European Investment Bank

An outline guide to Project Bonds

Credit Enhancement

and the Project Bond Initiative

European Investment Bank Project bonds – a guide

21 December 2012 page 1/27

An outline guide to

Project Bonds Credit Enhancement

and the

Project Bond Initiative

European Investment Bank Project bonds – a guide

21 December 2012 page 2/27

Note

This document is to provide a general outline of how it is currently contemplated that the Project

Bond Initiative and Project Bonds Credit Enhancement (PBCE) will work. This document is for

information purposes only; the terms and conditions of any PBCE may vary substantially from those

set out herein. Furthermore, these general terms do not constitute a commitment or undertaking by

either the EIB or the European Commission in respect of any PBCE transaction. Any such

commitment would require, amongst other things, prior approval from the governing bodies of the

EIB. Interested parties are invited to contact EIB for further information at ProjectB[email protected]

Acronyms used in this publication

BAFO: Best And Final Offer

BLCR: Bond Life Cover Ratio

CEF: Connecting Europe Facility

DSCR: Debt Service Cover Ratio

EIB: European Investment Bank

EC: European Commission

EU: European Union

ICT: Information and Communication Technology

LTA: Lenders Technical Advisor

OJEU: Official Journal of The European Union

PBCE: Project Bonds Credit Enhancement

TEN-T: Trans-European Transport Network

TEN-E: Trans-European Energy Network

European Investment Bank Project bonds – a guide

21 December 2012 page 3/27

Contents

Acronyms used in this publication .......................................................................................................................... 2

Section 1: Introduction ............................................................................................................................................ 4

How will the PBI work?........................................................................................................................................ 5

Eligible projects ................................................................................................................................................... 5

Process ............................................................................................................................................................... 5

The EIB and PPPs .............................................................................................................................................. 6

Purpose of this document and contacts .............................................................................................................. 7

Section 2: Description of the Project Bond Credit Enhancement Facility .............................................................. 8

How will EIB’s Project Bond Credit Enhancement (PBCE) work? ...................................................................... 8

What are the core requirements for an eligible project? ..................................................................................... 8

Detailed description of the funded and unfunded PBCE facilities: ...................................................................10

Interest, Fees, EIB Cost of Funds and Hedging ............................................................................................18

Repayment ....................................................................................................................................................18

Distribution lock-up requirements ..................................................................................................................18

Counterparty credit requirements ..................................................................................................................19

Security: .........................................................................................................................................................19

Events of default ............................................................................................................................................19

Voting rights and controlling creditor .............................................................................................................19

Section 3: Process and stakeholders: ..................................................................................................................21

Step 1 - Procuring Authority, with their advisers, determines whether PBCE may be applicable to the

project ............................................................................................................................................................21

Step 2 – Procuring Authority and its advisers develop bid instructions and evaluation criteria ....................21

Step 3 – Procuring Authority and its advisers evaluate bids .........................................................................22

Step 4 – Procuring Authority invites BaFOs ..................................................................................................22

Step 5 – Preferred bidder through to financial close .....................................................................................23

Annex : The EIB project Cycle ..............................................................................................................................24

FAQs .....................................................................................................................................................................26

Further information: ..............................................................................................................................................27

European Investment Bank Project bonds – a guide

21 December 2012 page 4/27

Section 1: Introduction

“An EU initiative to support project bonds, together with the EIB, would help address the needs for

investment in large EU infrastructure projects”

J.M. Barroso, President of the European Commission, “State of the Union” speech 2010

The European Union’s “2020 Objectives” foresee the need for investments totalling EUR 2 trillion in the

transport, energy and information and communication technology sectors.

This instrument is to be delivered in a challenging financial environment. The debt markets are still being

used for project finance transactions. However pressure on banks’ balance sheets from higher regulatory

capital requirements has constrained bank long-tenor lending. In addition, bond issues have become difficult

to achieve since 2007/8 as the monoline insurers (who previously guaranteed bonds issued by project

companies) have become significantly less active. In the absence of the monolines, European project

finance transactions have not been structured with bond issuances, due in part to bond investors being

hesitant so far to invest in the low BBB range, partly in light of their own regulatory requirements (e.g.

Solvency II). This is the credit rating that would typically be obtained by a traditionally structured project

finance transaction without the benefit of further credit enhancement.

Since 2010, the European Investment Bank (EIB) and the European Commission (EC) have been engaged

in an extensive consultation exercise to develop new financing products to respond to this funding gap.

The “Project Bond Initiative” (PBI) is the EIB and Commission’s response to this challenge. The EIB and EC

are confident that the credit enhancement offered through the PBI will facilitate investment by institutional

investors such as pension funds and insurance companies. For these investors, project bonds whose credit

ratings have been enhanced through the PBI may represent a natural match for their long-term obligations.

What are the key characteristics of an infrastructure asset?

Infrastructure investments tend to have the following characteristics:

• Essential services for the majority of the population and businesses, either relating to

physical flows in the real economy (i.e. transport, energy, broadband) or to social

goods (education, healthcare);

• Government either as a direct client (via fixed term concession) or highly proximate

to the transaction (through economic regulation);

• Long term in nature ( thus requiring long term finance);

• Stable cash flows, particularly where payments are based on availability rather than

demand (which is often beyond the control of a given project); charges may be linked

fully or partially to inflation;

• Natural monopolies, either due to network characteristics/capital intensity or

government policy; and

• Generally low technological risk.

These characteristics mean that infrastructure businesses can generally support high

leverage on a long term basis with returns that are less volatile than other investments.

Some investors do not consider infrastructure a separate asset class; others consider it an

alternative to (say) covered bonds or sovereign debt.

European Investment Bank Project bonds – a guide

21 December 2012 page 5/27

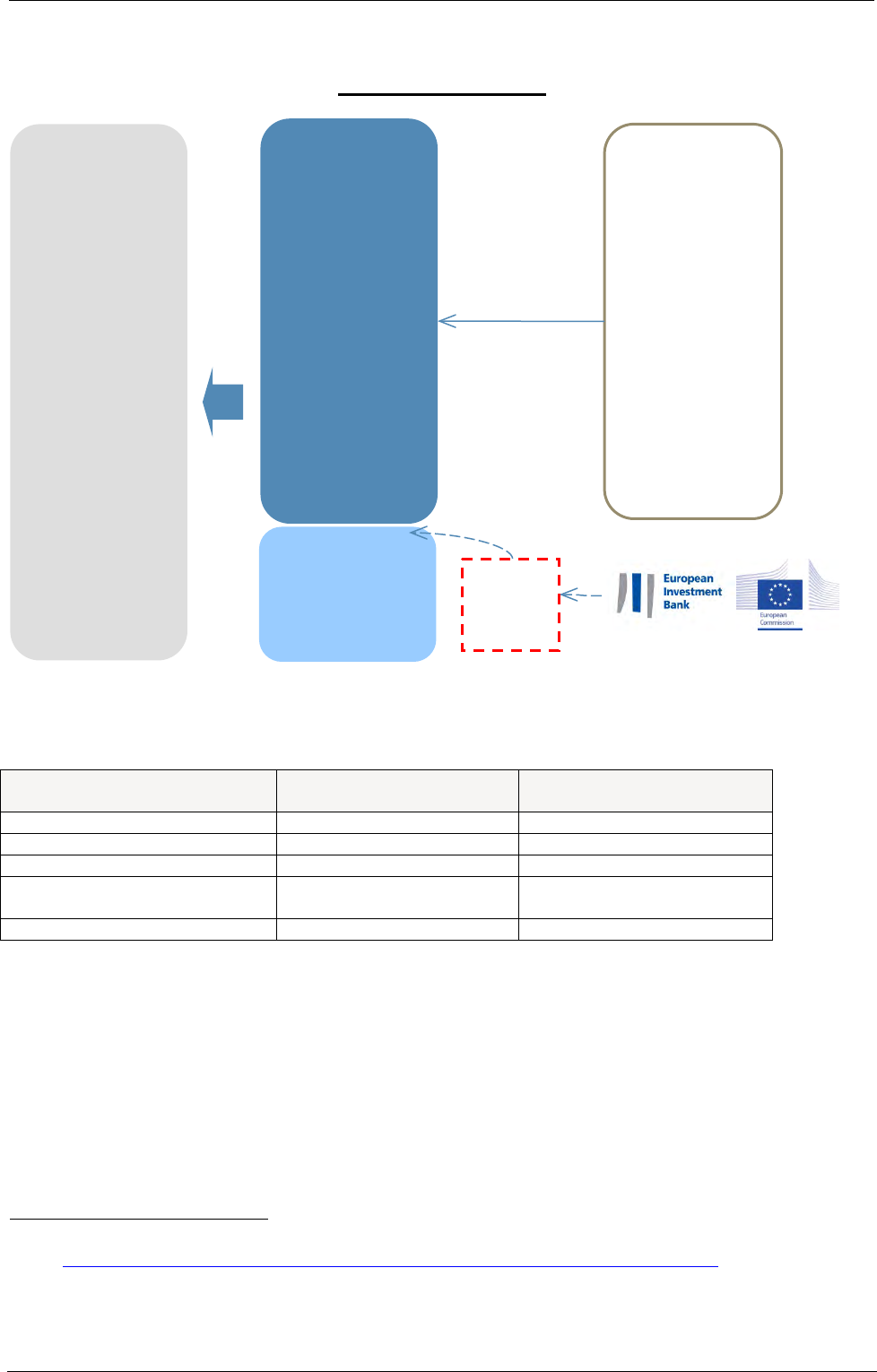

How will the PBI work?

Under the Project Bond Initiative, the EIB will be able to provide eligible infrastructure projects with PBCE in

the form of a subordinated instrument – either a loan or contingent facility – to support senior project bonds

issued by a project company (Senior Bonds). The core benefit of PBCE as described in this document is the

enhancement it brings to the credit ratings of the Senior Bonds. The ultimate objective is to widen access to

sources of finance and to minimise overall funding costs.

PBCE brings additional depth to the infrastructure mezzanine finance market and, particularly in its unfunded

form, an innovative approach to credit enhancing infrastructure transactions in a straightforward manner.

These principles will be tested in the Pilot Phase of the PBI which will run until 2016.

Eligible projects

The Pilot Phase of the Project Bond Initiative is targeted at projects in the areas of trans-European networks

of transport (TEN-T), energy (TEN-E), and broadband / information and communication technology (ICT).

The purpose of the Pilot Phase is to test the PBCE concept during the remaining period of the current multi-

annual financial framework (2007-2013), before the next multi-annual financial framework (2014-2020) and

the proposed implementation of the Connecting Europe Facility (CEF).

This testing phase will be supported by the redeployment of EUR 230 million of unused EU budgetary

resources from existing programmes. The sectorial split will be as follows: EUR 200 million and EUR 10

million will be dedicated to trans-European networks in the fields of transport and energy respectively; EUR

20 million will be dedicated to financing high-speed broadband projects.

The EIB calculates that this EUR 230 million of EU funds, acting as a first loss piece, could enable EIB to

provide around EUR 750 million of PBCE. This could leverage financing to infrastructure projects, on a

portfolio of PBCE transactions, worth more than EUR 4 billion across the three sectors.

• One of the objectives of PBCE is to increase the flow of projects that are suitable for capital markets

financing and so broaden the infrastructure investor base. The EIB’s longer-term objective of the PBI

are to: mobilise capital market Investment in Infrastructure projects

• radically reduce the cost whilst increasing the tenor and liquidity of infrastructure finance

• greatly increase infrastructure financing capacity throughout the European Union as a whole

• address the paucity of junior funding available in the market

• improve the capital markets by establishing tradable infrastructure project bonds that will enable

investors to invest in Infrastructure as an asset class

Process

During the Pilot Phase EIB will work with the public sector body responsible for procuring projects (Procuring

Authorities) and bidders/sponsors to finance eligible projects that incorporate PBCE in the overall funding

structure.

