State school district

credit enhancement programs

Executive summary

The use of state guaranties, state aid intercepts, and other similar

programs to enhance the credit ratings of local governments is a common

financing structure in U.S. public finance. Many states use such programs

to enhance the credit ratings of local school districts. State school district

credit enhancement programs generally fit within one of four categories:

• State Permanent Fund

• State Guaranty

• Standing or Annual Appropriation

• State Aid Intercept

The majority of the programs are designed to make funds available for

timely debt service payments prior to a default. In fact, all the programs

covered here have pre-default timing mechanics for debt service payment

recovery. Although a state’s program usually extends to all school districts,

it is important to note that not all school districts may qualify to participate,

and not all the bonds of an issuer may have the enhancement in place to

support the ratings. Some states—without the type of explicit school

district enhancement programs discussed here—provide other financing

vehicles that school districts participate in, such as municipal bond banks

or other pooled financings handled through a conduit issuer.

Inside

State permanent fund programs 2

State guaranty programs 2

Standing or annual

appropriation programs 3

State aid intercept programs 3

March 2024

Authors

Thomas DeMarco, CFA®

Senior Vice President

Fixed Income Market Strategist

Fidelity Capital Markets

Ilya Perlovsky, CFA®

Vice President

Fixed Income Market Strategist

Fidelity Capital Markets

State school district credit enhancement programs | 2

Program credit ratings and outlooks may not be

expressly tied to a state’s ratings. The contractual

relationship between the state and the program

participant determines the extent to which, if at all, the

program credit rating or outlook will track the state

credit rating. Not all programs fit neatly into the four

categories outlined above, and they are not necessarily

affected by state rating changes. While program

structure, mechanics, and specific statutory provisions

differentiate credit quality, there are at least three

features common to all school district credit

enhancement programs in general:

• An independent paying agent, notifying the state in

the event of a default or a potential default

• A revenue source independent of the school district,

sufficient to cure a debt service shortfall

• State oversight of school district participants

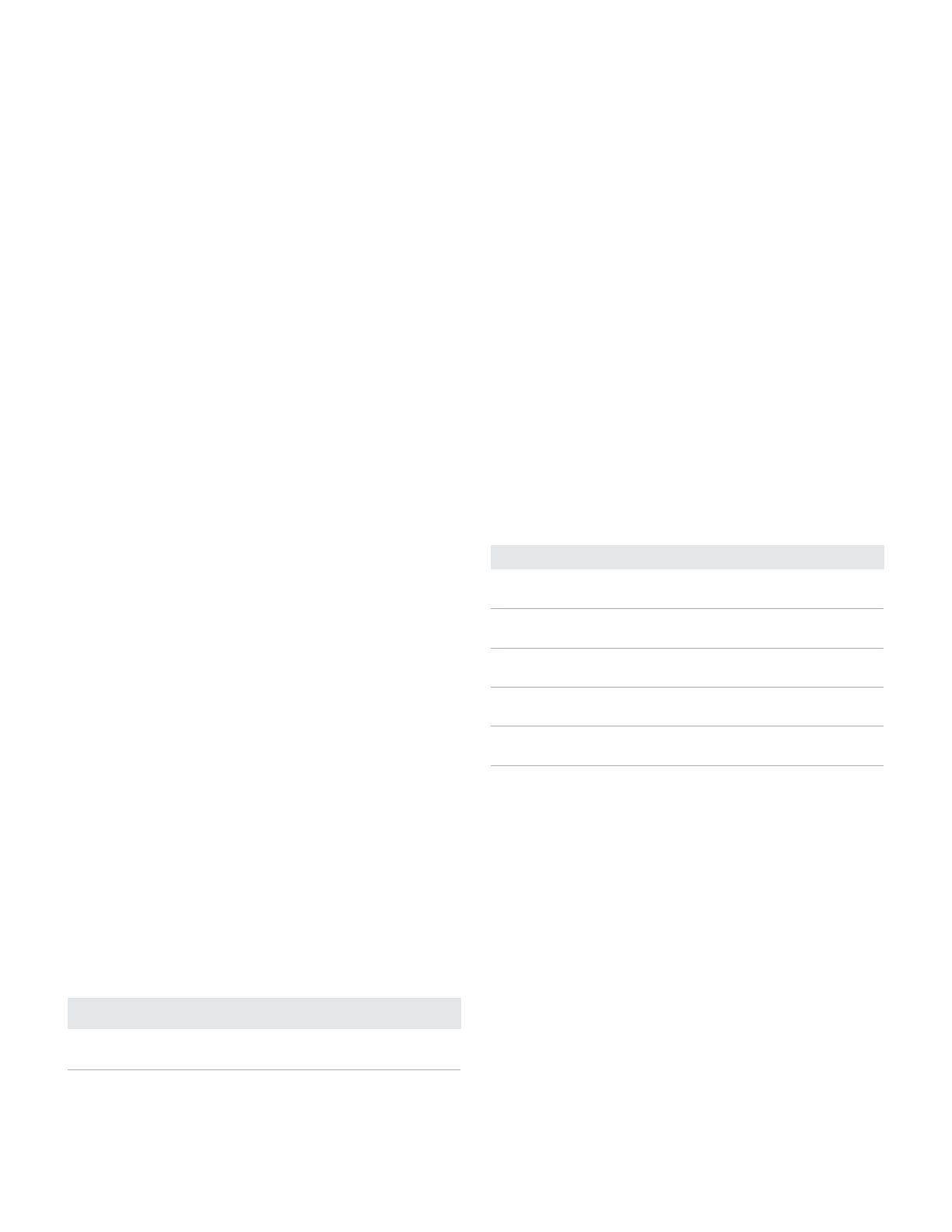

State permanent fund programs

State permanent funds are constitutionally created and

historically have been funded through natural resource

royalties and related activities. The corpus of the fund

functions similar to an insurance policy, whereby it is

leveraged to guarantee the debt service of school

district bonds. Permanent fund program credit ratings

are based on the fund’s investment policies, liquidity,

leverage, and operating guidelines, and are entirely

independent of the state’s ratings. Table 1 below

assesses the credit quality of the two state permanent

fund programs based on the following factors:

(i) liquidity and leverage, (ii) investment policies, and

(iii) operating guidelines.

TABLE 1. State permanent fund programs

Program Name Program Ratings State Ratings

Texas Permanent

School Fund

Aaa / AAA / AAA Aaa / AAA / AAA

Nevada Permanent

School Fund

Aaa / AAA / NR Aa1 / AA+ / AA+

State guaranty programs

Six states have established programs that guarantee

the debt service of eligible school district bonds. Under

a guaranty program, the state may commit to draw on

its general fund, on an alternative liquidity source, or

on a special dedicated reserve fund, or to issue general

obligation bonds, if necessary, to cure a debt service

shortfall of a participating school district. State

guaranty program credit ratings tend to be the same as

the state’s ratings. Table 2 provides an assessment of

credit quality of the six state guaranty programs based

on the following factors: (i) the state’s own credit

strength, (ii) the state’s level of commitment and

mandate to act, and (iii) the degree of institutionalized

state oversight.

TABLE 2. State guaranty programs

Source: Moody’s Investors Service, S&P Global Ratings, Fitch Ratings, FCM;

February 28, 2024

[-] Negative Outlook; [+] Positive Outlook

NR = Not Rated

Program Name Program Ratings State Ratings

Utah School District

Bond Guaranty

Aaa / AAA / AAA Aaa / AAA / AAA

Idaho School Bond

Credit Enhancement

Aaa / AA+ / NR Aaa / AA+ / AAA

Washington State School

Bond Guarantee

Aaa / AA+[+] / AA+ Aaa / AA+[+] / AA+

Oregon School Bond

Guaranty

Aa1 / AA+ / AA+ Aa1 / AA+ / AA+

Michigan School Bond

Qualification and Loan

Aa1 / AA / AA+ Aa1 / AA / AA+

New Jersey School Bond

Reserve Act (Fund for

Free Public Schools)

