

Banking

23

World Bank Fast Payments Toolkit

RTP system follows same pricing structure for all participants with no volume discounts, no volume commitments and no monthly minimums to ensure that

financial institutions of all sizes participate on the same terms

2.5. Scheme Pricing and Fee Structure

The system participants are not required to pay joining fees while onboarding the

system. Participants pay only for the transactions they originate.

Network fees

1

Request for Payment Incentive Fee: Upon each successful RTP Credit Transfer

sent in response to a Request for Payment message, the participant that initiated

the Request for Payment owes the incentive fee to the participant initiating the

RTP credit Transfer.

TCH facilitates the collection and disbursement of Request for Payment Incentive

Fees between participants. TCH is not obligated to distribute incentive Fees that

TCH is unable to collect from the owing participant.

Fees owed to other participants

2

Each RTP Participant is free to decide the transaction charges levied to end

users

Fee charged to users/payee

3

User /

Payee

Sending

participant

The Clearing

House

1

2

3

Receiving

participant

Source: TCH | Primary Interviews

Credit

Transfer Sent

Request for

Payment

Sent

Remittance

Advice Sent

Prefunded Balance

Account Drawdown

Request Executed

Overall cost of connectivity associated with either the MPLS or secure VPN connections to the RTP network is calculated by The Clearing House and charged as pass through on

a monthly basis. Connectivity costs applies to any participant with a direct connection. In case of third-party service provider, connectivity fee is shared by financial

institutions connecting through it

Network-at-Cost Pass-through

24

World Bank Fast Payments Toolkit

2.6. Use Cases/Services

• RTP system supports ‘Request for Payment’, which

require a payer to authorize a payment in

response to the request

• In the payment message, the payer is provided

with the necessary pre-populated information

for the RTP payment

• This functionality provides payees with an

effective method to initiate a potential

transaction, while also combatting fraud and

allowing the payer to maintain control over the

payment flow

Access Channels

Payment Instruments

Credit transfer

Pricing Scheme

• No special charge

• Merchant Payments are supported as a use case

in RTP system

• Similar to Bill Payments, Request for Payment

acts as a complementary service to drive the

adoption of Merchant Payments

Access Channels

Payment Instruments

Credit transfer, E-money

Pricing Scheme

• No special charge

Mobile

• Bill payments are supported as a use case in RTP

system

• Request for Payment acts as a complementary

service to drive the adoption of Bill Payments

• TCH is collaborating with participant financial

institutions to further drive traction for this use

case

Access Channels

Payment Instruments

Credit transfer, E-money

Pricing Scheme

• No special charge

Mobile

Internet

RTP is a core payment system which has been designed to accommodate multiple use cases/services. TCH is focused on facilitating an able infrastructure

