37 | FDIC | Affordable Mortgage Lending Guide

Credit Enhanced Products

OVERVIEW

OVERVIEW

Credit enhanced products require PFIs to share in the

credit risk of the loans sold under the MPF Program. In

return for holding a portion of the credit risk, the PFIs

are paid credit enhancement fees, which provide an

economic incentive to PFIs to retain credit risk on high

quality loans. MPF credit enhanced products vary by

the amount of credit enhancement fee income paid

to the PFI and whether or not that credit enhance-

ment fee is impacted by loan performance, as well

as the amount and structure of the shared credit-risk

arrangement between the PFI and the FHLB. Generally,

higher levels of credit risk assumed by the PFI equates

to higher credit enhancement fees paid to the PFI.

Depending on a PFI’s risk tolerance and collateral

needs, one product may provide greater benet over

another. While the MPF Program offers three distinct

credit enhanced products, each nancial institution

should carefully review the impact of the income

stream associated with the product as well as the

credit enhancement obligations and assess the risks

and benets.

The risk-sharing structures on all three MPF credit

enhanced products are multi-layered. After accounting

for any principal the borrower has paid down on the

loan, loan losses are paid rst from any existing primary

mortgage insurance policy on the property. Mortgage

insurance is required on all MPF transactions with

loan-to-values greater than 80 percent. Any remain-

ing losses are divided between the FHLB and the PFI.

The amount of risk assumed by the FHLB and the PFI

varies by product. The rst layer of losses is absorbed

by the FHLBs’ “rst loss account.” The second layer of

losses, called the “credit enhancement obligation,” is

paid by the PFI. Any losses incurred beyond the credit

enhancement obligation are absorbed by the FHLB.

The credit enhancement obligation is calculated so

that the total credit enhancement amount plus the rst

loss account is sufcient to bring the total loss reserves

for the master commitment to achieve an Acquired

Member Assets (AMA) investment grade.

19

Over time,

this credit enhancement obligation is recalculated. If

the newly calculated credit enhancement obligation

is lower than the remaining obligation, the PFI’s

credit enhancement obligation is reset to the new,

lower level.

The credit enhancement fees paid to the PFI vary by

loan product and by the total size of the MPF

delivery contract.

FHLBs provide three MPF credit-enhanced secondary

market products, MPF Original, MPF 125, and MPF 35.

MPF Original: Secondary market xed-rate con-

ventional mortgage product purchased by the

FHLB and held on its balance sheet. Credit risk is

shared between the FHLB and the PFI. For sharing

the risk, PFIs are usually paid a xed monthly credit

enhancement fee, typically 10 basis points. Credit

enhancement fee income is not impacted by loan

performance. The rst loss account starts at zero

and builds at 4 basis points of outstanding balance

each year. Servicing released or retained options

are available.

19

The FHFA has issued, “Acquired Member Assets (AMA) Final Rule For

Federal Home Loan Bank Investments” that makes certain changes to the

AMA programs. To comply with Dodd-Frank Act mandates that generally bar

regulatory agencies from incorporating NRSRO credit-rating requirements

into regulations, the FHLBs are now required to determine and document

that AMA assets are enhanced at least to an “AMA investment grade,” which

is a determination made by each FHLB based on documented analysis that

includes consideration of applicable insurance, credit enhancements, and

other sources for repayment on the assets. The FHLB must now determine the

total credit enhancement obligation no later than 30 calendar days after the

FHLB completes the purchase of an AMA asset. The nal rule can be found at

Federal Register 81 FR 91674 or https://www.fhfa.gov/SupervisionRegulation/

Rules/Pages/Acquired-Member-Assets-Final-Rule.aspx

FDIC | Affordable Mortgage Lending Guide | 38

MPF 125: Secondary market xed-rate conventional

mortgage product purchased by an FHLB and held

on its balance sheet. Credit risk is shared between

the FHLB and the PFI. For sharing the risk, PFIs are

paid between 6 basis points to 9 basis points credit

enhancement fee monthly. Credit enhancement fee

income is impacted by loan performance. The rst

loss account is set at the time of delivery at 100 basis

points of all loans delivered. Servicing released or

retained options are available.