A1 / A / NR A1 / A / A+

Source: Moody’s Investors Service, S&P Global Ratings, Fitch Ratings, FCM;

February 28, 2024

[-] Negative Outlook; [+] Positive Outlook

NR = Not Rated

State school district credit enhancement programs | 3

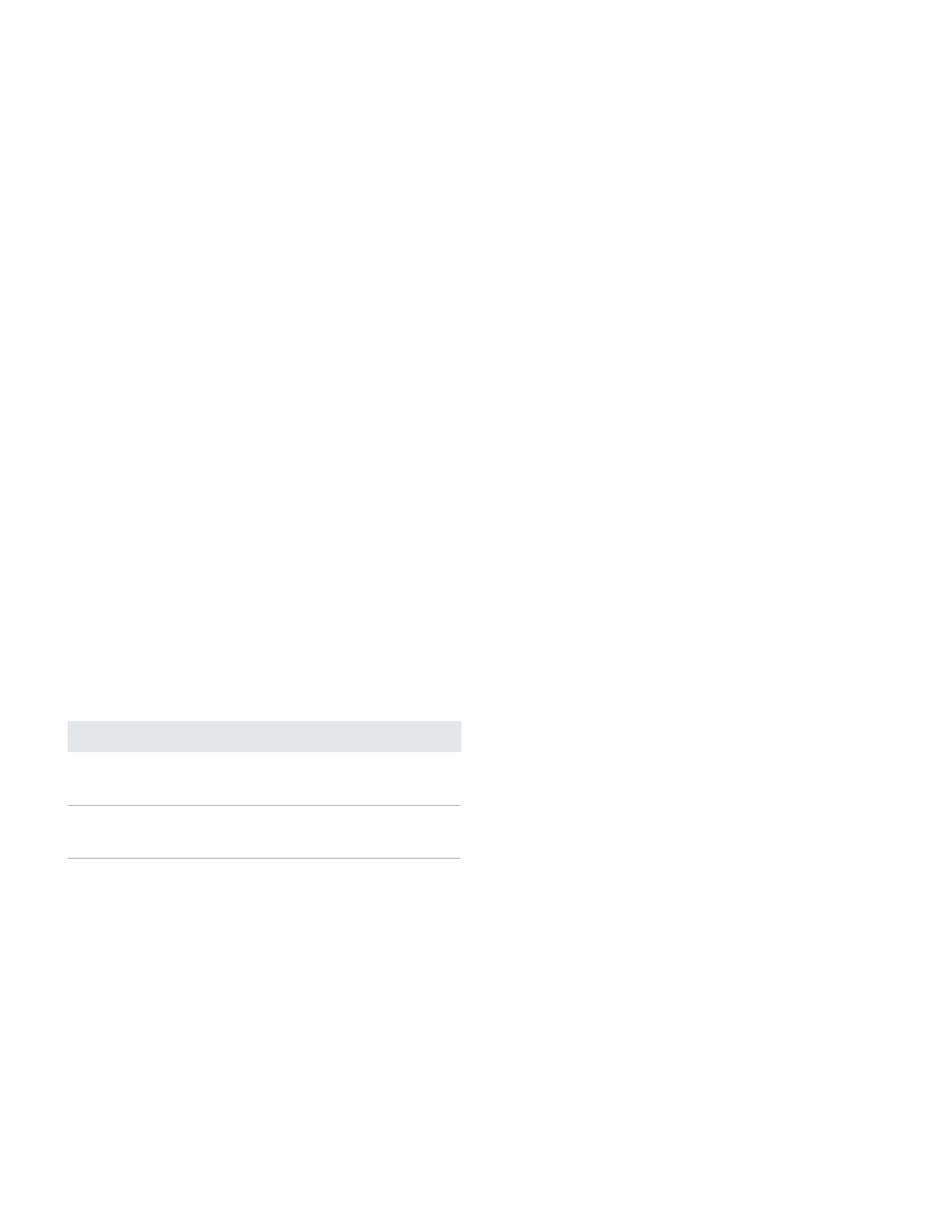

Standing or annual appropriation programs

The principal distinction between state guaranty

programs and state appropriation programs is that

under appropriation programs, states are not

contractually obligated to use all available resources

to cover a participating school district’s debt service

shortfall. Although appropriation programs do not

provide an explicit guaranty, they are structured to

ensure timely debt service payments in the event of

a shortfall, so the risk of nonappropriation by the

legislature is very low. These programs reflect each

state’s constitutional obligation to fund public

education. Three states use appropriation programs to

enhance the credit quality of school district bonds, and

the program credit ratings are typically equivalent to or

one notch below the state’s general obligation rating.

Table 3 provides an assessment of credit quality of the

three state appropriation programs based on the

following factors: (i) the state’s own credit strength,

(ii) the state’s level of commitment and mandate to act,

(iii) the degree of institutionalized state oversight, and

(iv) program mechanics.

TABLE 3. State appropriation programs

Program Name Program Ratings State Ratings

Minnesota School

District Credit

Enhancement

Aa1 / AAA / AA+ Aaa / AAA / AAA

South Carolina School

District Credit

Enhancement

Aa1 / AA / AA+ Aaa / AA+ / AAA

West Virginia Municipal

Bond Commission

NR / AA- / NR Aa2 / AA- / AA

State aid intercept programs

Intercept programs are designed to divert, or intercept,

state aid due a school district in the event of a debt