using which FIs can develop innovating use cases/services for end consumers

Request for Payment

Merchant Payments

• Bulk/Batch payments (e.g., payroll, etc.) are

supported in RTP system though it is processed in

form of individual credit transfer payments

• Participating financial institutions disaggregate the

bulk payments order and submit them in form of

series of individual RTP payments

Access Channels

Payment Instruments

Credit transfer

Pricing Scheme

• No special charge

Bill Payments

Bulk/Batch Payments

Internet

Mobile

Internet

• Recurring Payments or Standing Orders are

supported in RTP

• Users may have the option to set up a recurring

transaction with their respective FIs. Though user

have to authorize the payment at every instance

Access Channels

Payment Instruments

Credit transfer

Pricing Scheme

• No special charge

Recurring Payments

Mobile

Internet

Source: TCH | Primary Interviews

25

World Bank Fast Payments Toolkit

3. User Adoption

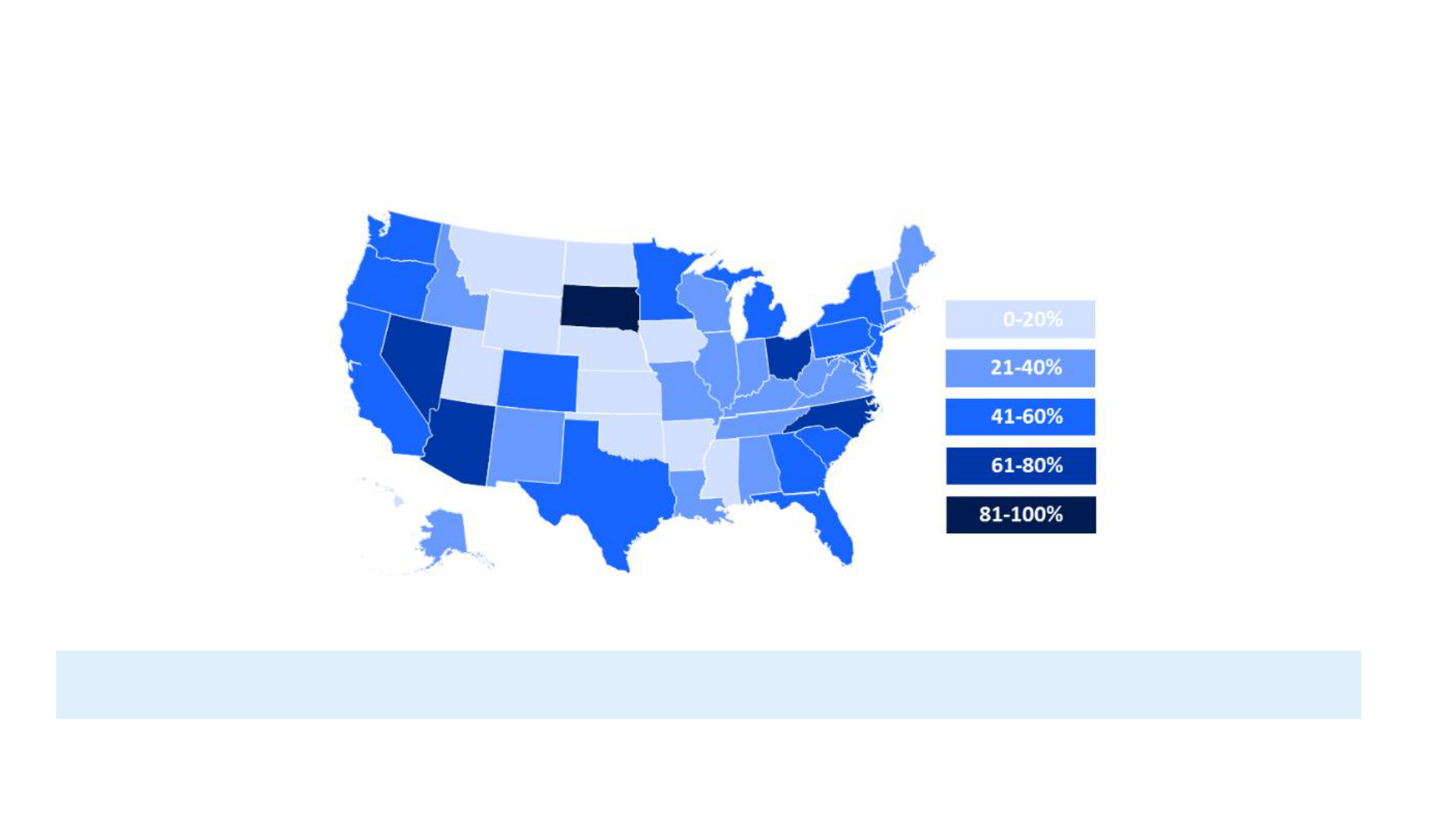

RTP Network Coverage by US Deposit Share

As of now, RTP network reaches over 56% of U.S. transaction accounts, and is on path to reach nearly all U.S. accounts by end of 2020. Zelle is the

preferred network for individual payments as it allows use of aliases. Currently, Zelle uses legacy ACH-next day settlement model. With the integration of Zelle

with RTP for the settlement service, P2P payments initiated through Zelle will also be processed using RTP network.

Note: Adoption statistics are confidential and not published by TCH

Source: TCH website

26

World Bank Fast Payments Toolkit

4. Technical Details and Payment Process

Chapter Summary:

• RTP system is based on ISO 20022 standard as it allows global interoperability, rich

remittance data, uniform and reusable messages and paves way for system as a strategic

platform for innovation

• As a core payment infrastructure, RTP can support QR payments. Currently, no financial

institutions and payment service providers are using RTP system for QR payments

• APIs have not been enabled by TCH for RTP system. Participants are providing APIs to end

customers for transaction instructions as well as value added services

• TCH has mandated use of multi factor authentication for all RTP payments. These

standards comply with the strong customer authentication standards

• RTP does not require one-time customer registration. Any account at a participating FI can

receive RTP credit transfers without registration. The payment process includes payer-

payee transaction fulfilment and inter-participant settlement

• RTP uses real time gross settlement mechanism for final settlement between the

participants as it allows instant settlement finality

Chapter sections:

4.1. Technical Details | Messaging Format and QR

Codes

4.1. Technical Details | APIs and Customer

Authentication

4.2. Payment Process (Customer Registration,

Transaction Fulfilment, Liquidity Management and

Settlement)

Source: TCH | Primary Interviews

27

World Bank Fast Payments Toolkit

4.1. Technical Details | Messaging Format and QR Code

Messaging Format

• ISO 20022 was chosen as messaging standard as it enables rich and

consistent follow of information. FIs can embrace this information to build

new and innovative products by embedding extensive information not

available in current payment messages into RTP payment messages

• The quantity and quality of data carried in ISO 20022 messages can be

extended to include remittance notes and additional supplementary

information which reduces the need for custom development in specific

geographic markets or industries to deliver to specific client needs

• Further, the use of the ISO 20022 standard enables multinational FIs and

corporates to utilize one message standard across all payment related

activities

• While RTP is a domestic payment system, use of ISO 20022 positions the

system to support cross-border commerce and interoperability with

other schemes as real time payments evolve in the global marketplace

ISO 20022

QR Code

Not supported, though system has technical capability

to support QR payments

• RTP has been developed as a core payment system. It is not involved in

development of end user application. Financial institutions and third-

party payment service providers are responsible for developing the

applications for the end users

• Technically RTP can support payments through QR codes, though currently

are currently no third-party application which is using the RTP network

for QR payments

• The US Faster Payments Council has a working group, which is looking at

the possibility of enabling QR payments using real time payments, including

the RTP network

RTP has adopted ISO 20022 messaging standard for allowing rich flow of information. Currently RTP is not being used for QR payments though a working

group of the US Faster Payments Council is looking at possibility of enabling QR payments using real time payments

Source: TCH | Primary Interviews

28

World Bank Fast Payments Toolkit

Customer Authentication

• According to the RTP Operating Rules, participants are mandated to establish

multifactor authentication (something you know and something you have

or something you are) to authenticate the identity of customers

• The TCH RTP system is open and flexible and supports various authentication

methods depending on customer segment or channel used to initiate the

transaction

• Participants are also obligated implement a layered security program that

includes fraud detection and monitoring as well as other effective controls

Multi factor authentication

APIs

• APIs are not enabled by TCH for the RTP system as participants connect

using ISO 20022 messages with the system

• Establishing connection through ISO 20022 messages has been purposeful

due to rich nature of information provided by these standards and helps FIs

in developing products for end customers. While API based connection would

have limited this information flow

• Many financial institutions offer APIs to their end customers for transaction

instructions as well as other value-added services such as checking

transaction status, fetching transaction details, etc.