To be eligible for consideration projects need to be capable of reaching financial close before the end of

2016. The EIB Board of Directors will need to have approved the project before the end of 2014.

EIB will engage with multiple bidders from the outset rather than engaging only with the preferred bidder.

This means that bids incorporating PBCE facilities will have been analysed and evaluated by the EIB’s

technical and financial teams before submission to Procuring Authorities. The early involvement of the EIB

will enable bidders to submit offers based on robust assumptions and including the EIB’s terms and

conditions for PBCE. In addition, it should give Procuring Authorities and Senior Bond investors greater

confidence in the final rating achievable by the Senior Bonds. Because the EIB will have analysed all bids

European Investment Bank Project bonds – a guide

21 December 2012 page 6/27

which incorporate project bonds as a financing solution, Procuring Authorities will be in a position to make

objective comparisons between them.

EIB should be involved at an early stage of transactions because:

• Credit quality is a key aspect of bids and should therefore be considered at the evaluation stage (while

there is still competitive tension) for both procurement and commercial reasons;

• In recent years Procuring Authorities have not had the requirement to evaluate project bond

structures. This also means that bidders have generally not invested the resources to develop project

bonds solutions. Both parties will benefit from EIB’s resources and understanding of the process; and

• Many institutional investors have not established in-house infrastructure teams, either due to irregular

transaction flow or (previously) because project evaluation has been effectively outsourced to the

monoline insurers. PBCE will not eliminate the need for investor diligence but it should help to

increase the flow of Senior Bonds and give investors greater confidence in the existence of a

sustainable pipeline of transactions, and also (where possible) to simplify and standardise project

structures.

The EIB and PPPs

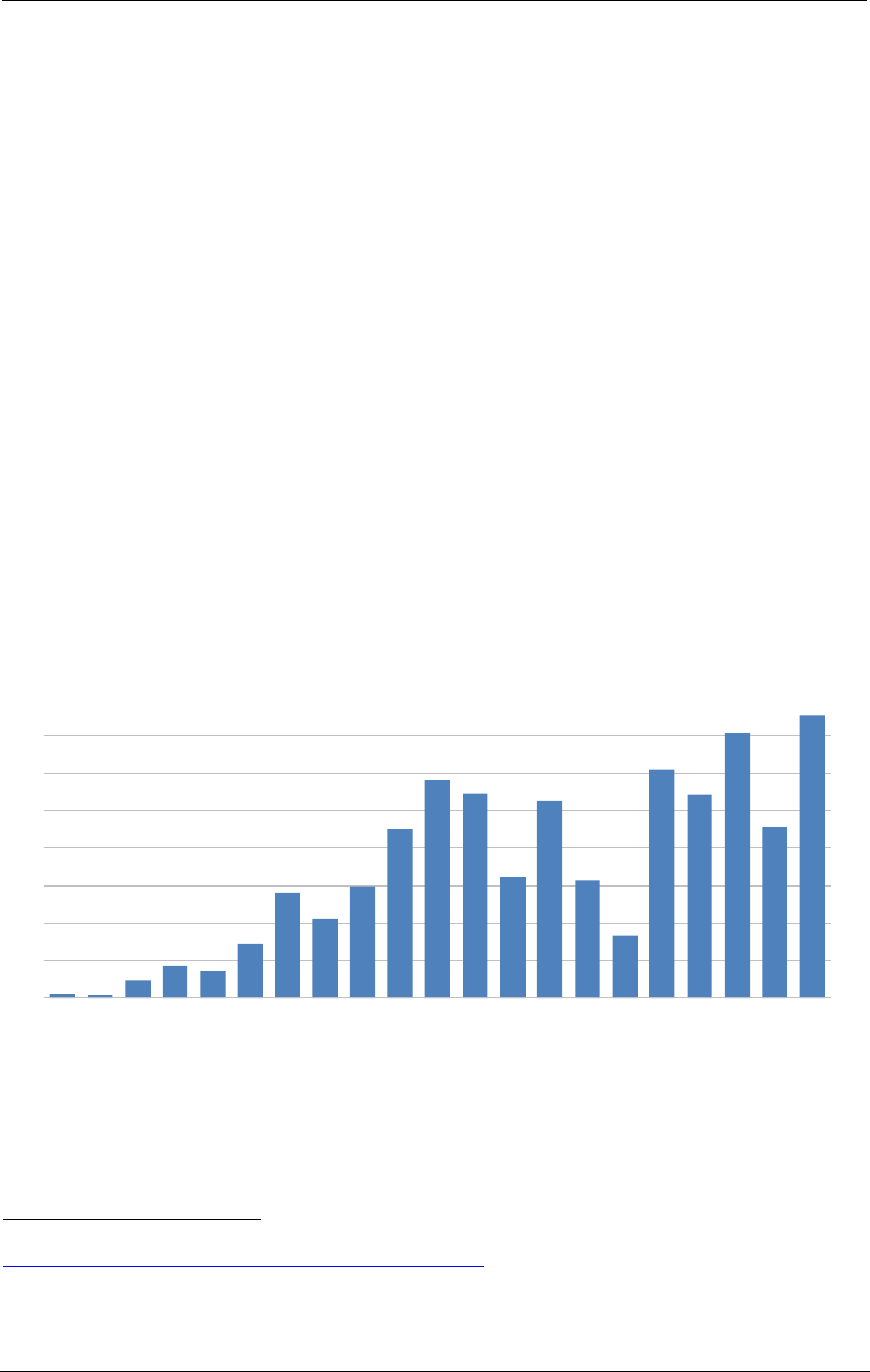

The EIB has long-standing experience in the analysis and successful closing of infrastructure Public Private

Partnerships (PPPs). Since 1990 the EIB has progressively broadened the geographic and sectorial spread

of its PPP lending and is now one of the major funders of projects in Europe with a portfolio of 130 projects

and investment of around EUR 30 billion.

The EIB also has a track record in developing new products which have demonstrably met infrastructure

market requirements The Loan Guarantee Instrument for Trans-European Transport Network Projects

(LGTT) and the Risk Sharing Financial Facility are examples

1

.

Procuring Authorities, bidders and investors can have confidence that the EIB will be able to combine its in-

house financial, technical and economic expertise across all sectors to analyse proposed financing