service payment shortfall. The strength of the state’s

pledge to ensure that any debt service deficiency is

cured in a timely manner is driven primarily by the

program’s mechanics and the availability of state aid.

The strongest programs are distinguished by structural

features that ensure full and timely payment of debt

service from the state in the event of a potential default

by a participating school district. Such programs serve

to appropriate sufficient amounts regardless of any

state aid to the school district that has already been

disbursed at the time of intercept—referred to here

simply as an unlimited advance. Intercept programs of

a weaker strain involve a structure that limits the

advance for the payment of debt service to any

remaining undisbursed state aid due the district in a

given fiscal year, or a limited advance. Still yet weaker

structures entail an unclear timing mechanism that may

result in a post-default debt service payment recovery.

The strength of the program’s mechanics drives its

credit ratings, which may be multiple notches below

the state’s general obligation (or equivalent) ratings.

Some intercept programs where the timing or the

amount of state aid disbursement is unclear may have

a ratings ceiling several notches below the state’s

general obligation ratings, and will not necessarily

change when the state’s ratings or outlook changes.

Table 4 illustrates the credit quality of the 14 state aid

intercept programs based on the following factors:

(i) timing of disbursement (pre- or post-default),

(ii) availability of funds (unlimited or limited advance),

(iii) required notification, (iv) the degree of

institutionalized state oversight, and (v) the state’s

own credit strength.

Source: Moody’s Investors Service, S&P Global Ratings, Fitch Ratings, FCM;