APIs provided by participants

TCH doesn’t issue any APIs for the RTP system to the participants, though participants enables APIs for their end customers. TCH has mandated use of multi

factor authentication for RTP payments

4.1. Technical Details | APIs and Customer Authentication

Source: TCH | Primary Interviews

29

World Bank Fast Payments Toolkit

Real time settlement

Transaction Basis

One-time

4.2. Payment Process

1

• Customer registration

• Creation of alias (if

applicable)

Customer

Registration

Transaction

Fulfilment

• Approach for settlement

and liquidity management

Inter-Participant

(PSP) Settlement

2

3

• Transaction Flow

• Connectivity between

participants

RTP does not require one-time customer registration. Any account at a participating FI can receive RTP credit transfers without registration. The steps in the

payment process include payer-payee transaction fulfilment and inter-participant settlement

30

World Bank Fast Payments Toolkit

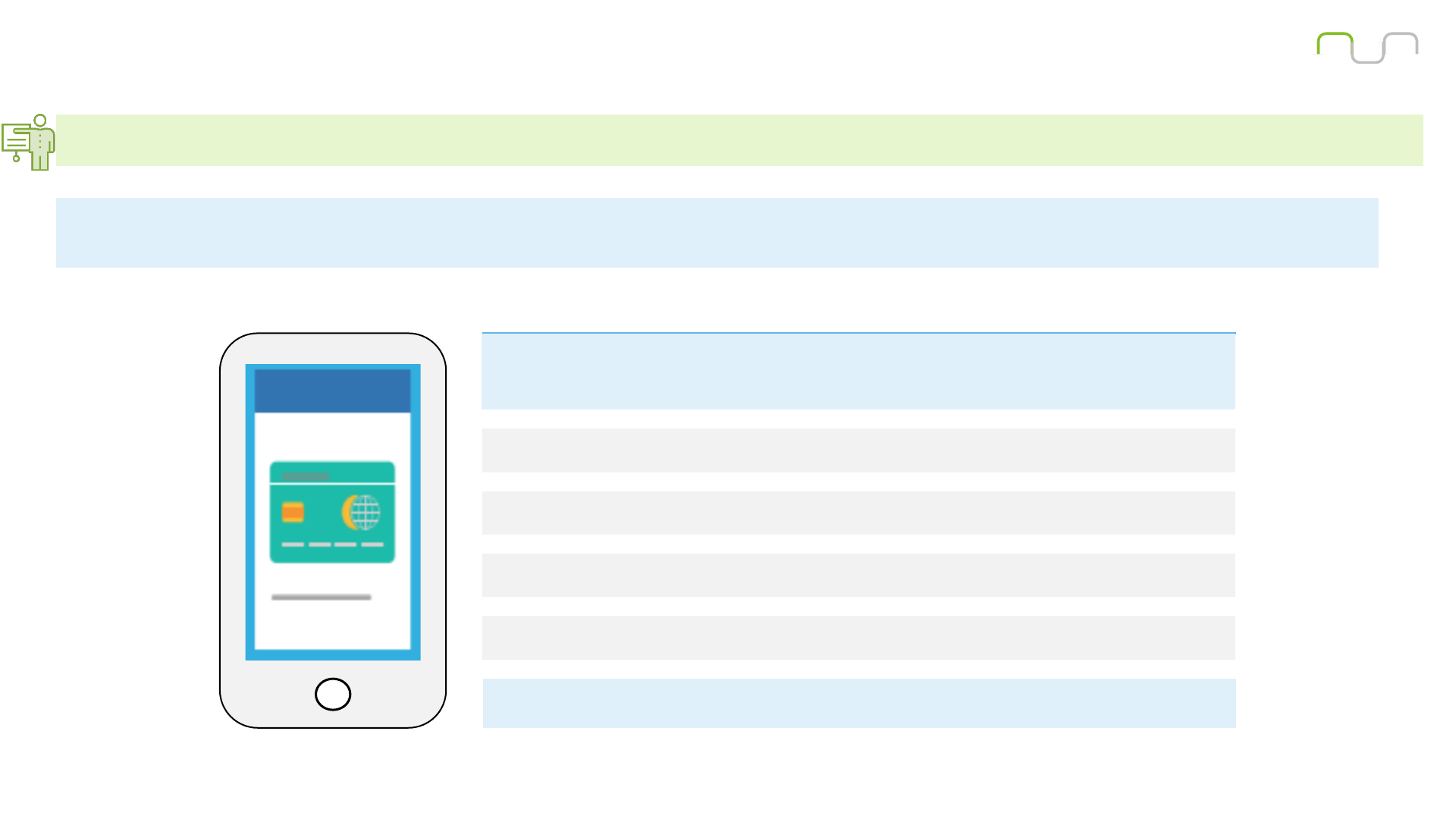

4.2. Payment Process | Customer Registration

Participating financial institutions are required to establish customer onboarding process in RTP system. Typical process for customer registration has been

described below

• RTP system is the core payment infrastructure to facilitate real-time payments. It is not involved in development of end user applications. TCH does not

prescribe any onboarding process. Only onboarding requirements relate to senders of Requests for Payments. Customers can make RTP

payments through existing channels like internet banking and mobile banking.

