Case Study

BELIZE BLUE BONDS FOR

OCEAN CONSER

VATION

© Alejandro Velasco/TNC Photo Contest

CS SUD: BI DB CONSION O MIN CONSION | 1

Executive Summary

In November 2021, The Nature Conservancy (TNC) and the

Government of Belize (Belize) announced the completion of

a USD 364 million debt conversion for marine conservation

that reduced Belize’s debt by 12 percent of GDP, created

long-term sustainable financing for conservation, and

locked in commitment to protect 30% of Belize’s ocean, in

addition to a range of other conservation measures. The

transaction is the world’s largest debt refinancing for ocean

conservation to date.

The debt conversion enabled Belize to repurchase USD

553 million, a quarter of the country’s total public debt,

from bondholders at a 45% discount through a “Blue

Loan” arranged by TNC. The “debt conversion” resulted in

a USD 189 million reduction in principal outstanding. The

savings achieved in the refinancing allowed Belize to create

an estimated USD 180 million in conservation funding over

20 years, composed of annual cashflows from the govern-

ment and an endowment capitalized through the Blue Loan.

As part of the transaction, Belize committed to ocean con-

servation undertakings, including placing 30% of its ocean,

including parts of the Mesoamerican Reef, under protec-

tion by 2026, using a transparent, participatory Marine

Spatial Planning process, and establishing an independent

Conservation Fund to allocate the conservation funding to

in-country partners.

The financial transaction was arranged by NatureVest,

TNC’s impact investment unit, in support of TNC’s Blue

Bonds for Ocean Conservation strategy. Credit Suisse

arranged and financed the Blue Bond. The structure

was credit enhanced by the United States International

Development Finance Corporation (DFC) and incorporated

a commercial parametric insurance policy to mitigate the

financial impact of natural disasters.

The transaction was recognized in Environmental Finance’s

2022 Bond Awards, winning the sovereign sustainability

bond of the year and the award for sustainability bond

structure innovation.

Transaction Highlights

Key

Transaction

Components

• Belize repurchased 100% of its

“Superbond” at a 45% discount

• A TNC subsidiary provided the Blue

Loan to finance the repurchase

• DFC provided Political Risk Insurance

wrap on Blue Loan

• Credit Suisse financed the Blue Bonds,

which funded the TNC subsidiary to

make the Blue Loan

• Blue Bonds Moody’s rating: Aa2

• Belize committed to achieving marine

conservation targets and using a

portion of the financing savings to fund

conservation over 20 years

Key

Conservation

Impact

• 30% of ocean area under protection

by 2026, half in high biodiversity

protection zones

• Science-based, participatory Marine

Spatial Planning to design protected

areas and ocean management plans

• Creation of a Conservation Fund

Conservation

Finance

• USD 4.2 M per year (on average)

• USD 23.5 M endowment to grow to

USD 92 M (est.) by 2041

Blue Loan

Transaction

• Original Superbond: USD 553 M

• Superbond repurchase price: 0.55c

on dollar

• New Blue Loan: USD 364 M

• Principal reduction: USD 189 M

• Blue Loan IRR: 6.1% (inclusive of

all insurance premiums, fees,

reserves, etc.)