1

http://www.eib.org/about/documents/lgtt-fact-sheet.htm?lang=-en and

http://www.eib.org/products/rsff/financing-products/index.htm

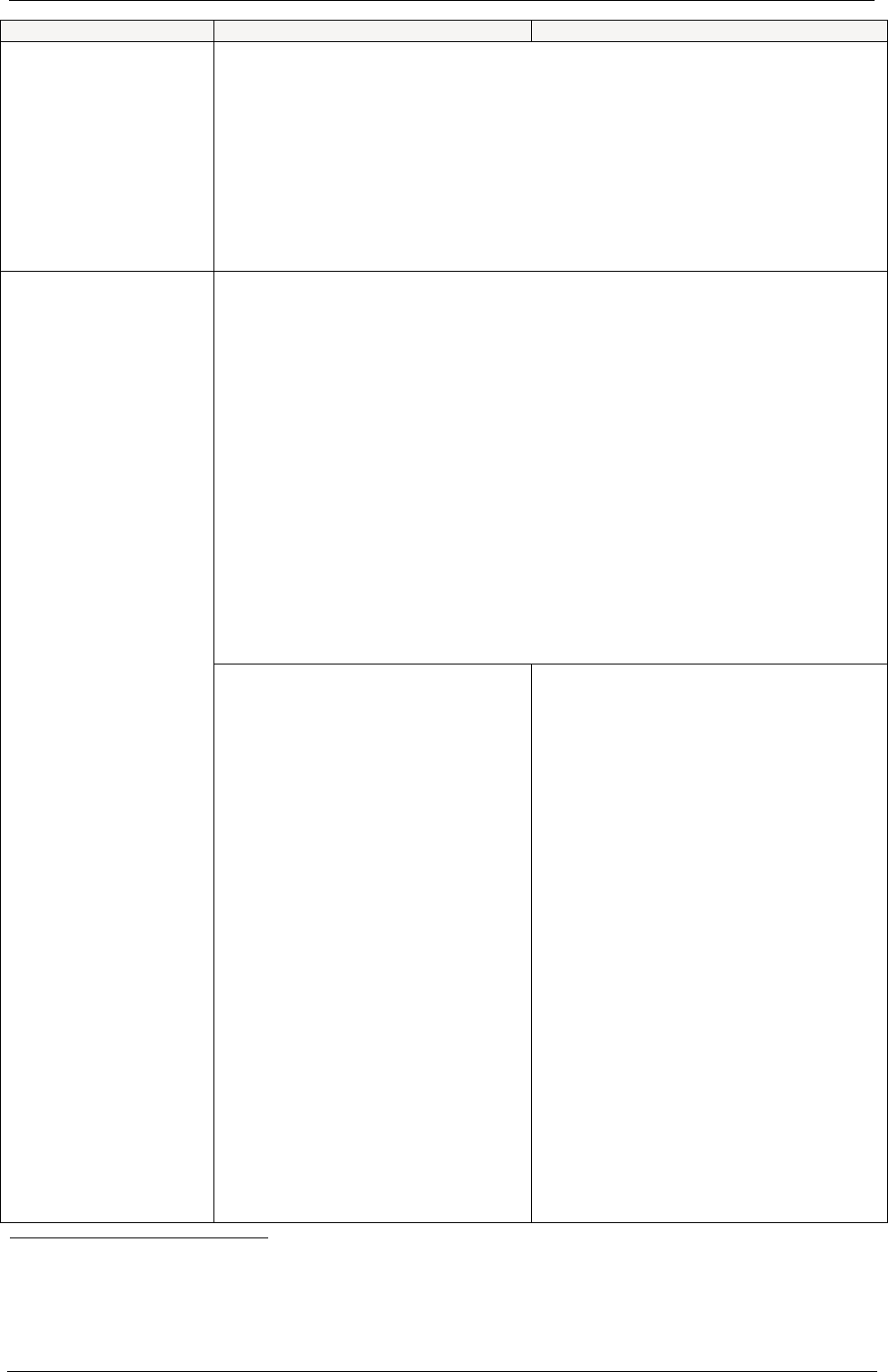

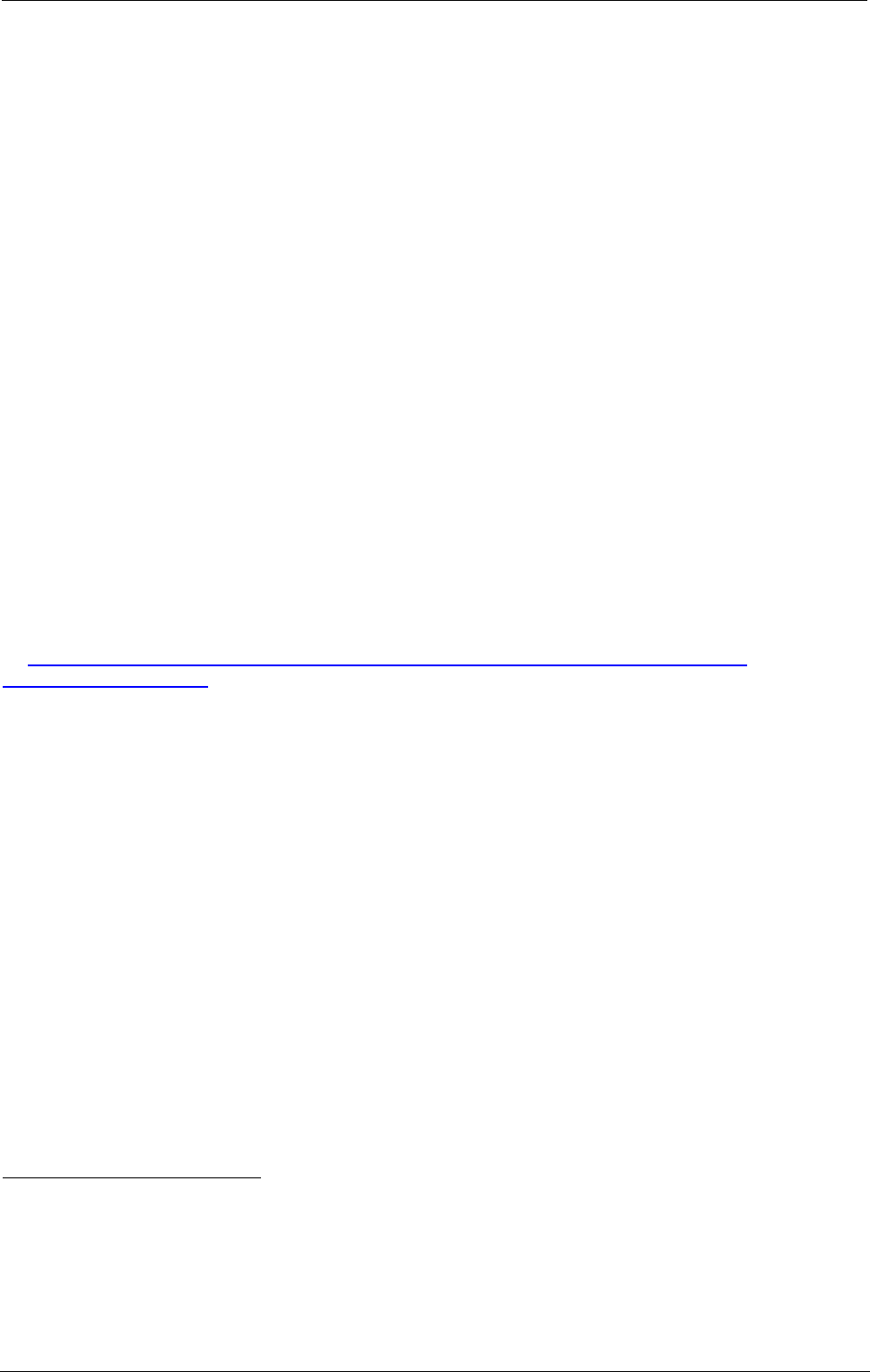

EIB financing of PPPs

0.0

0.5

1.0

1.5

2.0

2.5

3.0

3.5

4.0

1990

1992

1994

1996

1998

2000

2002

2004

2006

2008

2010

EUR bn

European Investment Bank Project bonds – a guide

21 December 2012 page 7/27

structures in a robust and timely way. All parties can also be confident that the projects approved by EIB

comply with EU procurement, environmental, social and economic standards and objectives.

In addition, the EIB carries a AAA rating. It is important that investors have confidence in the credit quality of

an entity providing PBCE to support the project.

Purpose of this document and contacts

This document provides Procuring Authorities, bidders and investors with a general overview of the PBCE

credit enhancement products. Section 2 sets out in detail how the PBCE products are structured; Section 3

sets out the roles of stakeholders.

Procuring Authorities, bidders and/or investors who wish to approach the EIB for consideration of a project

which may benefit of PBCE are invited to contact projectbonds@eib.org.

European Investment Bank Project bonds – a guide

21 December 2012 page 8/27

Section 2: Description of the

Project Bond Credit Enhancement Facility

The first part of this Section describes in general terms how it is contemplated the PBCE will work.

This is followed by descriptions of core eligibility criteria with which all projects will need to comply and of the

summary terms and conditions expected to be attached to EIB’s participation.

How will EIB’s Project Bond Credit Enhancement (PBCE) work?

The 2020 Project Bond Initiative aims to provide partial credit enhancement to projects in order to attract

capital market investors.

The mechanism of improving the credit standing of projects relies on the capacity to separate the debt of the

project company into senior and subordinated tranches. EIB will provide a subordinated tranche, or facility,

to enhance the credit quality of the Senior Bonds, and therefore increase their credit rating.

PBCE will provide this credit-enhancing subordinated tranche in one of two ways:

- a loan given to the project company from the outset (funded PBCE); or

- by way of a contingent credit line which can be drawn if the cash flows generated by the project are not

sufficient to ensure Senior Bond debt service or to cover construction costs overruns (unfunded PBCE).

The primary purpose of PBCE is to credit enhance Senior Bonds. PBCE will be available during the lifetime

of the project, including the construction phase.

In the past, the credit rating of senior project bonds has sometimes been enhanced through a guarantee

issued by a monoline insurance company (a “monoline wrap”). However, the mechanism of PBCE differs

from a monoline wrap in several ways:

i) PBCE is not a guarantee that covers the entire amount of the Senior Bond; rather it is limited in amount

from the outset. The maximum size of PBCE available for a single transaction will be the lower of

EUR 200 million or 20% of the nominal of credit enhanced Senior Bonds. In some cases, it will be less

than these limits;

ii) as a subordinated instrument PBCE is designed to increase the credit rating of the Senior Bonds, not to

extend the EIB’s AAA credit rating to the project;

IT is important to note that:

a) PBCE will only target a limited sector coverage;

b) PBCE projects will need to meet EIB’s normal eligibility criteria. A description of EIB’s process

for determining eligibility is annexed.

What are the core requirements for an eligible project?

The Project Bond Initiative is targeted at projects in the areas of trans-European networks of transport (TEN-

T) and energy (TEN-E), as well as broadband and information and communication technology (ICT).

The following general conditions will also apply:

Requires bond market infrastructure

PBCE is available to bond-financed transactions and not to bank-financed transactions.

European Investment Bank Project bonds – a guide

21 December 2012 page 9/27

Bond financed transactions typically require financial infrastructure such as rating agency coverage,

suitable legal precedents/frameworks, bond trustees and funded pension plans (either public or private)

which are permitted to invest in securities other than more limited debt classes such as sovereign debt.

Requires Ring Fenced Assets

A core requirement of the PBI is that the support of the initiative is directed towards developing specific

eligible infrastructure assets rather than merely supporting corporate balance sheets. Consequently, the

initiative requires that eligible assets are ring fenced. The costs and revenues of these assets are

segregated from other assets and liabilities of the Promoter. Whilst a range of security structures can be

considered, the repayment of the Projects Bonds and PBCE facility will typically be determined by the

performance of the ring fenced assets.

Robust project prior to PBCE

EIB will require the project (i.e. before PBCE is taken into account) have a robust (“bankable”) financial

structure. The required credit rating of the Senior Bonds after PBCE is taken into account will be a

function of investor demand and regulatory frameworks in each country. It is expected that Procuring

Authorities will consider the overall costs and benefits of structuring a project to various rating levels.

No minimum project size, but investors may need critical mass

There is no minimum capital value threshold for PBCE projects. Whilst public bonds have traditionally

been used for larger infrastructure transactions, private placements have been used for smaller

transactions. The use of PBCE can be considered for the credit enhancement of either public bonds or

private placements.