Source: HSBC Bank

RTP does not require a customer onboarding process however participant FIs can

establish onboarding procedure for a specific service. Onboarding process for one of

the participant FIs has been described below:

Step 1: Customer downloads the mobile banking application

Step 3: Customer registers using the Social Security Number (or Tax ID), an existing ATM,

credit or debit card number, and associated PIN

Step 4: Bank verifies the details and send a confirmation message to the customer

To make a real-time payment, customers log on to mobile banking application or internet

banking with biometrics or through digital or physical security device

Step 2: Customer requests for new registration through the application

31

World Bank Fast Payments Toolkit

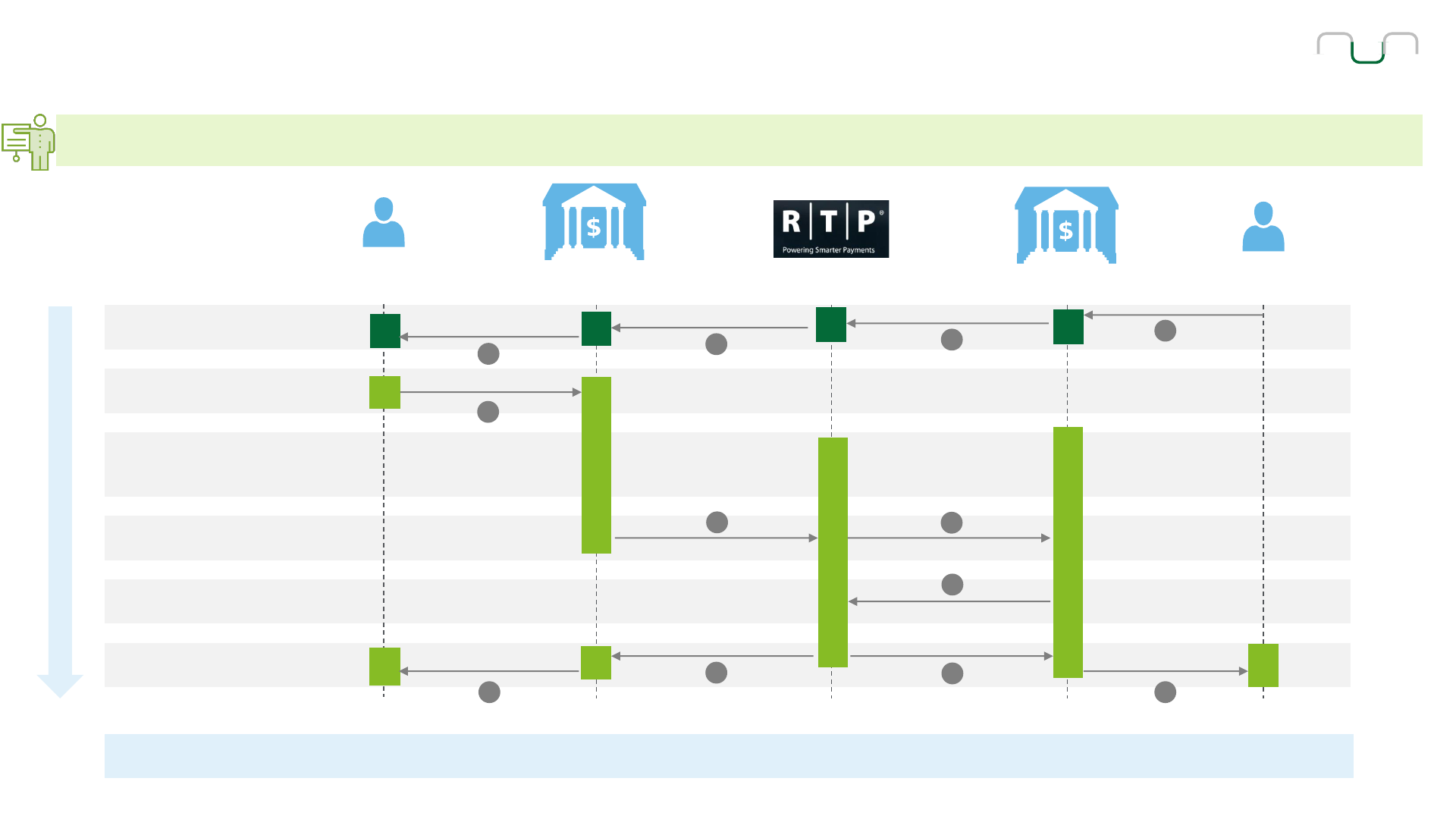

4.2. Payment Process | Transaction Fulfilment | Illustrative for Request for Payment

Typical transaction fulfilment process which is followed for Request for Payment with Credit Transfer has been described below. Intra-bank transfer are

not supported in RTP system

Payer

Payer FI

Payee FI

Payee

Request for Payment

Initiation

Authentication

Payer Authorization

Payer’s FI Approval

Clearing

Receipt and Settlement

Reconciliation

1

2

3

4

5

6

7

8

9

9

10 10

Payment Request

Message

Request for PaymentRequest for Payment

Notification of

Request for Payment

Payment initiated

(channel specific)

Credit transfer

(pacs.008)

Credit transfer

(pacs.008)

Accept/Reject

(pacs.002)

Accept/Reject

(pacs.002)

Accept/Reject

(pacs.002)

Confirmation

(email, text, etc.)

Confirmation

(email, text, etc.)

The payment request message is delivered in real time by the RTP core infrastructure; however, the payer determines when to initiate a credit transfer in

response to the request for payment.