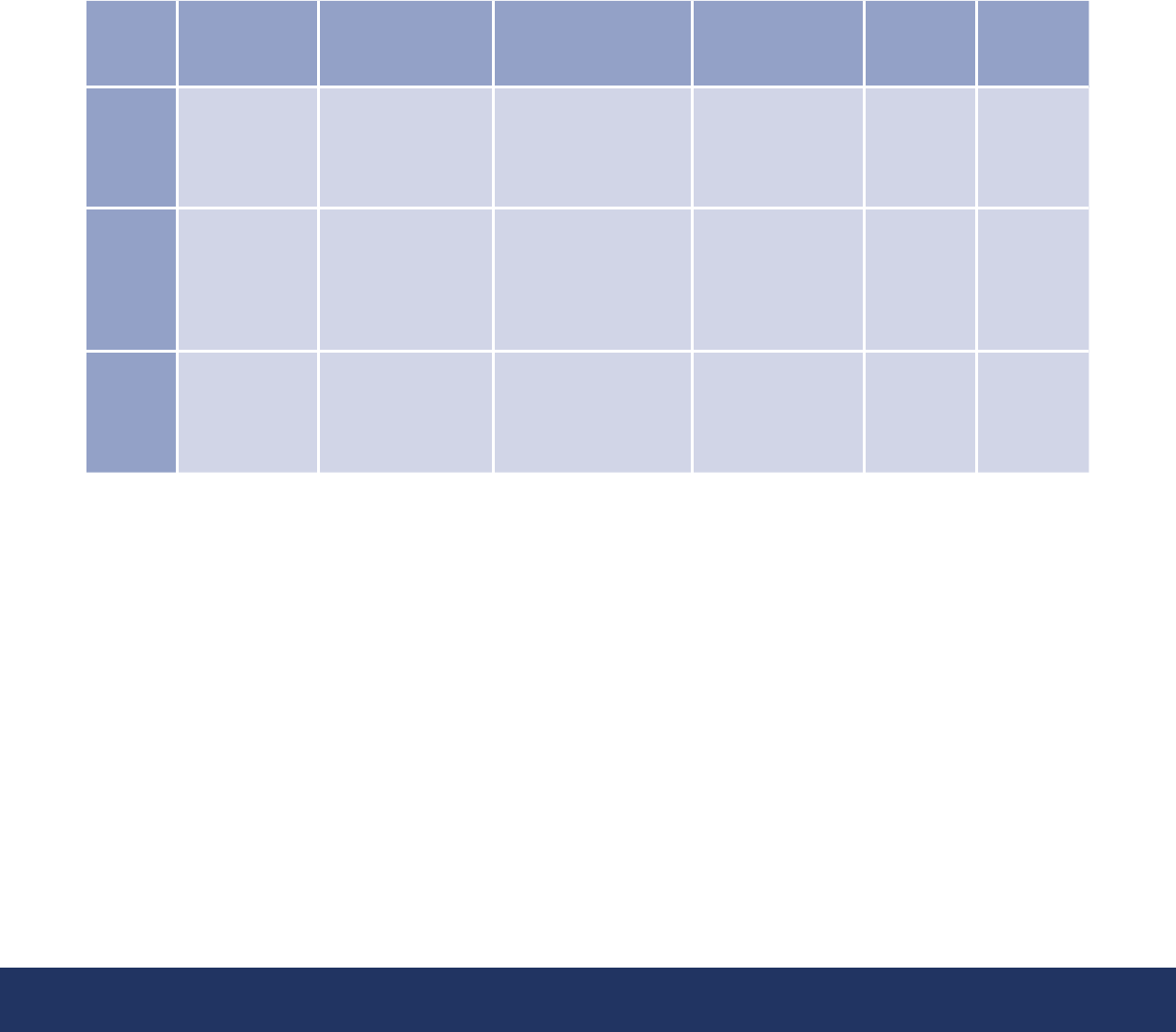

Credit

Enhancement

Fee Amount

Credit Enhancement

Fee impacted by

loan performance

FHLB First

Loss Account

PFI Credit

Enhancement

Obligation

Servicing

Options

Servicing

Income

MPF

Original

10 basis points No

Starts at zero, builds at

4 basis points

each year calculated

on the outstanding

principal balance

AMA investment

grade

Retained or

released

25 basis

points, if

retained

MPF 125 6-9 basis points Yes

Fixed at 100 basis

points of all loans

sold under the master

commitment

AMA investment

grade less 100

basis points rst

loss account,

minimum 25

basis points

Retained or

released

25 basis

points, if

retained

MPF 35

9-12 basis

points

Yes

Fixed at 35 basis

points of all loans

sold under the master

commitment

AMA investment

grade less 35

basis points rst

loss account

Retained or

released

25 basis

points, if

retained

MPF CREDIT ENHANCED PRODUCT COMPARISON

MPF 35: Secondary market xed-rate conventional

mortgage product purchased by an FHLB and held

on its balance sheet. Credit risk is shared between

the FHLB and the PFI. For sharing the risk, PFIs are

paid between 9 basis points to 12 basis points credit

enhancement fee monthly. Credit enhancement fee

income is impacted by loan performance. The rst

loss account is set at the time of delivery at 35 basis

points of all loans delivered. Servicing released or

retained options are available.