European Investment Bank Project bonds – a guide

21 December 2012 page 10/27

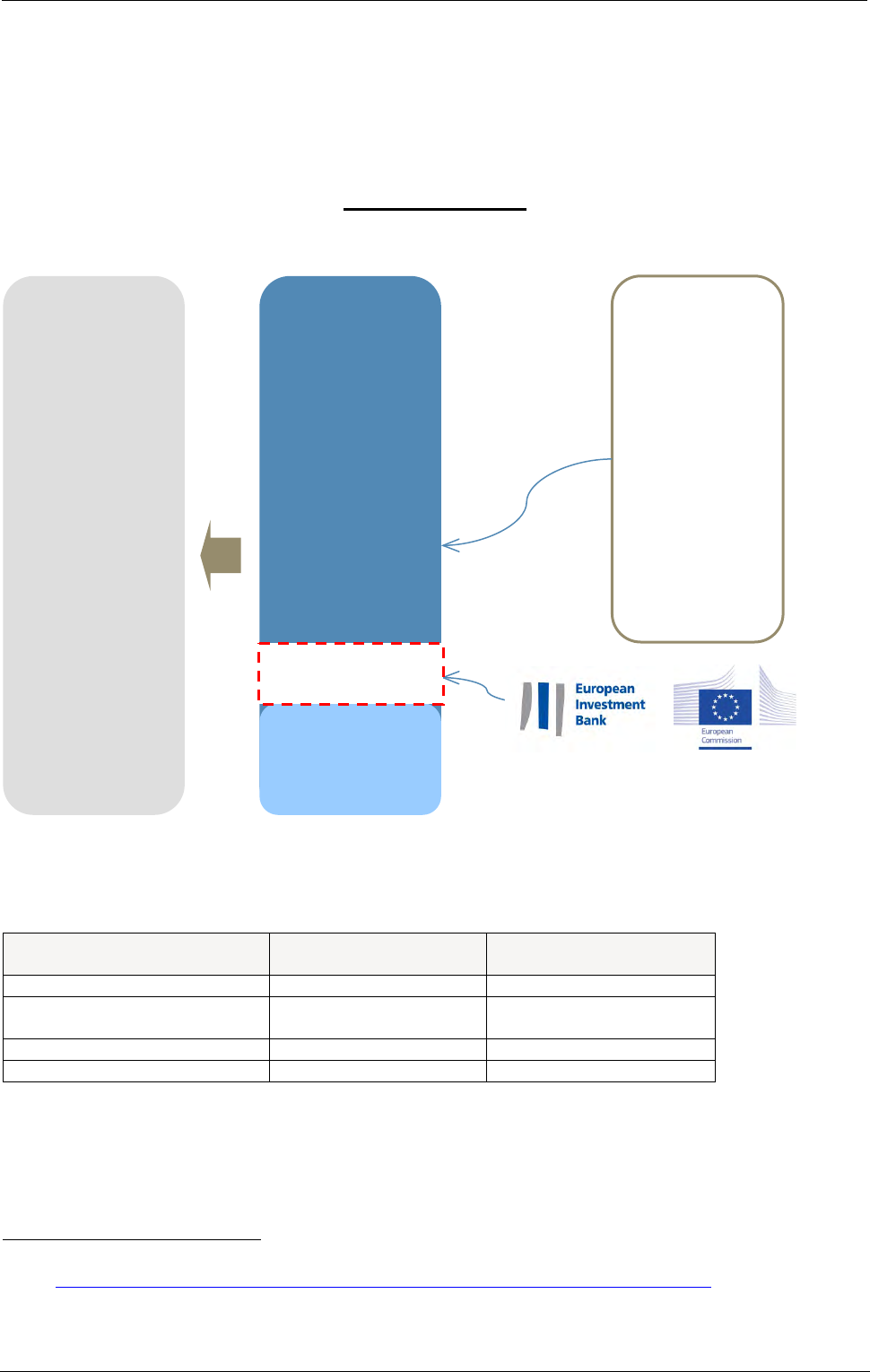

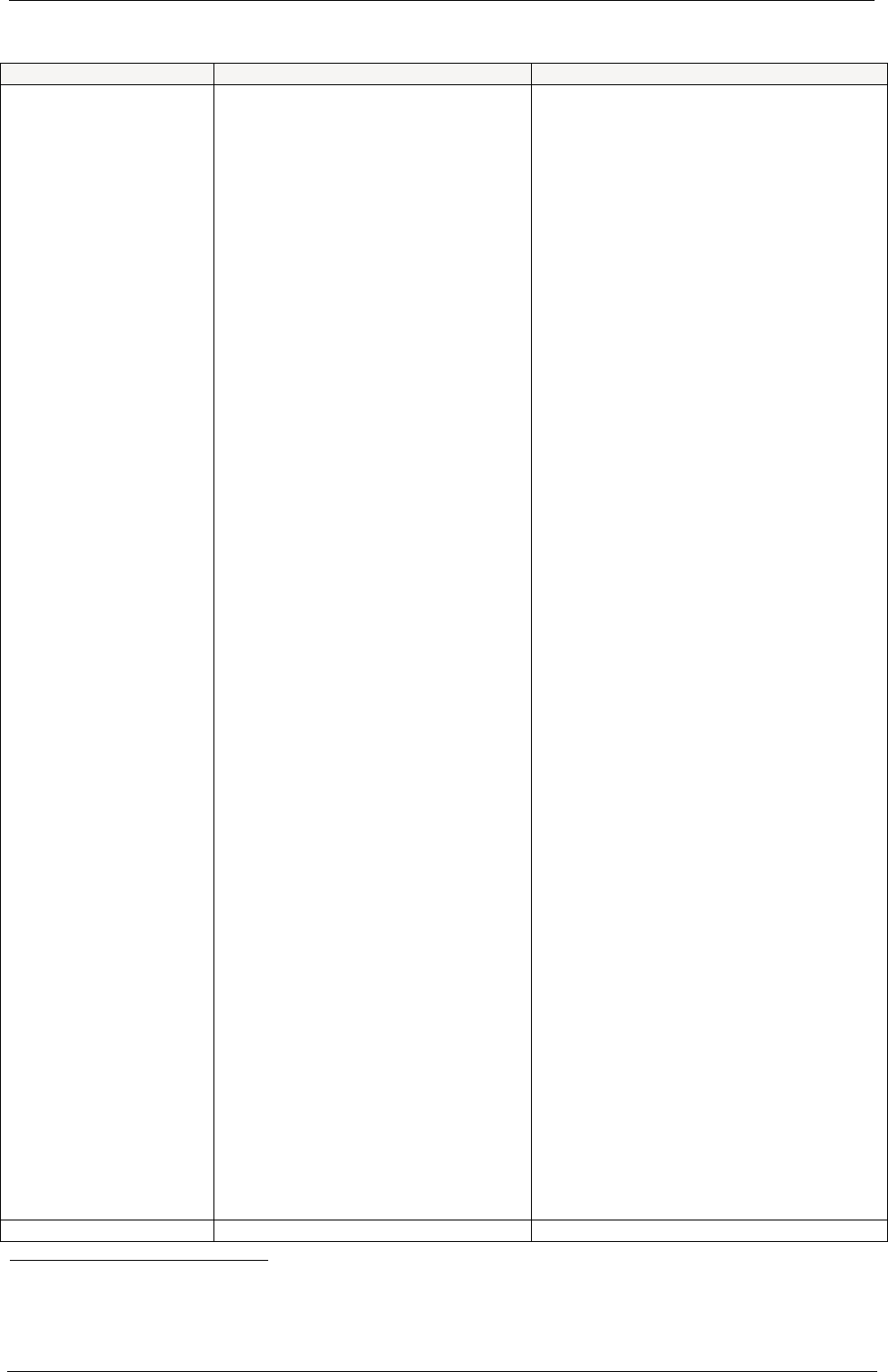

Detailed description of the funded and unfunded PBCE facilities:

There are two variants of PBCE, funded and unfunded, each of which is described in general terms below:

Funded PBCE

Funded PBCE - example

2

:

Sources of funds:

Without EIB funded

PBCE (EUR m)

With EIB funded PBCE

(EUR m)

Senior Bond

100

83.3

Funded PBCE facility

(subordinated)

0 16.7

Equity

20

20

Total sources of funds

120

120

In the example above the EIB provides funded PBCE in the form of a subordinated tranche at the maximum

permitted level of 20% of total credit enhanced Senior Bond.

Positive impacts for Senior Bondholders include:

2

Source: Moody’s Special Comment on the Europe 2020 Project Bond Initiative 28 June 2011, available on-

line at http://www.moodys.com/researchdocumentcontentpage.aspx?docid=PBC_133841

.

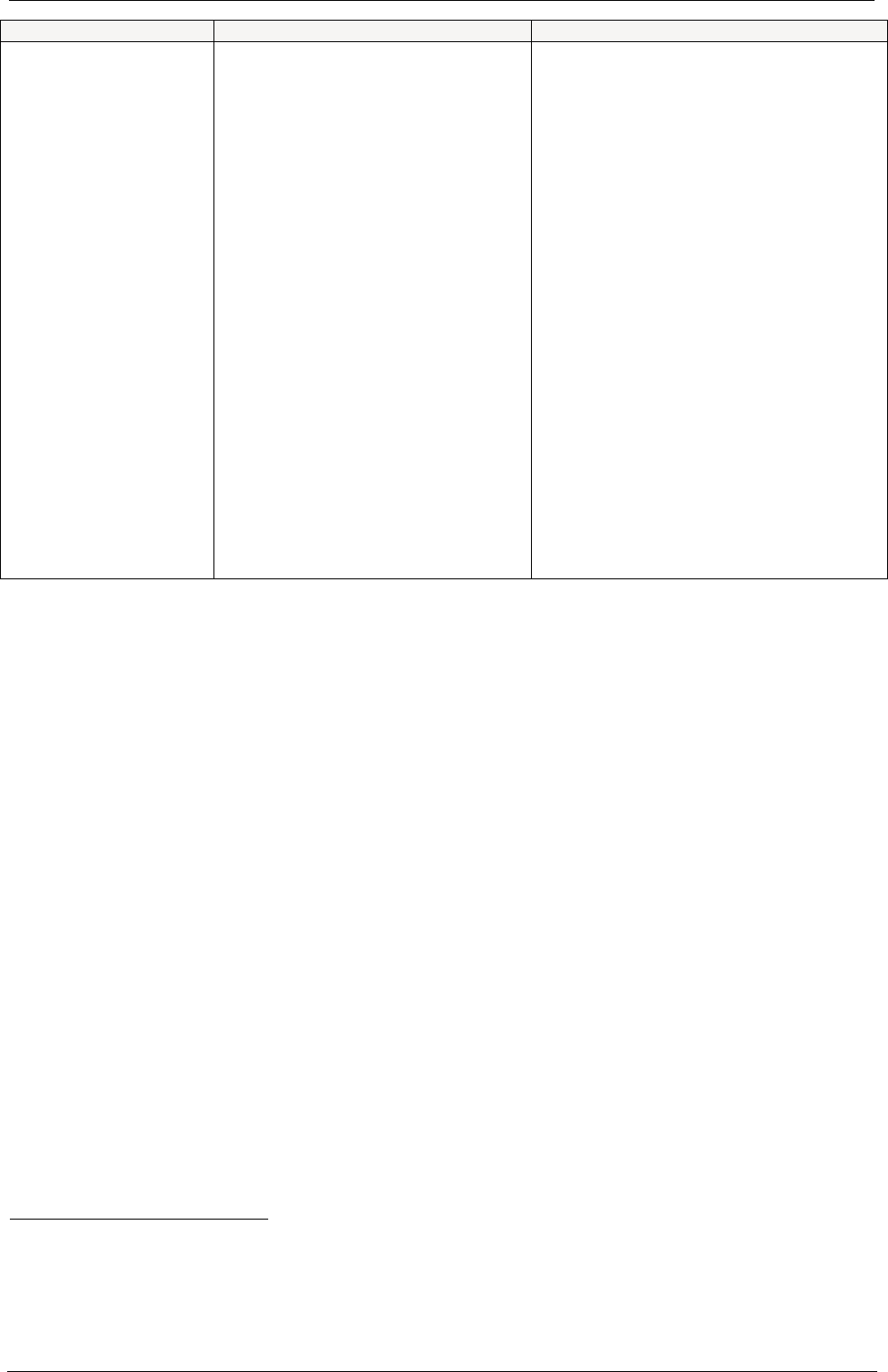

Project

Bonds

(Target rating

based on

market

conditions)

Public bond

issue or

private

placement

Project

Costs

Project

Bond

Investor(s)

Equity

EIB sub-debt

European Investment Bank Project bonds – a guide

21 December 2012 page 11/27

• substantial mitigation of loss given default during both construction and operation as the amount of the

Senior Bond drawn down / outstanding will be lower and EIB will be subordinated to the Senior

Bondholders in terms of repayment priority;

• enhancement of Senior Bond debt service cover ratios.

Funded PBCE is similar to typical infrastructure mezzanine finance. This is used with other financing to fund

construction and other project costs, and then repaid during the operations phase.

In terms of repayment priority, such finance ranks below the Senior Bond but ahead of the remaining risk

capital of the project (generally subordinated debt and/or ordinary share capital but also potentially

contingent equity). Under PBCE, it is expected that EIB will have no right to convert unpaid mezzanine into

equity (please see the Repayment section below for details of underlying repayment timings).

From the perspective of senior investors, funded PBCE will therefore act as a “first loss piece”

3

during both

construction and operation and hence improve the credit quality of Senior Bond.

Funded PBCE will therefore generally reduce the probability of default during the operations phase.

However, as the mezzanine proceeds are a source of funds used to cover eligible project costs in the base

case, funded mezzanine finance will generally not improve probability of default during the construction

phase to the same degree as providing an additional junior finance facility

4

- the unfunded PBCE.

3

I If the project’s cash flow falls short in the operations phase, the mezzanine lenders would not be paid at

all before the senior lenders experience any non-payment. Therefore, if the reduction in net cash flow is less

than the sum of the mezzanine debt sevice and the anticipated risk capital distributions, the shortfall will not

result in non-payment of the senior bond.

4

There is however a degree of enhancement that does arise from the ability to lock-up debt service on the

mezzanine finance.

