1

How to update or change your banking information in iSolved

1. Login to iSolved through the Purdue intranet site or from the NASDA web page.

2. Choose the Direct Deposit Updates tab under Employee Self Service.

3. The blue tool bar will appear on the screen after choosing Direct Deposit Update. The six

options are:

a. Add New: This is used to add an additional bank account for either a set percentage or

dollar amount from each pay check to be deposited into a separate account.

b. Edit: Choose edit to make changes to you existing routing or bank account numbers.

c. Delete: Use this option to remove the existing bank account information.

d. Refresh: Use this to reload the direct deposit page in iSolved.

e. Save: Use this to save the information that has been updated or changed.

f. Cancel: Use this to return to the original information before the change was saved.

4. Please choose one of the four scenarios below that best fits your banking needs and follow

the corresponding instructions:

a. I want to change my account number at the same bank.

i. Touch on the Edit icon in the blue box so that changes can be made.

ii. Touch on the Account Number box and enter the new account number

provided by your bank or from the second set of numbers on the bottom of

your check.

iii. Touch on the Save icon from the blue bar.

2

b. I want to deposit my entire check into an account at a different bank.

i. Touch on the Delete icon in the blue box.

ii. Touch OK on the pop up box about deleting the record.

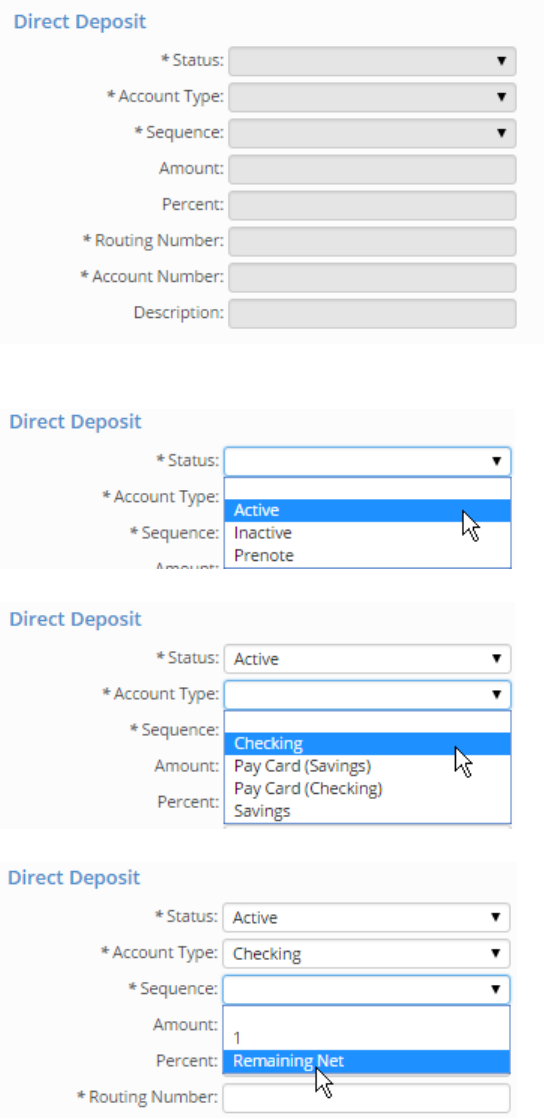

iii. The Direct Deposit boxes should all be empty as shown below.

iv. Touch on the Add New icon in the blue box.

v. Touch on the Status box and chose Active from the drop down.

vi. Touch on the Account Type and chose the type of account.

vii. Touch on Sequence and choose Remaining Net.