February 28, 2024

[-] Negative Outlook; [+] Positive Outlook

NR = Not Rated

State school district credit enhancement programs | 4

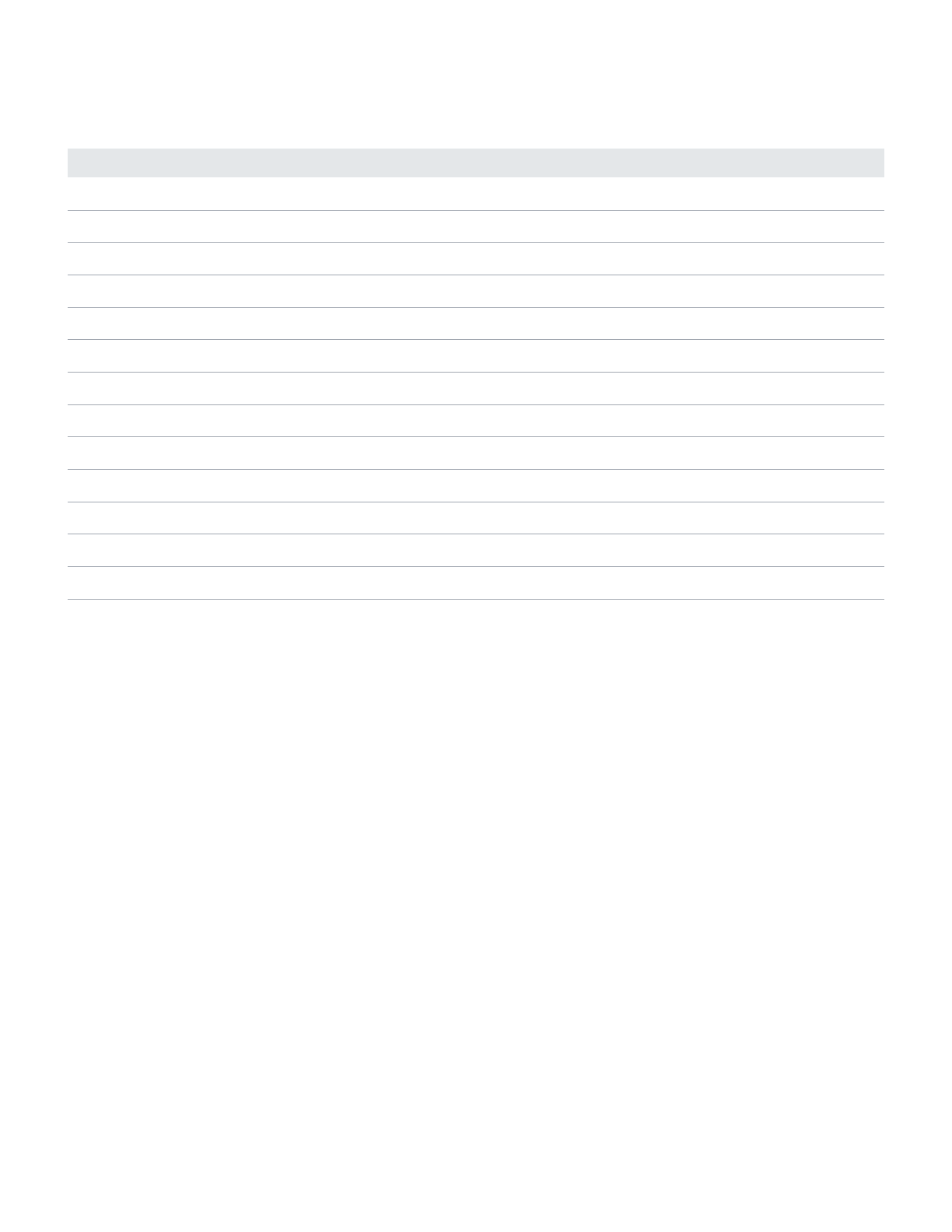

TABLE 4. State aid intercept programs

Program Name Program Ratings State Ratings

Missouri School District Direct Deposit Aa1 / AA+ / AA+ Aaa / AAA / AAA

Georgia School District Intercept Aa1 / AA+ / AA+ Aaa / AAA / AAA

Indiana School District Enhancement NR / AA+ / AA+ Aaa / AAA / AAA

Ohio School District Credit Enhancement Aa1 / AA+ / AA+ Aaa / AAA / AAA

Virginia Localities Intercept Aa1 / NR / NR Aaa / AAA / AAA

Massachusetts Qualified Bond Aa2 / AA+ / NR Aa1 / AA+ / AA+

Dormitory Authority of State of New York School District Intercept Aa2 / NR / NR Aa1 / AA+ / AA+