Time

0 sec

1 sec

2 sec

3 sec

5 sec

1 sec

Source: RTP Playbooks

32

World Bank Fast Payments Toolkit

4.2. Payment Process | Liquidity Management and Settlement

Final settlement in RTP is done through Real-time Gross Settlement (RTGS) mechanism. This mechanism was used with a prefunding model to enable the

immediate finality of payments without settlement risks

Approach

Real time Not applicable

RTGS

Settlement Mechanism

• Settlement in RTP system is done through Real-time Gross Settlement mechanism through a fully prefunded account, jointly owned by all the financial institutions

in the Federal Reserve. The use of a prefunded model to achieve real time settlement eliminates the settlement risk and enables immediate finality of all payments

• In 2017, Federal Reserve published regulations for creation of Joint Federal Reserve account that can be owned by multiple FIs. This joint account allows financial

institution to pool their funds and facilitate innovative payment services. RTP system uses similar joint prefunded balance account for fulfilling settlement obligations

of the participants

• The RTP system clears and settles payments on a good funds model. The RTP system verifies and reserves settlement capacity by the sending participant before

forwarding the payment to the receiving participant, eliminating the risk of settlement failure. In case the sending participant has an insufficient prefunded position

to cover a payment, the core infrastructure will reject the payment. Overdrafts or negative prefunded positions are also not permitted in the RTP system

• TCH has established a prefunded requirement for each sending participant, which must be funded and maintained by the financial institution to send payments.

Financial institutions that do not fund for themselves must have an arrangement in place with another financial institutions for fulfilling funding obligations

• RTP system continuously records net position and current prefunded position. In case of successful transfer, system records entries by decreasing net position

and current prefunded position of sending participants or funding provider, and increases net position and current prefunded position of receiving participants or its

funding provider

• Participants provide funding through Fedwire payments to the joint account. Prior to the close of Fedwire, financial institutions must ensure that there is sufficient

prefunding in place to fund the net amount of transactions until Fedwire reopens on the next business day

• If a Payment Message is cancelled, no changes are made to the Net Position or Current Prefunded Position of the Receiving Participant or the Current

Prefunded Position of the Funding Provider

• Settlement with respect to a Payment Message is complete when the RTP System has recorded both the decrease in the Sending Participant's Net Position and the

increase in the Receiving Participant’s Net Position in the joint federal reserve account

Type | Time

Source: TCH | Primary Interviews

33

World Bank Fast Payments Toolkit

5. Governance Framework

Chapter Summary:

• The legal framework supporting RTP activities is comprised of comprised of RTP

Operating Rules and RTP Participating Rules along with existing payments laws

wherever applicable

• TCH is regulated and is regularly examined by supervisory staff from the Board of

Governors of the Federal Reserve System (FRB), Office of the Comptroller of the Currency

(OCC) and the Federal Deposit Insurance Corporation (FDIC). The Federal Reserve entity

that regulates the RTP Network directly is the Federal Reserve Bank of New York, under a

regulatory framework established by the Federal Reserve Board

• TCH has established the RTP Business Committee to govern the RTP network. It is

responsible for providing input and guidance on the strategic execution of the RTP network

• RTP Operating Rules have established multiple layer of risk mitigation for the system.

Apart from this, TCH also applies a risk management framework for ensuring security,

reliability and resiliency of the system

• Settlement risk is eliminated in RTP system by using fully pre-funded real-time settlement

• No centralized guidelines has been issued by TCH for inter-bank dispute scenarios and

customer complaints resolution. US Federal regulations (Regulation E) and State laws

(UCC 4a) govern both interbank and customer disputes. Though RTP System provides a

mechanism to participants to send and respond to requests for the return of funds

Chapter sections:

5.1. Legal and Regulatory Aspects

5.2. Risk Management

5.3. Dispute Resolution and Customer Complaints

Source: TCH | Primary Interviews

34

World Bank Fast Payments Toolkit

5.1. Legal, Regulatory and Governance Aspects (1/2)

• RTP Participation and Operating Rules act as the legal framework for the system. These RTP Operating Rules have been drafted

to define the rights and responsibilities of participants and TCH with respect to RTP

• The participation rules will address topics including, among others, general eligibility requirements; the process for connecting to

the RTP system through a third-party service provider; and requirements in the event of a change of name, form of organization, or

control of a participant

• The operating rules will address topics including, among others:

• General participant eligibility requirements and operating responsibilities

• Eligible payments

• The protection of confidential information and customer information security

• Payment notification and messaging

• Funds availability

• Errors and unauthorized transfers

• Funding and settlement

• Risk management

• Enforcement of RTP rules

• Choice of Law

• EFTA (Electronic Fund Transfer Act) Consumer Payments (For an RTP Payment any part of which is subject to the

EFTA): the rights and obligations of a Participant and end user is governed by:

• the EFTA and Regulation E, to the extent applicable to the transaction

• to the extent consistent with EFTA and Regulation E as applicable to an RTP Payment, by RTP Operating Rules, and

the laws of the State of New York, excluding Article 4-A of the New York Uniform Commercial Code

• Commercial and Non-EFTA Consumer Payments (For an RTP Payment in which no part of the transaction is subject to

the EFTA): Sending Participant, Receiving Participant and other parties involved in an RTP transaction are governed by RTP

Operating Rules and by the laws of the State of New York, including Article 4-A of the New York Uniform Commercial Code

TCH has established RTP Participation and Operating Rules to constitute the legal framework of the system. Existing laws has been also incorporated to

complete the legal basis of the system

Institutional and

Governance Framework

Legal Framework

RTP Participation and

Operating Rules along

with existing relevant

laws

Regulator

FRB, OCC and FDIC

Overseer and Operator

The Clearing House

Source: RTP Operating Rules | RTP Playbooks

35

World Bank Fast Payments Toolkit

5.1. Legal, Regulatory and Governance Aspects (2/3)

• Due to the important nature of the Clearing House’s role in the USA financial system, it is regulated and is regularly examined by

supervisory staff from the Board of Governors of the Federal Reserve System (FRB), Office of the Comptroller of the

Currency (OCC) and the Federal Deposit Insurance Corporation (FDIC)

• The Federal Reserve entity that regulates the RTP Network directly is the Federal Reserve Bank of New York, under a regulatory

framework established by the Federal Reserve Board

• Under the Bank Service Company Act, the Clearing House, and all of the payments systems it operates including the RTP

network, are subject to regulation and examination to the same extent, as if the services being provided were being performed by a

depository institution that is subject to FRB, OCC or FDIC supervision itself.