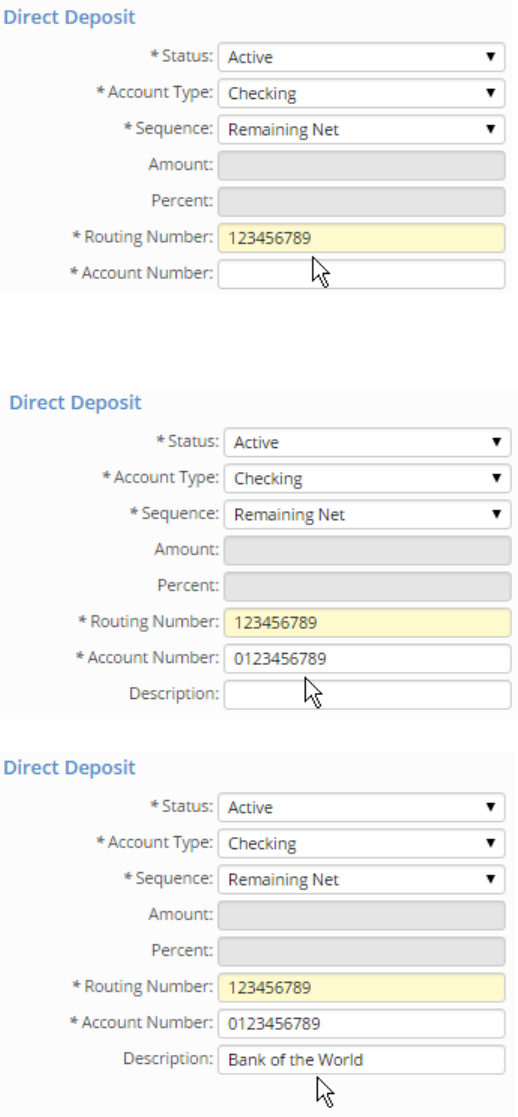

viii. Touch on Routing Number and enter the bank’s 9 digit number. (It is usually

the first group of numbers on the bottom of a check).

3

ix. Touch on Account Number and enter your account number. It is usually the

second group of numbers on the bottom of your check and can be of varied

length.

x. Touch on Description and enter the name of your bank.

xi. Touch on the Save icon on the blue box.

4

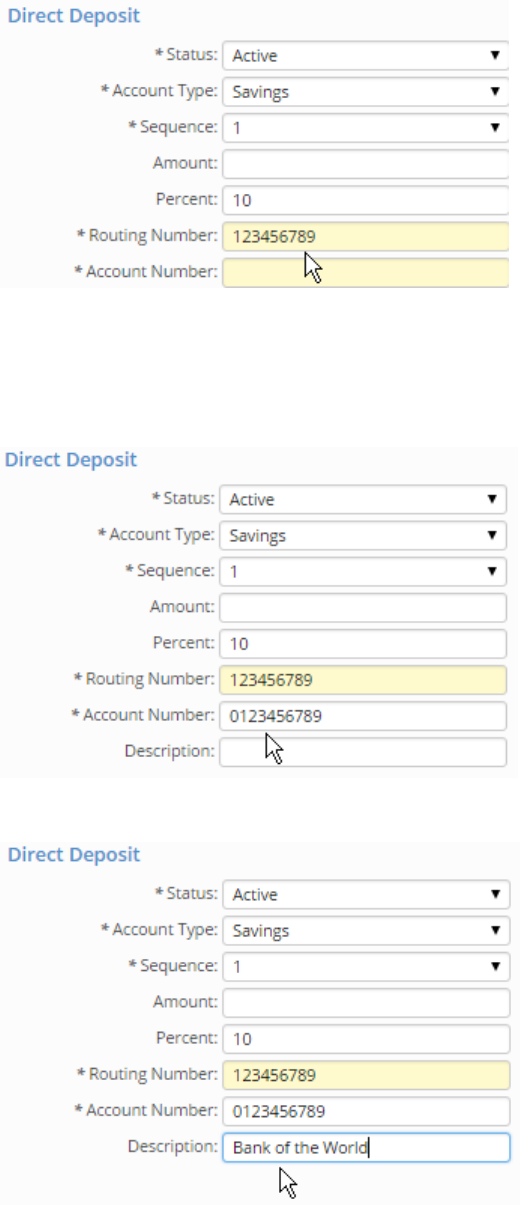

c. I want to put a percentage of each check into a separate account.

i. This option requires two separate bank accounts. One for the percentage to be

deposited into and one for the remaining amount. These instructions will show

you how to add an additional account for the percentage.

ii. Touch on Add New from the blue box.