European Investment Bank Project bonds – a guide

21 December 2012 page 12/27

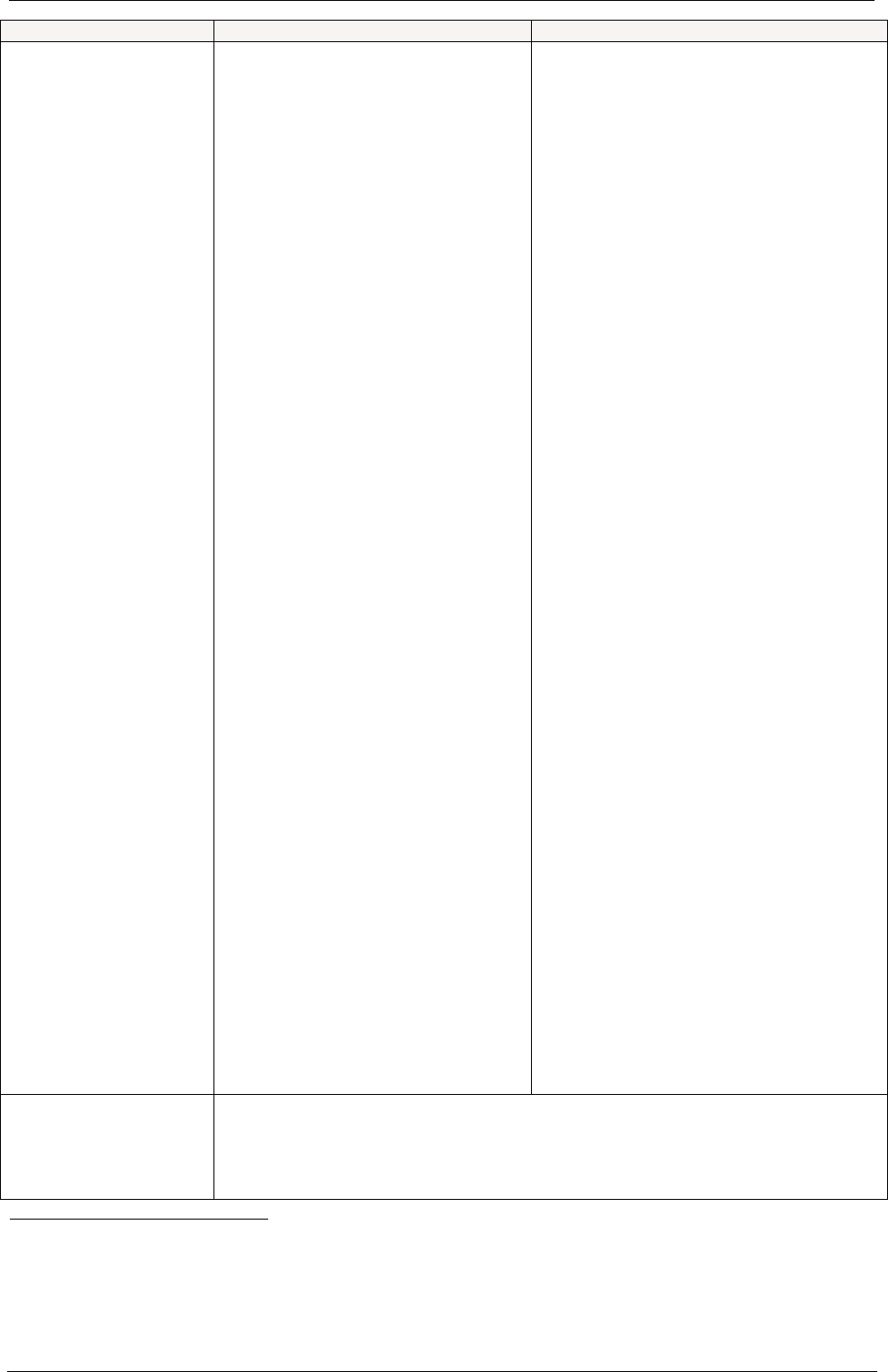

Unfunded PBCE

Unfunded PBCE - example

5

:

Sources of funds:

Without EIB unfunded

PBCE (EUR m)

With EIB unfunded PBCE

(EUR m)

Senior Bond

100

100

Equity

20

20

Sub-total

120

120

Unfunded PBCE facility (Letter

of Credit)

0

20

Total available funding

120

140

In this example the EIB provides unfunded PBCE in the form of a Letter of Credit at the maximum permitted

level of 20% of total credit enhanced Senior Bond which may be drawn on occurrence of a Permitted Event

(cash shortfall during construction, debt service shortfall post-completion and to pay any shortfall in amounts

due on acceleration of the Senior Bond – see below for detailed explanation).

Positive impacts for Senior Bondholders include:

5

Source: Moody’s Special Comment on the Europe 2020 Project Bond Initiative 28 June 2011, available on-

line at http://www.moodys.com/researchdocumentcontentpage.aspx?docid=PBC_133841

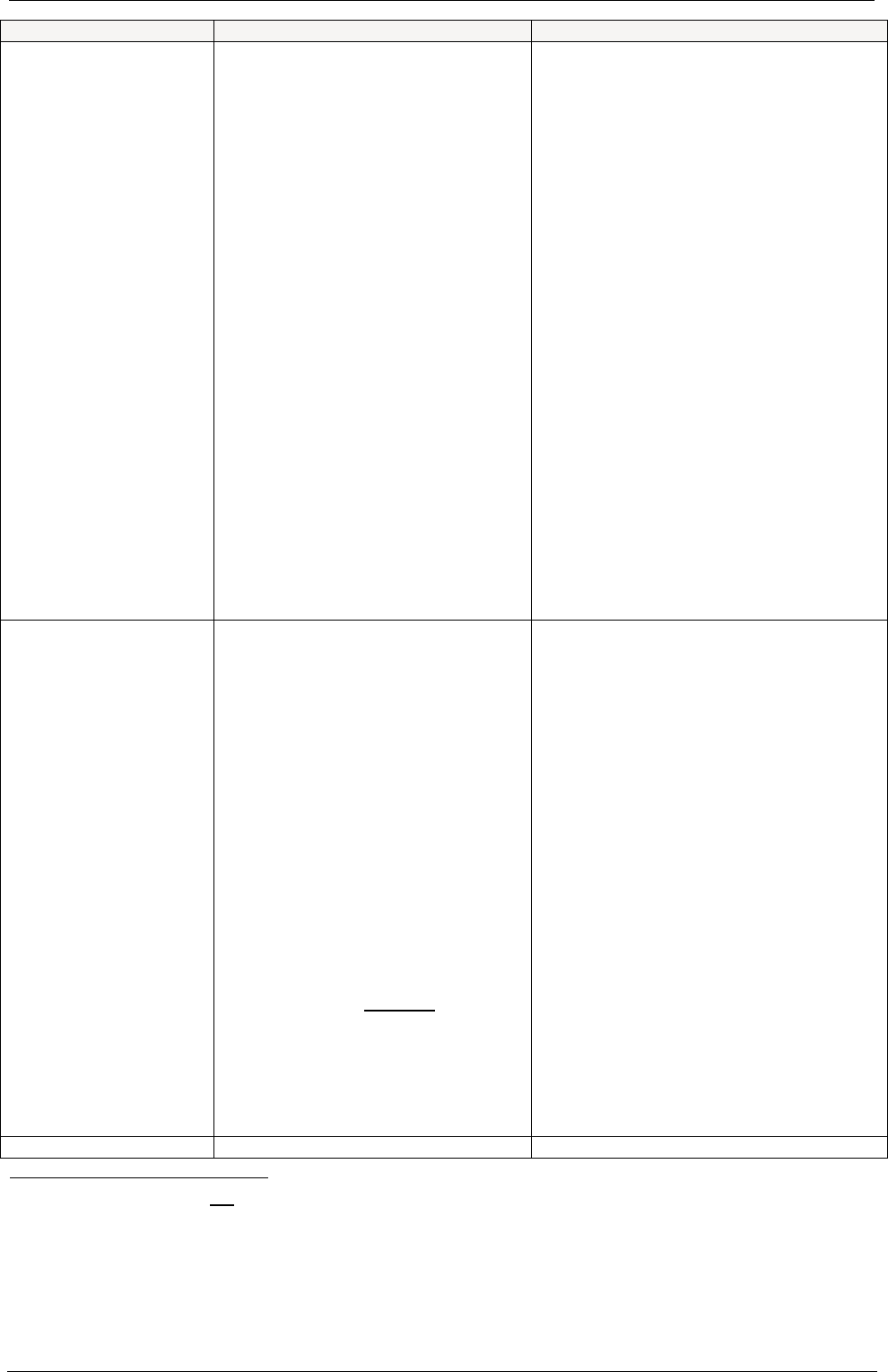

Project

Bonds

(Target rating

based on

market

conditions)

Project

Costs

Equity

Project

Bond

Investor(s)

EIB

G’tee

Public bond

issue or

private

placement

European Investment Bank Project bonds – a guide

21 December 2012 page 13/27

• reduction in the probability of Senior Bond default as unfunded facility will mitigate risk in the event of

cash flow shortfall; as the facility is revolving, amounts drawn and subsequently repaid will be available

for redrawing;

• substantial mitigation of loss given default during both construction and operation as the EIB will be

subordinated to the Senior Bondholders in terms of repayment priority (should amounts be outstanding

under the Letter of Credit).

In this version of PBCE, rather than funding a mezzanine debt tranche, the EIB will provide a long-term,

irrevocable and revolving letter of credit (“Letter of Credit”) to the project, the benefit of which will be

assigned to the trustee for the Senior Bonds

6

.

This Letter of Credit will act as a contingent credit line which can be drawn if cash flows generated by the

project are not sufficient to achieve construction completion and/or ensure Senior Bond debt service.

In the event that the project runs into difficulties and the credit line is drawn, the EIB will inject funds under

the Letter of Credit. This will create a mezzanine instrument broadly similar to funded PBCE as described

above. However, the mezzanine loan only arises when the project risk occurs, not before.

Unlike traditional letters of credit, the Letter of Credit will be long-term in nature and be available until

scheduled final repayment of the Senior Bonds (or at an earlier date if preferable for the sponsors and the

Senior Bond investors). After financial close of the project the EIB will not be able to withdraw the Letter of

Credit or amend its terms, including pricing

7

. As a revolving facility, any amounts drawn and subsequently

repaid on the Letter of Credit will be available for re-drawing

8

.

Similarly to the funded PBCE facility, unfunded PBCE will act as a first loss piece (please see the

Repayment section below for details of underlying repayment timings). Loss given default scenarios will

typically improve, as will probability of default scenarios during the operations phase. However, as the Letter

of Credit represents an extra source of funds over and above those used in the base case to fund project

costs, it will also generally improve probability of default scenarios during the construction phase.

Following disbursement under the Letter of Credit, EIB will become a direct, subordinated lender to the

project. In a situation where the Letter of Credit is partly drawn and accrues capitalised interest, the amount

of capitalised interest is excluded from the calculation of the remaining amount of the Letter of Credit

available for drawdown. Such excluded interest nonetheless remains payable.

The remainder of this Section 2 outlines the key features of both the unfunded and funded PBCE facilities.

However, in an actual financing these will be developed case-by-case to meet the specific requirements of

the funding structure.

6

This means that the EIB will act as a direct standby lender to the project company, rather than act as

guarantor to a third party lender who would then provide the liquidity.

7

As a practical matter, the letter of credit fee is fully payable upfront at financial close.

8

In any case not exceeding the 20% limit on the Senior Bond as described below.

European Investment Bank Project bonds – a guide

21 December 2012 page 14/27

FUNDED

UNFUNDED

Purpose and

Permitted Uses

Costs representing eligible uses of

funded PBCE include design,

construction and commissioning,

development costs & fees, interest,

fees and other financing expenses

(including those that relate to PBCE),

funding mandatory reserve accounts

and other costs and expenses as

agreed by EIB.

In any case PBCE proceeds cannot

be used to pay make-whole

payments such as spens/modified

spens, costs or indemnities

associated therewith

The PBCE in the form of a Letter of

Credit can be drawn for the following

purposes:

1. Pre-completion cash shortfall: to

fund a cash shortfall in the event

of construction cost overruns (or

other shortfalls in the funding

requirement) not absorbed by the

construction contractor and/or

funded with other project-level

credit supports (“Pre-completion

Shortfall”);

2. Post-completion Senior Bond

debt service shortfall:

(i) to cover periodic shortfalls in

meeting scheduled Senior

Bond debt service

9

by way of

periodically drawing down on

the Letter of Credit to make

up the shortfall. (Post

completion Debt Service); or

(ii) to cover shortfalls in Senior

Bond debt service that are

considered likely to recur in

future. In this scenario, the

Letter of Credit will be drawn

in full and the proceeds used

to pay down the Senior

Bond. The senior debt

service coverage ratios

(DSCRs) will improve by

virtue of reduced Senior

Bond debt service going

forward (PBCE Injection);

and

3. Accelerated payments: to pay

any shortfall between the

amounts due on acceleration of

the Senior Debt and any

termination payments from the

Procuring Authority. This applies

regardless of the reason for the

termination (Acceleration).

In any case PBCE proceeds cannot be

used to pay make-whole payments such

as spens/modified spens, costs or

indemnities associated therewith.