• Through an arrangement among the federal financial regulatory agencies through the Federal Financial Institutions

Examination Council, the FRB acts as the lead examiner of TCH for examinations conducted under the Bank Service Company

Act

• The Clearing House has also been designated by the Financial Stability Oversight Council as a Systemically Important Financial

Market Utility (SIFMU) under Title VIII of the Dodd-Frank Act and is subject to a regulatory and supervisory regime

• While TCH’s regulation and supervision under Title VIII relate specifically to its role as the operator of CHIPS, TCH operates as a

single entity in the operation of its payments systems and, therefore, many of the requirements of Title VIII may affect its broader

operations such as RTP system

• Federal Reserve is not actively engaged in the oversight of the RTP system. Federal Reserve and other federal agencies regulate

TCH payment systems, including the RTP network, as a Technology Service Provider. Also, there is a separate examination process

for the regulation of the CHIPS (high value payment network) as a SIFMU

• TCH has constituted RTP business committee in order to perform overseeing activities for RTP system

Federal Reserve is not actively engaged in the oversight of the RTP system. Although Federal Reserve has supervisory authority over its operator TCH

because of its operation of CHIPS that has been designated under the USA Law

Institutional and

Governance Framework

Legal Framework

RTP Participation and

Operating Rules along

with existing relevant

laws

Regulator

FRB, OCC and FDIC

Overseer and Operator

The Clearing House

Source: RTP Operating Rules | RTP Playbooks

36

World Bank Fast Payments Toolkit

5.1. Legal, Regulatory and Governance Aspects (3/3)

TCH has established RTP Business Committee to govern the RTP network. comprised of representatives from TCH owner banks and representatives from

non-member financial institutions

• The principal governance arrangements for the RTP system has been set forth in the limited liability company agreement.

Management of TCH is under the direction of two boards of directors: the Supervisory Board and the Managing Board

• According to the LLC Agreement, Supervisory Board has overall responsibility for the business of TCH, while the Managing Board,

which reports to the Supervisory Board, is responsible for oversight of TCH’s business and financial performance and for setting

TCH’s strategic agenda

• TCH has established the RTP Business Committee to govern the RTP network. It is responsible for providing input and guidance

on the strategic execution of the RTP network

• The Business Committee is also responsible for ensuring prudent risk management practices, promoting the design, operation,

and management of the system, and establishing or amending the rules for the RTP network

• The RTP Business Committee is comprised of representatives from TCH owner banks and representatives from non-member

financial institutions. The participation of non-member financial institutions ensures that non-member financial institutions have

an active voice in the governance of the RTP network

• In addition, the RTP system is also managed and supported by executives, officers, and employees of TCH, including product,

operations, technology, customer relations, risk-management, audit, and legal staff

Institutional and

Governance Framework

Legal Framework

RTP Participation and

Operating Rules along

with existing relevant

laws

Regulator

FRB, OCC and FDIC

Owner and Operator

The Clearing House

Source: RTP Operating Rules | RTP Playbooks

37

World Bank Fast Payments Toolkit

5.2. Risk Management

The RTP network has multiple layers of risk mitigation. Some key ones have been mentioned below:

• All participants are required to meet information security requirements including multi-factor authentication of

originators and data center security standards

• The RTP network is configured for multi-site, multi-node, high availability operation. The multi-site operation is

active/active for continuous operation

• All data transmissions are encrypted and require digital signatures at sign-on. All messages are encrypted and

digitally signed

• Administrative access by participants, processors and operators are subject to privilege-based access controls

secured by individual tokens

• RTP operating rules also require that sending participants employ multi-factor authentication and processes to

detect and prevent unauthorized payment initiation. The RTP network does not support debit transactions, only

credit transfers. All payments must be authorized by the sender to their financial institution

• All message exchanges are based on an assured delivery model. The receiving participant must send a confirming

message, or the transaction is cancelled. The network sends final confirming messages to both the sending and

receiving participant. The message flows are designed to ensure a “fail safe” outcome in all operational failure

scenarios.

• Participants are required to report all incidents of fraud to RTP network administration for tracking and analysis

• Based in incidents reported by participants or analysis of network activity, Network administration can request an

that a participant investigated suspicious activity on any of its accounts

• RTP network administration also monitors the operational performance of participants and processors, and will

require remediation of any situation that may adversely affect network performance or the operations of other

participants

TCH applies a risk management framework for operation of the RTP system for ensuring security, reliability and resiliency of the system. RTP Operating

Rules have also established multiple layers of risk mitigation

TCH also applies a risk management framework for operation of the RTP system. This framework exists outside of the RTP Operating Rules, and includes significant

resources devoted to system reliability and resiliency, security (e.g., physical, operational, network security), incident response, overall risk management, and

comprehensive business continuity plans

Potential Risk

Risk Controls

… are receiving participants

… support 3rd party services

… support request for payments

… both send and receive payments

Low

High

Participating FIs that…

Source: RTP Playbooks | Primary interviews

38

World Bank Fast Payments Toolkit

5.2. Risk Management

Credit and

Liquidity

Risks

• TCH has a sole discretion to determine the prefunding requirement for:

• Sending participant that is a funding participant in the system

• Sending participant that is a non-funding participant but has a current prefunded position (participants with a funding obligation)

• Each Funding Provider

• During Fedwire operating hours, participant with funding obligations and funding providers are required to monitor their current prefunded position

and provide supplemental funding to the Prefunded Balance Account if current prefunded position falls below their prefunded requirements

• Supplemental funding for maintaining current prefunded position based on prefunded requirement should occur:

• No later than the next opening of Fedwire, if the current Prefunded Position falls below the Prefunded Requirement during hours when Fedwire

Funds is closed

• Before the next close of Fedwire, if the Current Prefunded Position falls below the Prefunded Requirement during hours when Fedwire is open

• During Non-Fedwire hours, supplemental funding is provided in advance of the close of Fedwire to ensure that the funding provider or participant’s

current prefunded position is sufficient to cover its anticipated payment origination activity when Fedwire is closed

• Funding providers and participants with funding obligations can also have arrangements with each other to transfer liquidity through RTP Payments

in case their current prefunded position becomes low during Non-Fedwire hours. Such liquidity transfers must be reported to TCH within ten banking

days using procedures specified by TCH

Settlement risk is eliminated in RTP system by using fully pre-funded real-time settlement. TCH has established several guidelines for participants for

maintaining their pre-determined pre-funded positions. TCH has also issued guidelines for mitigating fraud risks

Fraud

Risks

• TCH has established a tiered approach to fraud prevention and mitigation as not all financial institutions participate in real-time payments at the same

level

• All participating financial institutions are required to:

• Comply with Federal Financial Institutions Examination Council (FFIEC) guidelines as applied through prudential regulator examination

• Report fraudulent behavior to The Clearing House and/or sending financial institutions

• React to alerts from centralized activity monitoring utility

• Apart from these, there are additional compliance requirements for FIs that support request for payments and permit third party payments

• In addition to the centralized fraud monitoring, TCH has ability to limit the RTP activities of participating FIs that violate system rules and risk

management requirements

Source: RTP Operating Rules | RTP Playbooks

39

World Bank Fast Payments Toolkit

5.2.1. Cyber Resilience and Data Management

Data

Manange-

ment

•

RTP Operating Rules include provisions regarding the treatment of confidential information by TCH and participating FIs including encryption

requirements for the storage and transmission of RTP message data

•

Participating FIs holding customers’ accounts are subject to existing consumer privacy laws regarding the proper use of consumer data and

restrictions on disclosure of such information to third parties. Participating FIs are subject to the Gramm-Leach-Bliley Act, which governs the

treatment of nonpublic personal information about consumers by financial institutions and requires financial institutions to safeguard the security and

confidentiality of customer information

•

Additionally, the PSP compliance criteria require PSPs that access the RTP system through banks to develop and implement administrative, technical,

and physical safeguards to protect the security, confidentiality, and integrity of customer information, as well as to ensure the proper disposal of

customer information

Cyber

Resilience

• TCH monitors its system and its procedures for security breaches, violations, and suspicious activity, including suspicious external activity

(unauthorized probes, scans, or break-in attempts) and suspicious internal activity (unauthorized system administrator access, unauthorized changes to

its system or network, system or network misuse, or theft or mishandling of customer information)

• Industry-standard information channels are monitored by TCH for newly identified system vulnerabilities regarding the technologies and services

(including application software, databases, servers, firewalls, routers and switches, hubs, etc.) and fix or patch any identified security problem as soon

as commercially reasonable, based on TCH’s determination of the severity level of the security problem

• TCH maintains and implements appropriate plans to assure its continued operation. These plans shall include the following: recovery strategy,

documented recovery plans covering all areas of operations necessary to delivering services as required by the RTP Operating Rules, vital records

protection, and testing plans

• The plans shall provide for backup of critical data files, customer information, application software, documentation, forms and supplies. The recovery

strategy shall provide for recovery after both short- and long-term disruptions in facilities, environmental support, and data processing equipment

• TCH shall continue to provide service to a participant if the participant activates its contingency plan or moves to an interim site to conduct its business,

including during tests of the Participant’s contingency operations plans

• TCH’s contingency plans for disruptions in facilities, environmental support, and data processing equipment provides the ability to bring any impacted

operations that are necessary to delivering services as required by the RTP Operating Rules up to full capacity at its back-up site within 60 minutes of

a declared disaster

As per the RTP Operating Rules and RTP Customer Information Security Standards and Requirements, TCH has established guiding principles for

ensuring the cyber resilience and data privacy. It has also obligated participants to follow certain guidelines for safeguarding the sensitive information

Source: RTP Operating Rules | RTP Playbooks

40

World Bank Fast Payments Toolkit

5.3. Dispute Resolution and Customer Complaints

Customer complaintsInter-bank Dispute Resolution

• RTP Operating Rules incorporate existing laws (i.e., EFTA, Regulation E

and UCC 4A) that sets forth a well-established framework regarding banks’

liability for unauthorized transactions from their customers’ accounts, as well

as specific requirements regarding the resolution of errors from consumer

accounts

• This structure simplifies the account-holding financial institution’s dispute

investigation processes and minimize the need for a detailed set of

interbank dispute resolution rule

• RTP System provides a mechanism to participants to send and respond to

requests for the return of funds for any reason, including unauthorized or

erroneous RTP Payments

• TCH shall not be a party to any dispute between Participants regarding

liability for erroneous or unauthorized RTP Payments. Such determination is

left to the participants, including through any available dispute resolution

and/or judicial process

• TCH shall only be liable for RTP Payments if such RTP Payments are

unauthorized and the RTP Payments were caused by dishonest or

fraudulent acts of TCH or its representatives

• There are no centralized guidelines for resolution of customer complaints

• Though RTP Operating Rules obligates the sending financial institutions to

put in place policies and procedures for handling customer claims for

unauthorized transfers and funds sent in error

• Disputes and exception scenarios are addressed by additional messages

such as request for information and request for return of funds.