Arkansas School District Intercept Aa2 / NR / NR Aa1 / AA / NR

Colorado School District Credit Enhancement Aa2 / AA- / AA Aa1 / AA / NR

New Mexico School District Intercept Aa3 / NR / NR Aa2 / AA / NR

Mississippi School District Debt Enhancement NR / AA- / NR Aa2 / AA / AA

Pennsylvania School District Intercept A2 / NR / AA- Aa3 / A+[+] / AA

Kentucky School District Enhancement A1 / A / AA- Aa3 / A+ / AA

New Jersey Qualified Bond A2 / A- / A A1 / A / A+

A common question concerning state aid intercept programs is in regard to the specific mechanics that apply to

the intercept of state aid itself and the required notification necessary to redirect it to bondholders. Is state aid

transferred directly to the bond trustee to pay debt service as it comes due, or is debt service paid from district

resources and state aid intercepted, or redirected, upon notification in the event of a shortfall? In fact, both

processes are used, but the latter is more common. The former is referred to here as a direct advance intercept,

with the schedule for the payment of state aid covering debt service established upon bond issuance. For those

programs that require notification to cover a shortfall, notice of at least one week prior to the scheduled debt

service payment date is considered strong; three days, average; less than three days, weak; and post-default or

unclear timing, weakest.