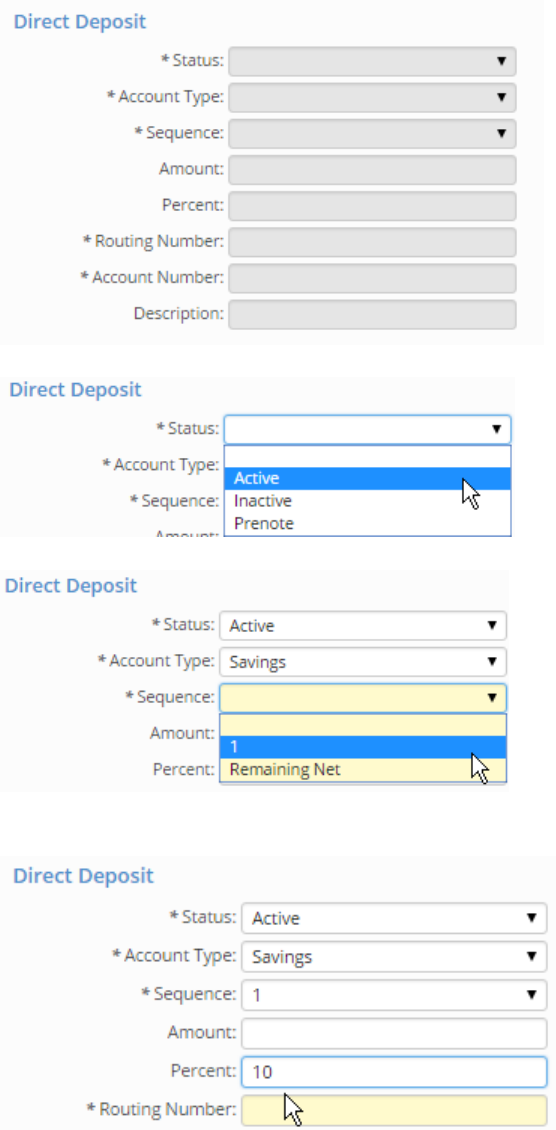

iii. All of the Direct Deposit boxes should all be empty as shown below.

iv. Touch on the Status box and choose Active from the drop down.

v. Touch on the Sequence box and choose 1.

vi. Touch on the Percent box and enter the percentage from each check that you

want deposited into this account. Type in 10 for 10%, 20 for 20%. Etc.