PBCE Injection

Paid in upfront or over time as

As the case may be

9

Principal, interest and fees

European Investment Bank Project bonds – a guide

21 December 2012 page 15/27

FUNDED

UNFUNDED

agreed with Sponsors and

Bondholders

1. Pre-completion Shortfall : PBCE

injection upon receipt of the LTA

certification that other construction

support has been called and that use of

the undrawn amount of the PBCE will

enable construction to be completed

prior to the longstop date

2. Post-completion Senior Bond debt

service shortfall:

(i) PBCE Injection may occur at

interest payment date

(ii) As an alternative to debt service

payment described in (i), full

PBCE injection may occur

under two scenarios:

a) following a bondholder vote

on whether to exercise the

injection upon the breach of

certain DSCR triggers, or

b) automatically upon the

breach of DSCR triggers. Such

injection would trigger a

prepayment of Senor Bonds in

an amount equivalent to the

injection. The views of bond

managers / private placement

investors will be taken into

account in negotiating this

mechanism.

The application of the prepayment across

the amortisation profile would be pro-rata

to remaining maturity.

Injection (either voluntary or mandatory)

can occur only once. To the extent that

the Letter of Credit is undrawn

10

,

subsequent drawdowns on the Letter of

Credit will be permissible only to meet

post-

completion Debt Service or

Acceleration.

3. Acceleration : PBCE Injection following

the receipt of termination payments from

the Procuring Authority

Acceleration

It is contemplated that any decision to accelerate the Senior Bond following an

event of default under the finance documents will be subject to a vote by holders

of Qualifying Debt

11

. The vote could be triggered by any of the following:

•

Certification by the LTA that with the use of the PBCE or any other

10

For example: due to partial injection or subsequent repayment of previously injected amounts.

11

Defined as the principal amount of Senior Bonds plus outstanding principal (excluding capitalised interest)

drawn under the PBCE Letter of Credit.

European Investment Bank Project bonds – a guide

21 December 2012 page 16/27

FUNDED

UNFUNDED

support construction, the project cannot be completed prior to the

longstop date under the construction contract; or

• The senior debt service cover ratios are below the default threshold as

defined in the finance documents having taken into account all available

amounts of the PBCE; and

• Any other event of default under the finance documents has occurred and

is continuing.

Maximum Amount

The maximum amount of PBCE available will normally be equal to the lesser of

EUR 200 million and 20% of the nominal amount of a given project’s Senior

Bonds.

It may be that the desired credit quality uplift (e.g. improvement in cash breakeven

or other key project sensitivities) can be attained with an amount of PBCE that is

lower than the maximum facility size. The EIB recognises that the exact amount

required will be subject to iteration between the EIB and the sponsor project team,

but in any case will be fixed when the indicative ratings are obtained. However, it

is expected that sponsors, Procuring Authorities and their respective advisers will

estimate the maximum amount likely to be required and to approach the EIB as

early as possible in the project cycle.

The amount of PBCE cannot be increased subsequent to financial close of the

project.

The means by which the PBCE is sized varies between unfunded and funded

variants, as detailed below:

FUNDED

T

he maximum amount may be

constrained by base case

requirements for total debt

12

(i.e.

gearing, Debt Service Cover Ratio

and/or Bond Life Cover Ratio) which

will be established on a project-

specific basis.

As the facility is funded, its sizing will

be calculated with reference to a set

percentage of the senior bond issue.

There is no on-going limit on the size

of the funded PBCE as a percentage

of the then outstanding Senior Bond.

See also comments below regarding

funded PBCE amortisation profile.

UNFUNDED

There are no other indirect limits such as

gearing tests or base case coverage ratio

requirements although the underlying

structure is expected to be sufficiently

robust.

As the Letter of Credit is equal to a set

percentage of the project’s Senior Bond

principal outstanding at any given time, it

will reduce as the Senior Bond amortises.

If the Senior Bond debt balance includes

indexation i.e. in the case of index linked

debt, the amount available under the

Letter of Credit will follow the indexed

nominal value of the debt

(subject to the

maximum size limits described above).

In a

situation where the Letter of Credit is

partly drawn and accrues capitalised

interest, the amount of capitalised interest

is excluded from the calculation of the

remaining amount of the Letter of Credit

available for drawdown

. Such excluded

interest nonetheless remains payable.

European Investment Bank Project bonds – a guide

21 December 2012 page 17/27

FUNDED

UNFUNDED

Availability

Funded PBCE will be available

during the construction phase of the

project. In contrast to the unfunded

variant of PBCE, the funded PBCE

facility is not revolving, meaning than

principal amounts previously repaid

are not available to be redrawn.

The PBCE facility requires a tail

during which project cash flow is

available to repay any balance of

funded PBCE following the end of the

availability period. (EIB will accept

the senior debt tail required by Senior

Bonds.)

For unfunded PBCE the availability period

is set by definition i.e. the Letter of Credit

will refer to a maximum percentage of the

Senior Bond available to be drawn at any

given time. The Letter of Credit will remain

available for drawing for the period during

which amounts of principal and/or interest

are due under the Senior Bonds.

The overall senior debt tail

13

requirement

of the project will be set following

discussion with the investors and/or bond

arranger

14

. Senior debt lenders typically

require a tail to cover the eventuality that

project cash flows

and other credit

supports have been insufficient to service

the senior debt. This calculation will in

turn affect the availability period of the

Letter of Credit.

The PBCE facility requires a tail during

which project cash flow

is available to

repay any balance still drawn on the

Letter of Credit following the end of the

availability period. (EIB will accept the

senior debt tail required by Senior Bonds.)

13

Being the period between the final repayment date of a given loan facility and the end of the project.

14

Senior debt will not have a shorter tail than the PBCE facility. As such, the EIB’s tail requirement may drive

the overall tail requirement to the extent it is greater than that required by the senior debt investors.

European Investment Bank Project bonds – a guide

21 December 2012 page 18/27

FUNDED

UNFUNDED

Interest, Fees, EIB Cost

of Funds and Hedging

An arrangement fee will apply, plus

commitment fees equal to 50% of

margin. Commitment fees may not

always be applicable, as EIB

envisages the proceeds being drawn

upfront and deposited in an escrow

account.

EIB will require escrow

account providers to have a minimum

credit requirement.

However, EIB may also consider

allowing funded mezzanine debt to

be drawn into the project company

towards the end of the construction

period, at a time when a majority of

the senior bond proceeds have been

utilized

15

. Any

cost of funds

adjustment

related to the use of

mezzanine debt will be set by EIB at

financial close.

I

nterest during construction on

funded PBCE will need to be payable

in cash, not capitalised/rolled up into

the loan balance.

In the event that funded PBCE is

prepaid, breakage costs will apply.

It is expected that, the Letter of Credit fee

will typically be paid

upfront at financial

close with no on-going

fee element. An

arrangement fee will apply but there will be

no commitment fees.

Should the Letter of Credit be drawn, the

EIB’s cost of funds adjustment

16

and a

credit margin will be added to the

reference rate.

The EIB’s cost of funds

adjustment will on

ly be known at the time

of the drawdown and margins will be set at

financial close in line with market

conditions.

As the facility will be repaid on a cash-

sweep basis, no hedging will be

implemented at the time of the drawdown.

Drawn PBCE will therefore

be a floating

rate facility with a reference rate based on

the periodicity of Senior Bond debt service

(e.g. quarterly, semi-annual).

Repayment

It is expected that funded PBCE will

have a scheduled amortisation profile

based on sculpted repayments pro

rata to the Senior Bond.

Repayment of the PBCE will

generally

commence at the same

time as

Senior Bond debt

repayments

- Repayment term

to be the

same as those of the Senior

Bonds.

-

PBCE debt service will be

repaid from cash flows

following

scheduled Senior

Bond principal and interest

payments and transfers to

senior secured reserve

accounts including the DSRA

- Payments received by the

EIB will be applied firstly to

current interest, second to

capitalised interest and

thirdly to principal

repayment.

It is contemplated that there will be no

specific repayment dates for repayment of

drawn Letter of Credit amounts.

Following drawdown of the Letter of

Credit, EIB will benefit from a full cash

sweep of cash flow after scheduled

Senior Bond principal and interest

payments and transfers to senior secured

reserve accounts, including the DSRA. As

such, any payments in respect of the risk

capital of the project (generally

subordinated debt and/or ordinary share

capital but also potentially contingent

equity) will not be permitted until

outstanding Letter of Credit amounts

(principal and capitalised interest) have

been repaid.

Payments received by the EIB will be

applied firstly to current interest,

secondly to capitalised interest and

thirdly to principal repayments.

Distribution lock-up

Prior to final repayment of the funded

Full cash sweep as set out above will

15

In this case EIB would not provide a Letter of Credit in favour of the Senior bond-holders in respect of

supporting deferred mezzanine subscriptions.

16

Similar to EIB Senior Debt, expressed as a premium over LIBOR or EURIBOR and based on the EIB’s

cost of funding itself, not a given project. In contrast from EIB Senior debt, the timing (or eventuality) of

drawdown is unknown and thus the premium cannot be fixed at financial close.

European Investment Bank Project bonds – a guide

21 December 2012 page 19/27

FUNDED

UNFUNDED

requirements

PBCE, lockups will be required

based on total debt

17

BLCR,

backward looking total debt DSCR

and forward-looking total debt DSCR.

Such lockups will affect payments to

risk capital below the mezzanine

level and thus are distinct from the

lockups that will prevent payment of

PBCE debt service. L

ockup levels

will be set on a project-specific basis.

apply during any period in which an

amount is drawn on the Letter of Credit.

Whenever

there is a balance drawn on the

Letter of Credit, EIB will require distribution

lock-

ups (to be agreed with the Senior

Bondholders on a project-

specific basis)

based on the Senior BLCR as well as a

Senior DSCR.

These lockup levels will be set on a

project-specific basis.

Counterparty credit

requirements

Standard EIB minimum credit requirements will apply for counterparties such as

other senior lenders, account banks, escrow account providers, insurers and

hedge counterparties. At present, this requirement is generally A-.

Security:

It is expected that the PBCE will benefit from the same security package as the

Senior Bondholders, but in a subordinated position.

The security package will thus typically be comprised of second ranking fixed and

floating security over all borrower assets (including project accounts, project

documentation and insurances), plus second ranking fixed security over shares in

the borrower and proceeds arising from the disposal of such shares.

In the Unfunded option case, unlike a

traditional letter of credit that would attach

at the senior debt level if drawn (thereby

increasing senior debt), the drawn Letter

of Credit would remain subordinated.

Events of default

On occurrence of a PBCE event of

default the EIB will be entitled to full

payment of outstanding PBCE

amounts, but will be subject to

receiving payments in accordance

with the cash waterfall

18

.

In practice this would constitute a full

cash sweep after senior debt service,

similar to the repayment pattern for

unfunded PBCE following drawdown

on the Letter of Credit.

Until the Senior Bonds are repaid in full,

the EIB will not have the right to call an

event of default under the Letter of Credit

Agreement unless an event of default has

been called under the Common Terms

Agreement by the Senior Bondholders.

Calling an event of default under the

Letter of Credit agreement does not block

the availability of the Letter of Credit (for

example in acceleration scenarios). The

EIB will not be able to take separate

enforcement action and will be subject to

receiving payments in accordance with

the cash waterfall.

Voting rights and

controlling creditor

In general the EIB will not be entitled to vote on matters subject to a vote of the

Senior Bondholders, with the exception of votes on Enforcement Actions. Further

detail is set out below.

The EIB recognises the gap left by the monoline insurers who traditionally held the

controlling creditor role. However, the EIB does not anticipate acting as controlling

creditor, in part due to the conflict inherent in having a junior creditor act on behalf

of senior creditors. A Bund trustee and an Agent will be named.

The EIB has therefore developed a potential decision matrix, the specifics of

which may be considered on a project-specific basis. However, the EIB will

17

In which funded PBCE is counted as senior debt for the purposes of the gearing test and coverage ratio

tests.

18

Meaning the priority in which the available cash flow in the project is applied to claims on that cash flow.