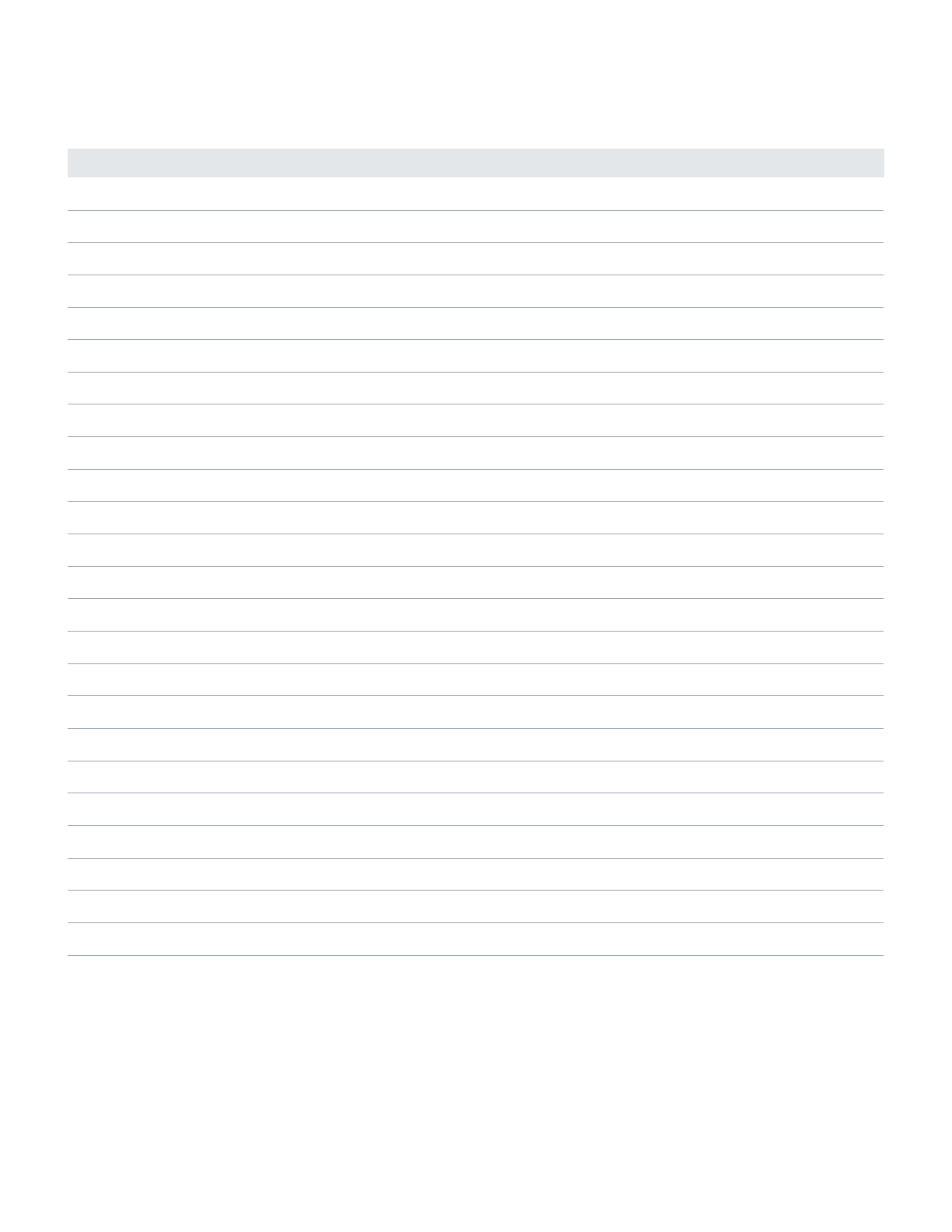

Although the four categories of credit enhancement programs discussed above are presented in the order of their

relative strength, specific program mechanics and the credit strength of the state itself can elevate the quality of

any one program above another. Table 5 provides an overall assessment of credit quality of school district credit

enhancement programs, regardless of their particular category, based on the following factors: (i) the dedication of

specific state resources for school district credit enhancement, (ii) the state’s level of commitment and mandate to

act, (iii) the state’s own credit strength, (iv) program mechanics, and (v) the sufficiency of available revenues.

Source: Moody’s Investors Service, S&P Global Ratings, Fitch Ratings, FCM; February 28, 2024

[-] Negative Outlook; [+] Positive Outlook

NR = Not Rated

State school district credit enhancement programs | 5

TABLE 5. Relative ranking of all programs

Program Name Program Ratings State Ratings

Texas Permanent School Fund Aaa / AAA / AAA Aaa / AAA / AAA

Nevada Permanent School Fund Aaa / AAA / NR Aa1 / AA+ / AA+

Utah School District Bond Guaranty Aaa / AAA / AAA Aaa / AAA / AAA

Idaho School Bond Credit Enhancement Aaa / AA+ / NR Aaa / AA+ / AAA

Washington State School Bond Guarantee Aaa / AA+[+] / AA+ Aaa / AA+[+] / AA+

Oregon School Bond Guaranty Aa1 / AA+ / AA+ Aa1 / AA+ / AA+

Michigan School Bond Qualification and Loan Aa1 / AA / AA+ Aa1 / AA / AA+

Minnesota School District Credit Enhancement Aa1 / AAA / AA+ Aaa / AAA / AAA

Missouri School District Direct Deposit Aa1 / AA+ / AA+ Aaa / AAA / AAA

Georgia School District Intercept Aa1 / AA+ / AA+ Aaa / AAA / AAA

Massachusetts Qualified Bond Aa2 / AA+ / NR Aa1 / AA+ / AA+

Ohio School District Credit Enhancement Aa1 / AA+ / AA+ Aaa / AAA / AAA

Indiana School District Enhancement NR / AA+ / AA+ Aaa / AAA / AAA

South Carolina School District Credit Enhancement Aa1 / AA / AA+ Aaa / AA+ / AAA

Virginia Localities Intercept Aa1 / NR / NR Aaa / AAA / AAA

Dormitory Authority of State of New York School District Intercept Aa2 / NR / NR Aa1 / AA+ / AA+