5

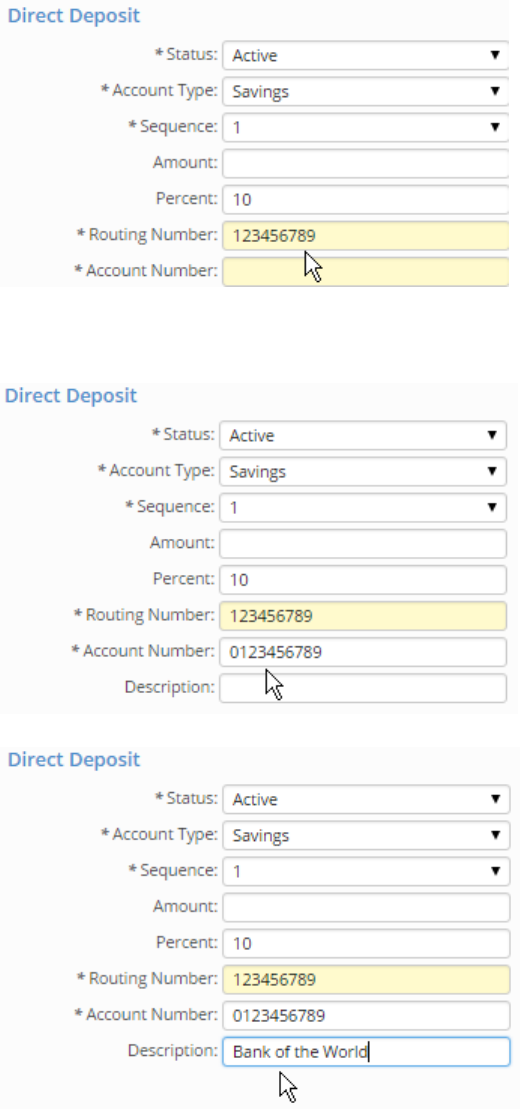

vii. Touch on the Routing Number box and enter the bank’s 9 digit number. (It is

usually the first group of numbers on the bottom of a check).

viii. Touch on the Account Number and enter your account number. (It is usually

the second group of numbers on the bottom of your check and can be of varied

length).

ix. Touch on the Description box and enter the bank’s name.

x. Touch on the Save icon on the blue box.

6

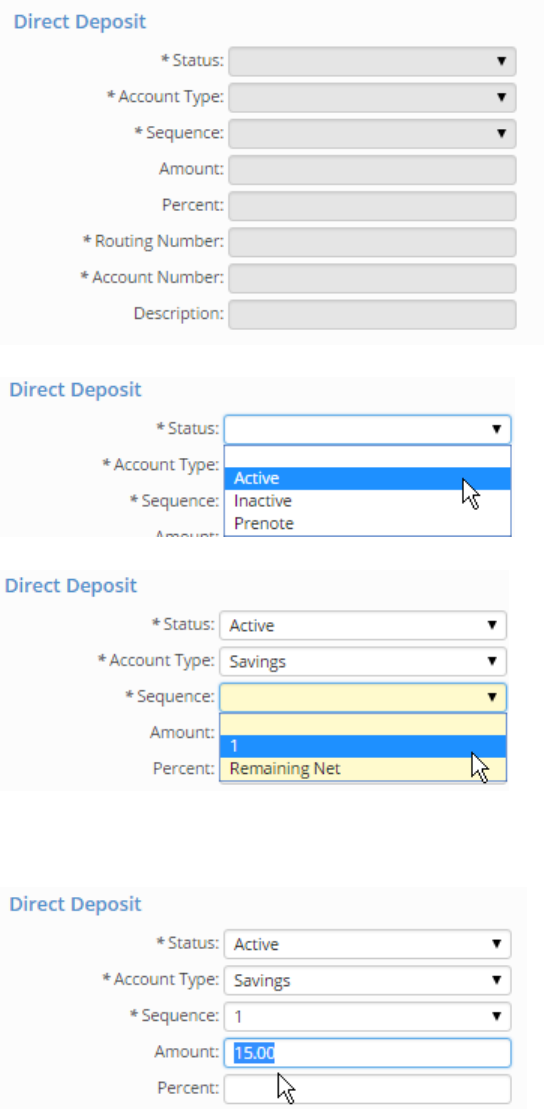

d. I want to put a set dollar amount from each check into a separate

account.

i. This option requires two separate bank accounts. One for the set amount to be

deposited into and one for the remaining amount. These instructions will show

you how to add an additional account.

ii. Touch on Add New from the blue box.

iii. All of the Direct Deposit boxes should all be empty as shown below.

iv. Touch on the Status box and choose Active from the drop down.

v. Touch on the Sequence box and choose 1.

vi. Touch on the Amount box and enter in the dollar amount that you want to

have put into this account from every pay check. In this example $15 is entered

as 15.00

7

vii. Touch on the Routing Number box and enter the bank’s 9 digit number. (It is

usually the first group of numbers on the bottom of a check).

viii. Touch on the Account Number and enter your account number. (It is usually

the second group of numbers on the bottom of your check and can be of varied

length).

ix. Touch on the Description box and enter the bank’s name.

x. Touch on the Save icon ion the blue box.