Currently, number of disputes and exception scenarios are low in RTP

• Receiving FIs must have policies and procedures to respond to requests to

reclaim funds sent in error

No centralized guidelines has been issued by TCH for inter-bank dispute scenarios and customer complaints resolution. Though RTP System provides a

mechanism to participants to send and respond to requests for the return of funds

Source: TCH | RTP Operating Rules

41

World Bank Fast Payments Toolkit

6. Annexure

Chapter sections:

6.1. Key Features

42

World Bank Fast Payments Toolkit

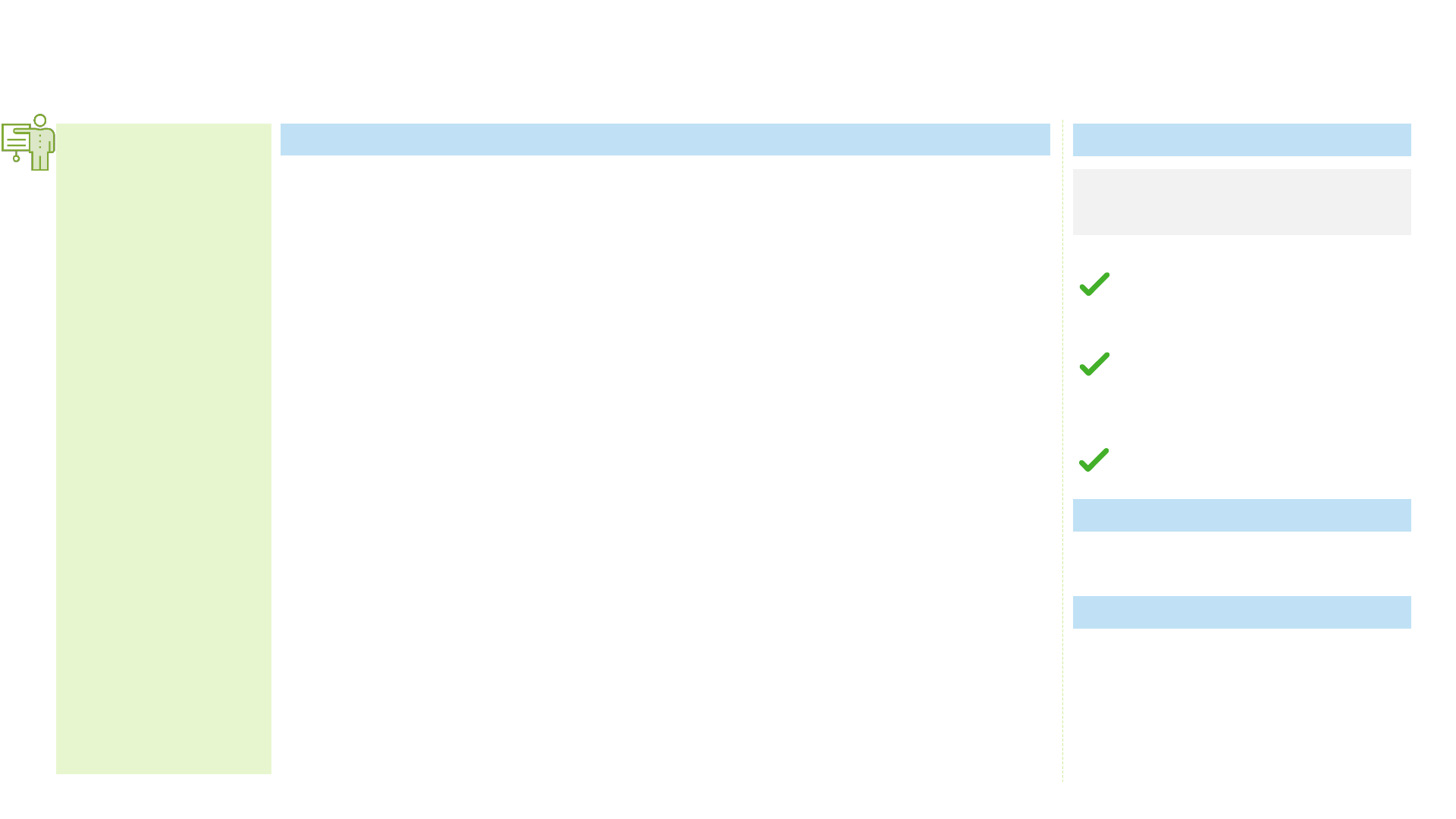

Features

Key Highlights

Payment Types & Use Cases/Services

Settlement

Approach

Type | Time

Hub

RTGS

Distributed

clearing

Individual Business Government

Merchant

Payments

Bulk / Batch

Payment

Request to Pay

Bill payments

Recurring

payments

Cross-border

payments

Source: The ClearingHouse | ACI Report | FIS Report

Operating hours

• 24*7 including weekends and bank holidays

Payment Speed

• Real time

Transaction limit

• $100,000

Alias

• No aliases supported by the core infrastructure

Channel

• Branch, ATM, Internet banking and Mobile banking

User Charges

• At participants’ discretion to charge customers for

RTP payments

Infrastructure Setup

• New system

Messaging format

• ISO 20022

Use of Open APIs

• Open APIs not available

Authentication

• Multifactor authentication

Real time Not applicable

6.1. Key Features