European Investment Bank Project bonds – a guide

21 December 2012 page 20/27

FUNDED

UNFUNDED

require the ability to vote the full amount of the PBCE (for the funded transactions)

or the drawn amount of the PBCE (for unfunded transactions) on Enforcement

Actions (such as acceleration) by virtue of being included in the definition of

Qualifying Debt. This means that, post default, amounts drawn under the Letter of

Credit will be included in the definition of Qualifying Senior Debt when voting on

enforcement actions. For the avoidance of doubt, such voting rights will not affect

the recovery of Senior Bondholders in default scenarios.

In summary, the EIB’s potential decision matrix has the following four thresholds:

• Routine matters over which the Agent has discretion. For the avoidance of

doubt, this does not mean that when the Letter of Credit is drawn in the EIB

becomes pari passu with the Senior Bonds;

• Ordinary voting matters, in which the Agent requires approval from a simple

majority of voting bondholders (subject to quorum) before approving a

request;

• Extra-ordinary voting matters, in which the Agent requires approval from a

super majority of voting bondholders (subject to quorum) before approving a

request; and

• Entrenched rights, where the EIB (as PBCE provider), Security Trustee or

Bond Trustee need to agree changes that affect their interests.

European Investment Bank Project bonds – a guide

21 December 2012 page 21/27

Section 3: Process and stakeholders:

This section provides an outline description of the roles of the Procuring Authority, the Bidder and EIB at

each stage of the tendering of a project which may incorporate PBCE.

The process should be understood in the context of the following core principles:

1. The Senior Bonds will be issued by the project company itself (generally a PPP established to build,

finance and operate an infrastructure project), not the EIB or a Member State;

2. Project companies cannot normally combine PBCE and other EIB credit facilities within the same

financing structure; and

3. Procuring Authorities will be the primary drivers of the inclusion of a PBCE within a financing structure.

As such, Procuring Authorities will need to contact the EIB and design the procurement process in a

way that facilities both bond financing options generally as well as potential EIB participation in the

project.

Given these considerations, stakeholders should consider the following outline steps:

Step 1 - Procuring Authority, with their advisers, determines whether PBCE may be

applicable to the project

Issues to be considered include:

• Whilst Procuring Authorities may have experience of evaluating bank-financed structures, experience of

procuring and evaluating bond-financed facilities and credit enhancement structures such as PBCE may

be limited. As such, Procuring Authorities should consider their capacity to structure the project, hire and

direct advisers, evaluate the bids and negotiate with Bidders. The additional costs of specialist advisory

services should be budgeted;

• EIB will not normally be able to provide both senior debt and PBCE within the same financing structure.

As such, the Procuring Authority and its advisers may wish to consult EIB on the financing available and

that best fit with their project (i.e. no EIB participation, EIB senior debt, unfunded PBCE or funded

PBCE). Procuring Authorities may wish to consult specialist advisers qualified to advise on the

evaluation of possible structures;

• Procuring Authorities and their advisers will need to undertake a preliminary assessment of the relative

risks and benefits of each financing option (shadow modelling). As PBCE is intended to be an enabler of

bond finance, Procuring Authorities and their advisers will need to conclude that the underlying financial

infrastructure in the project’s jurisdiction exists to facilitate bond financing. In addition, Procuring

Authorities should consider investor credit rating requirements and rating agency criteria / methodologies

in analysing whether a given project is a suitable candidate for credit enhancement via PBCE.

Step 2 – Procuring Authority and its advisers develop bid instructions and

evaluation criteria

Procuring Authorities will need to instruct bidders as to how to present a financing structure including EIB

PBCE. EIB will be able to engage directly with bidders who wish to use PBCE and negotiate term sheets

with them. These terms may reflect differential credit quality between the bidders in terms of the requirement

for other credit support.

European Investment Bank Project bonds – a guide

21 December 2012 page 22/27

In general, Procuring Authorities will need to consider:

• How Bidders will be required to demonstrate credit robustness i.e. do they need to provide evidence of

rating agency involvement via pre-rating / ratings estimates

19

and if so, how many, from which rating

agencies and when in the tender process

20

? If not, what other evidence will be required to demonstrate

that sufficient credit support has been priced into the Bid at this stage and when will the pre-rating(s) be

required in the process?

• How much evidence of bond manager / end investor involvement will be required?

• How to evaluate which proposals / target credit rating for the Senior Bonds will represent the lowest all-in

cost to the Procuring Authority. This has an impact on the required level of PBCE, the project structure

and the amount of Other Credit Support;

• To the extent public bonds or other uncommitted financing structures are used, how to deal with these in

the context of procurement rules, and the interaction with the duration of the preferred bidder period;

• Whether bank or bond finance will constitute the “base case” for tender evaluation purposes, and the

manner in which alternative financing options will be evaluated;

• The degree to which standardised financing assumptions will be used for macro-economic or other

variables; and

• Public policy in respect of termination compensation.

Procuring Authorities may wish to refer to an EPEC paper entitled "Financing PPPs with Project Bonds -

Issues for public procuring authorities”

at:

http://www.eib.org/epec/resources/Financing%20PPPs%20with%20project%20bonds%20-

%20October%202012.pdf

Step 3 – Procuring Authority and its advisers evaluate bids

The Procuring Authority and its advisers may be required to evaluate the relative robustness of financing

structures which provisionally include PBCE facilities against structures based on more conventional forms of

funding.

The experience and judgment of a qualified financial adviser will therefore be crucial to the Procuring

Authority at this point in determining whether a Bidder(s) whose financing structure incorporates EIB credit

enhancement should be taken forward to Best and Final Offer (BaFO) stage.

Step 4 – Procuring Authority invites BaFOs

It is to be hoped that a majority of the procedural elements associated with bond financing should have been

addressed prior to this stage. However, depending on the process, bidders may not have been previously

required to provide pre-ratings earlier in the process due to cost and lower overall maturity of the project. If

bidders have not previously been required to obtain pre-ratings, this should be a requirement at this stage

and the pre-rating should take PBCE into account. .

19

EIB will not cover the costs of any pre-rating or ratings estimates/advisory exercises.

20

In general, it is preferable to obtain informed views on the commercial implications of ratings requirements

early on in the project while there is still competitive tension. However Procuring Authorities may wish to

consider the cost implications of requiring ratings at this stage and the project also needs to be sufficiently

mature to be assessed by the rating agencies.

European Investment Bank Project bonds – a guide

21 December 2012 page 23/27

Issues to consider include:

• The number of pre-ratings to require, the minimum required level of the ratings and acceptable ratings

agencies (realising that approaches differ between the agencies, but that some investors require more

than one rating); and

• Project timing implications resulting from any external credit rating processes.

Step 5 – Preferred bidder through to financial close

Issues to be considered include:

• Mechanisms for either benchmarking credit spreads and/or gaining visibility into the book-building

process for setting the spread on the Senior Bonds;

• Mechanisms by which Bidders will accept the risk of price increases associated with failing to secure the

targeted rating (other than as a result of material changes to the Project Agreement required by the

Procuring Authority);

• Timescales for negotiation between EIB, Bidder and Senior Bond arranger as well as credit

documentation and the ratings processes.