Arkansas School District Intercept Aa2 / NR / NR Aa1 / AA / NR

Colorado School District Credit Enhancement Aa2 / AA- / AA Aa1 / AA / NR

New Mexico School District Intercept Aa3 / NR / NR Aa2 / AA / NR

Mississippi School District Debt Enhancement NR / AA- / NR Aa2 / AA / AA

West Virginia Municipal Bond Commission NR / AA- / NR Aa2 / AA- / AA

Pennsylvania School District Intercept A2 / NR / AA- Aa3 / A+[+] / AA

Kentucky School District Enhancement A1 / A / AA- Aa3 / A+ / AA

New Jersey School Bond Reserve Act (Fund for Free Public Schools) A1 / A / NR A1 / A / A+

New Jersey Qualified Bond A2 / A- / A A1 / A / A+

Source: Moody’s Investors Service, S&P Global Ratings, Fitch Ratings, FCM; February 28, 2024

[-] Negative Outlook; [+] Positive Outlook

NR = Not Rated

In general, the bond market is volatile, and fixed income securities carry interest rate risk. (As interest rates rise, bond prices usually fall, and vice

versa. This effect is usually more pronounced for longer-term securities.) Fixed income securities also carry inflation risk, liquidity risk, call risk,

and credit and default risks for both issuers and counterparties. Any fixed income security sold or redeemed prior to maturity may be subject to

a substantial gain or loss.

Interest income generated by municipal bonds is generally expected to be exempt from federal income taxes and, if the bonds are held by an

investor resident in the state of issuance, from state and local income taxes. Such interest income may be subject to federal and/or state

alternative minimum taxes. Investing in municipal bonds for the purpose of generating tax-exempt income may not be appropriate for

investors in all tax brackets. Generally, tax-exempt municipal securities are not appropriate holdings for tax-advantaged accounts such as IRAs

and 401(k)s.

Interest income generated by Treasury bonds and certain securities issued by U.S. territories, possessions, agencies, and instrumentalities is

generally exempt from state income tax but is generally subject to federal income and alternative minimum taxes and may be subject to state

alternative minimum taxes.

Short- and long-term capital gains and gains characterized as market discount, recognized when bonds are sold or mature, are generally

taxable at both the state and federal levels. Short- and long-term losses recognized when bonds are sold or mature may generally offset capital

gains and/or ordinary income at both the state and federal levels.

The content in this piece is provided for informational purposes only, and any references to securities listed herein do not constitute

recommendations to buy or sell. The content herein is valid only as of the date published and is subject to change because of market

conditions or for other reasons. Fidelity disclaims any responsibility to update such views. The information presented herein was prepared by

Fidelity Capital Markets based on information obtained from sources believed to be reliable but not guaranteed. This white paper is for

informational purposes only and is not intended to constitute a current or past recommendation, investment advice of any kind, or a

solicitation of an offer to buy or sell securities or investment services.

The Chartered Financial Analyst (CFA®) designation is offered by the CFA Institute. To obtain the CFA charter, candidates must pass three

exams demonstrating their competence, integrity, and extensive knowledge in accounting, ethical and professional standards, economics,

portfolio management, and security analysis, and must also have at least 4,000 hours of qualifying work experience completed in a minimum of

36 months, among other requirements. CFA is a trademark owned by CFA Institute.

Fidelity Capital Markets and its affiliates do not provide tax advice. Accordingly, any discussion of U.S. tax matters included herein is not

intended to be written or used, and cannot be used, in connection with the promotion, marketing, or recommendation by anyone affiliated or

not affiliated with Fidelity Capital Markets. Please consult a tax or financial professional about any specific situation.

Third-party marks are the property of their respective owners; all other marks are the property of FMR LLC.

Fidelity Capital Markets is a division of National Financial Services LLC, a Fidelity Investments company and a member of NYSE and SIPC.

Fidelity Brokerage Services LLC, Member NYSE, SIPC, 900 Salem Street, Smithfield, RI 02917

© 2024 FMR LLC. All rights reserved.

786467.4.0