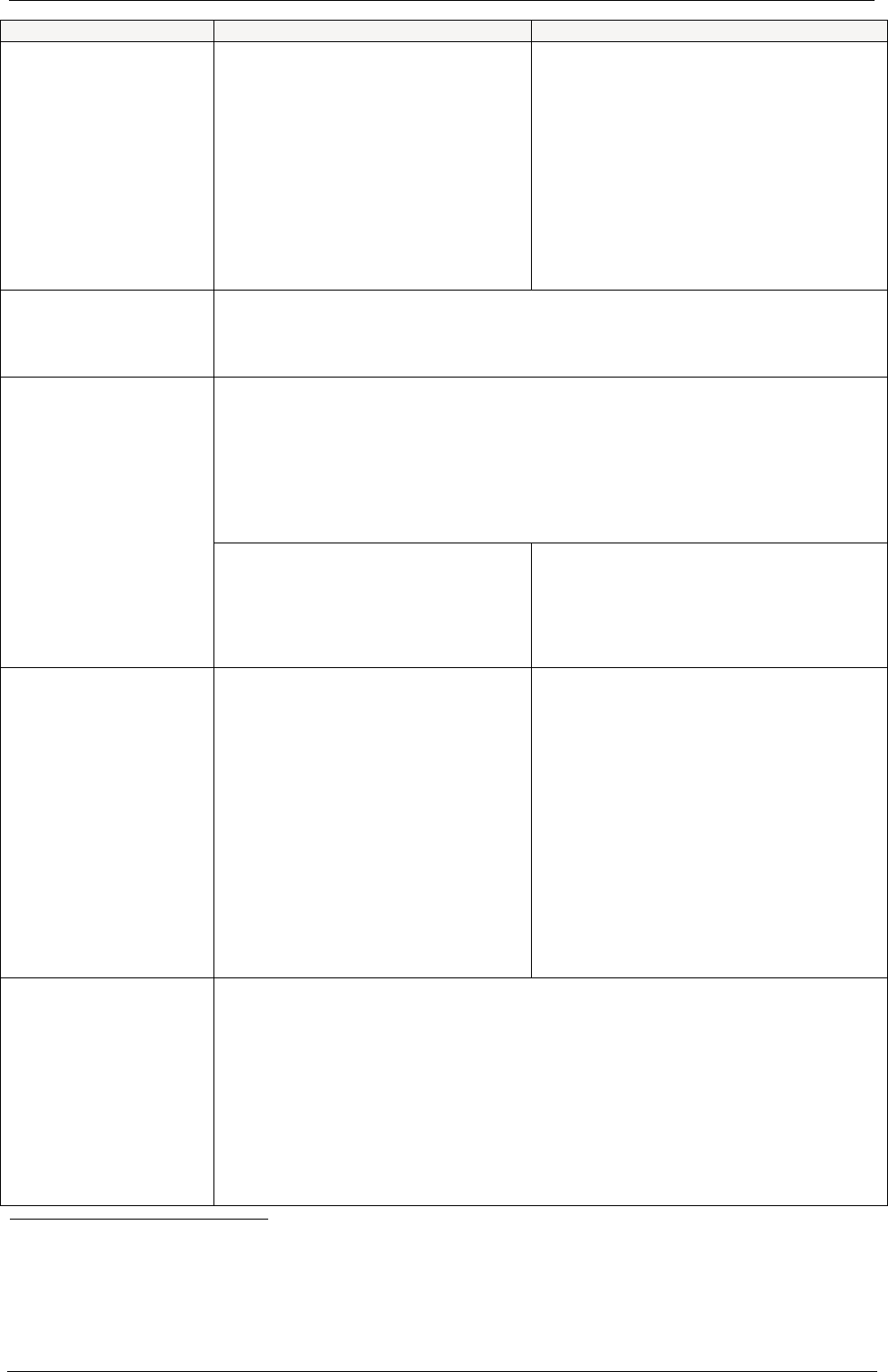

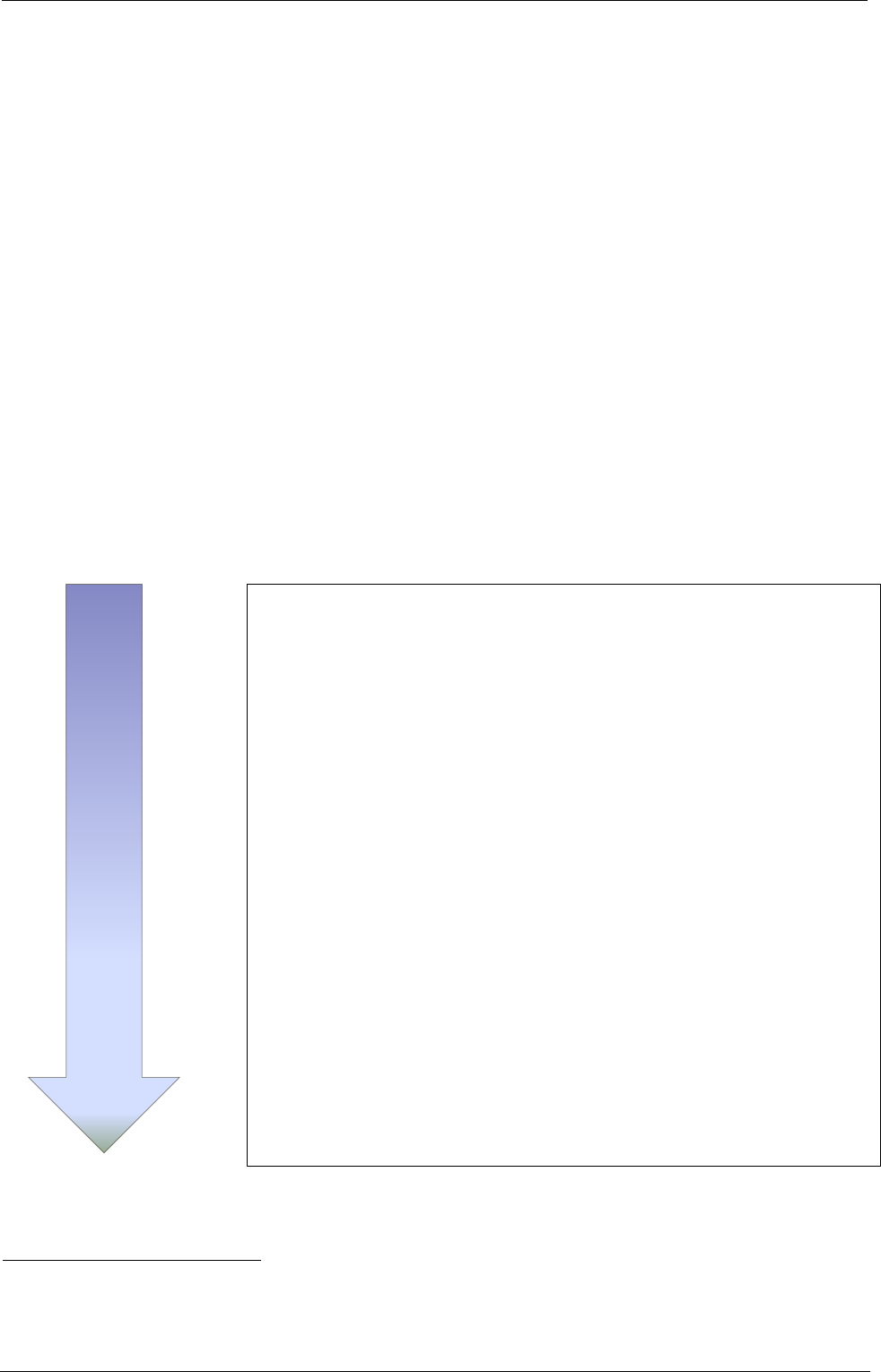

Key procurement steps in the case of a project bond financed PPP have been

summarized in the following table

21

21

EPEC Financing PPPs with project bonds – issues for public procuring authorities October 2012

• Pre-OJEU : assess if the project fits for project bonds

• OJEU : mention the possibility of project bonds

• Bid invitations:

o open to / request project bonds offers

o set the terms of arrangers’ letters of support

• Bid submissions : assess offers

• BAFO Invitations :

o request pre-rating and support letters (placement strategy and

pricing building blocks)

o provide indicative bond pricing data

• BAFO submissions

• Preferred bidder phase:

o opt for a financing solution

o final rating

o set price range and monitor pricing

• Financial close

European Investment Bank Project bonds – a guide

21 December 2012 page 24/27

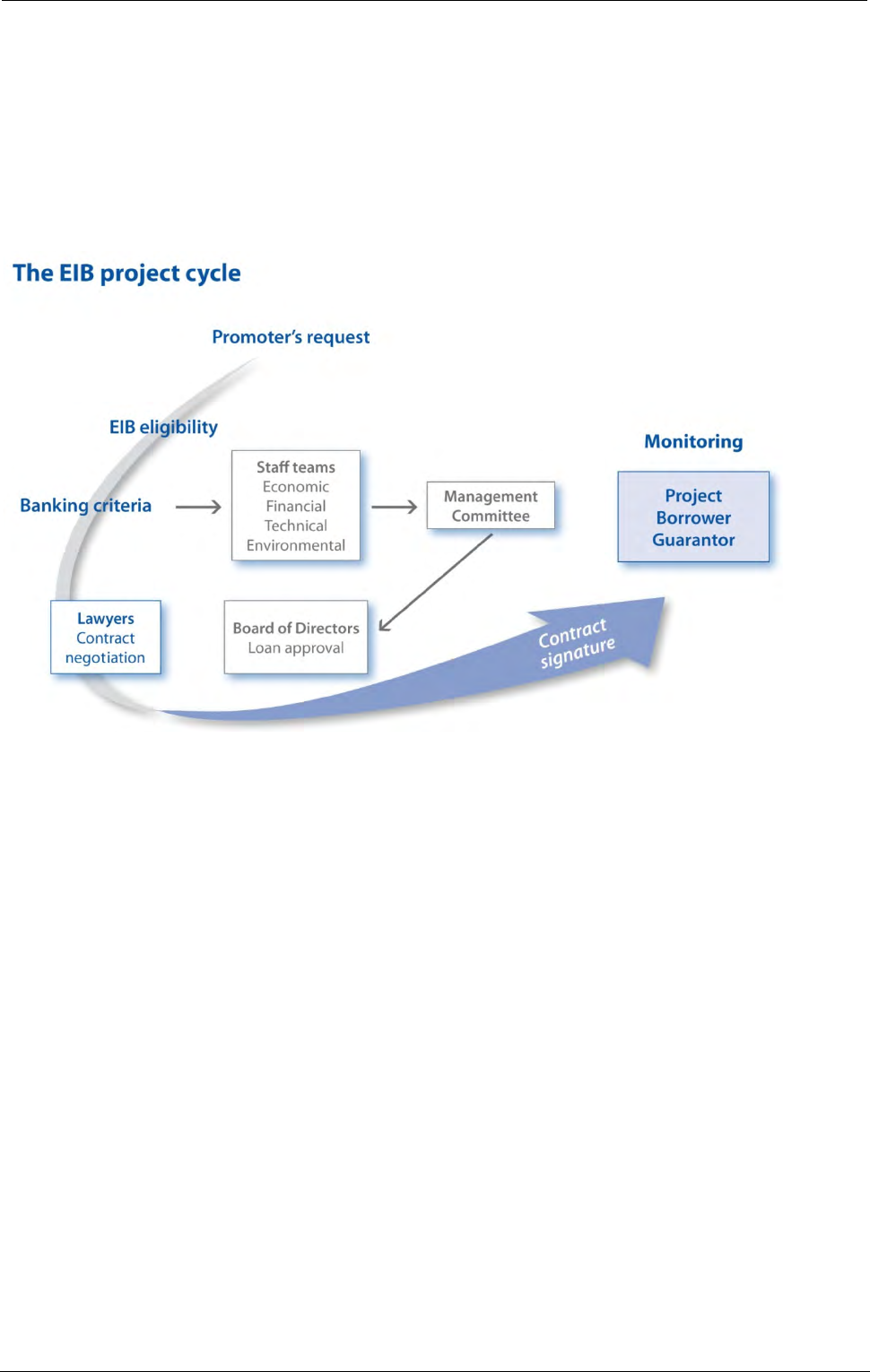

Annex : The EIB project Cycle

Project Appraisal is carried out by the EIB’s teams of engineers, economists and financial anylists, in close

cooperation with the promoter. Please note that EIB can also be involved earlier in the project if the

procuring authority contacts our Services.

Criteria for a typical EIB appraisal are tailored to each specific project. Results are included in the project

report to the Board of Directors for a financing decision.

Eligibility and overall quality and soundness of projects are being appraised by EIB services. The EIB

finances projects in most sectors, eligible projects contribute to EU economic policy objectives like promotion

of economic and social cohesion in the EU, improvement of EU transport and telecommunications

infrastructure, secure energy supplies etc.

With regards to the Project Bond Initiative, EIB will explicitly concentrate, as described previously, on

projects in the areas of transport (TEN-T), energy (TEN-E) and broadband / information and communication

technology (ICT).

Project quality is based on

Technical scope: definition of the project’s “technical description”, technical soundness innovative

technology, risks and mitigation measures, information on capacity for products/ services;

Implementation: promoter capability to implement the planned project, information on timing and

employment during operational life

Procurement: compliance with applicable legislation and EIB guidelines

Environmental impact: compliance with applicable legislation, information on environmental impact

assessment

Market and demand: analysis of the market and demand of the project’s products/services over the

project’s life.

European Investment Bank Project bonds – a guide

21 December 2012 page 25/27

Investment costs: information on project costs and its detailed components, comparison with cost of similar

projects

Profitability: information on financial profitability and related indicators (e.g. rate of return), information on

economic profitability.

This information together with EIB’s financial analysis, and in the case of PBCE, extensive structuring work,

are subsequently assessed from a credit risk point of view.

Once financed, the projects progresses are regularly monitored. A financial monitoring, physical monitoring

and ex post evaluations reports enable EIB Group to draw lessons from past experience.

European Investment Bank Project bonds – a guide

21 December 2012 page 26/27

FAQs

A set of Frequently Asked Question will be maintained on EIB’s Project Bonds website. Questions can be

sent to projectbonds@eib.org

.

Please note that questions may be posted (anonymously) on EIB’s

website http://www.eib.org/products/project-bonds/index.htm

European Investment Bank Project bonds – a guide

21 December 2012 page 27/27

Further information:

For additional information on the 2020 Project Bond Initiative, see the EIB’s website

at: http://www.eib.org/infocentre/press/news/all/the-europe-2020-project-bond-initiative.htm

;

For specific information for public authorities, see "Financing PPPs with Project Bonds - Issues for public

procuring authorities"

at:

http://www.eib.org/epec/resources/Financing%20PPPs%20with%20project%20bonds%20-

%20October%202012.pdf;

For information on the pilot phase, see the Europa website:

• On 10 July, ECOFIN issued country-specific recommendations on the economic and fiscal policies of

the Member States and a recommendation for the Eurozone as a whole. Furthermore, it gave the go-

ahead to the PBI pilot

phase: http://consilium.europa.eu/uedocs/cms_data/docs/pressdata/en/ecofin/131686.pdf

• The pilot phase of the Europe 2020 Project Bond Initiative

at: http://ec.europa.eu/economy_finance/financial_operations/investment/europe_2020/index_en.htm

• Q&A “A pilot for Europe 2020 Project Bond Initiative - legislative proposal adopted by the Commission

- Memo/11/707

at:

http://europa.eu/rapid/pressReleasesAction.do?reference=MEMO/11/707&format=HTML&aged=0&

language=EN&guiLanguage=en

For background information, see previous related documents:

• The press release announcing the initiative

(28/02/2011):

http://europa.eu/rapid/pressReleasesAction.do?reference=IP/11/236&format=HTML&ag

ed=0&language=FR&guiLanguage=en

• Introduction, Q&A and results of the consultation (Spring

2011): http://ec.europa.eu/economy_finance/consultation/europe_2020_en.htm

© EIB –12/2012 – © EIB GraphicTeam

Contacts

For general information:

Information Desk

Corporate Responsibility and

Communication Department

3 (+352) 43 79 - 22000

5 (+352) 43 79 - 62000

U info@eib.org

European Investment Bank

98 -100, boulevard Konrad Adenauer

L-2950 Luxembourg

3 (+352) 43 79 - 1

5 (+352) 43 77 04

www.eib.org

The EU Bank