• Maturity extension: 6.5 years

CS SUD: BI DB CONSION O MIN CONSION | 2

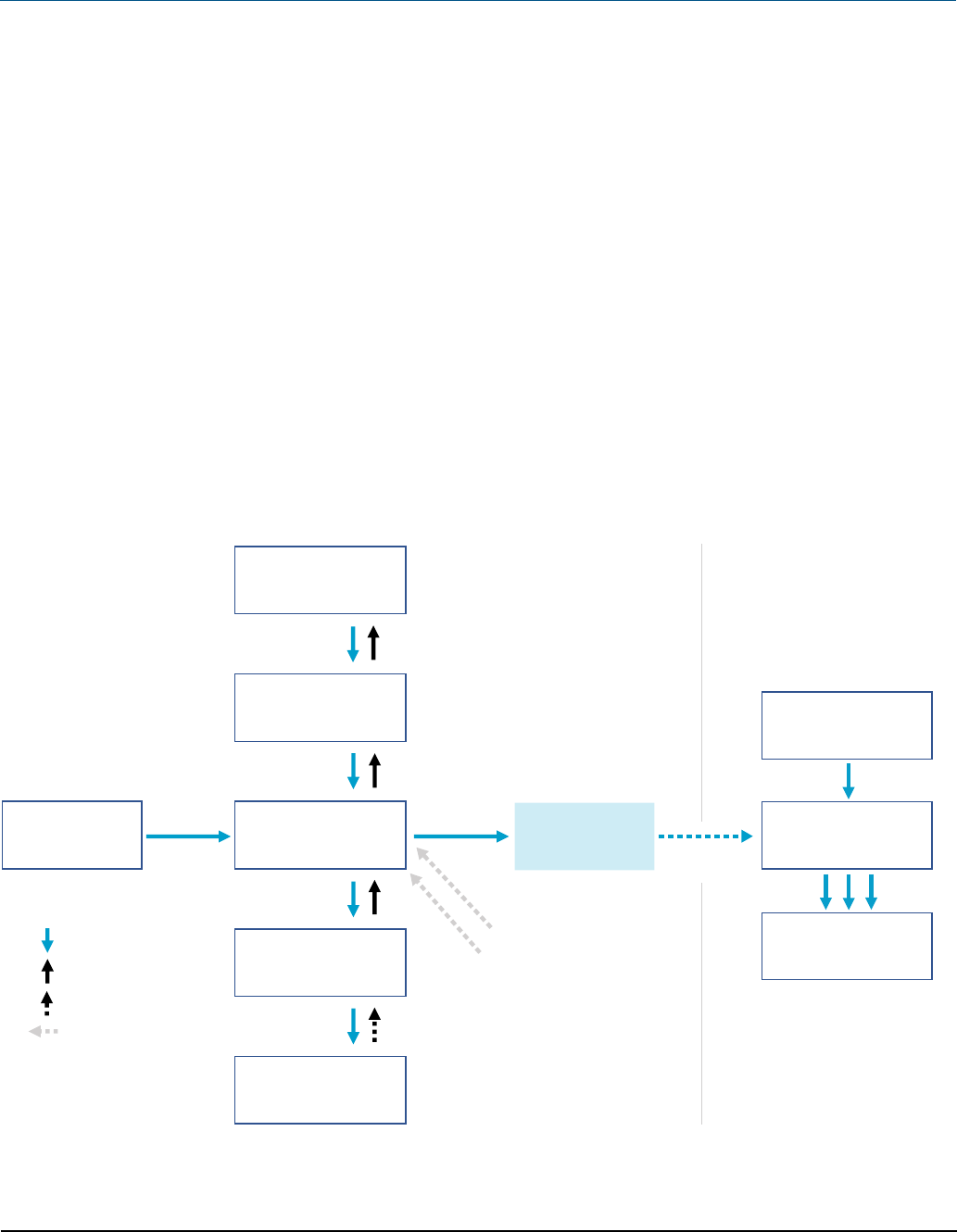

How the Transaction Worked

Belize had USD 553 million in a single Eurobond known

as the “Superbond”, as it represented all of Belize’s exter-

nal commercial debt and a quarter of its total debt. The

Superbond was trading at a deep discount (see graphic on

page 3) due to bondholder concerns over Belize’s ability to

pay given an economic slowdown and high debt burden.

As a result of this transaction, Belize was able to source

funding and negotiate the repurchase of the Superbond at

55 cents on the dollar.

Belize could not borrow the funds in the market to pay

the bondholders as the interest rate would have been too

high to create savings. At Belize’s request, TNC arranged

an innovative financial structure, the DFC-insured Blue

Loan between the Belize Blue Investment Company (BBIC)

and Belize, that allowed the country to repurchase the

Superbond. The DFC credit enhancement allowed BBIC to

raise funding from Credit Suisse via the issuance of highly-

rated Blue Bonds and pass through below-market rates

to Belize.

The Superbond refinancing created both immediate

and longer-term fiscal savings for Belize. Belize signed a

Conservation Funding Agreement with BBIC committing to

finance marine conservation eorts over 20 years. These

payments are transferred to an independent Conservation

Fund in Belize and mostly paid in Belizean dollars. Belize

also capitalized an endowment for the Conservation Fund

via borrowing from the Blue Loan. Drawdowns from the

endowment are expected to replicate Belize government’s

payments after year 20 when the Conservation Funding

Agreement expires. Finally, Belize agreed to significant

ocean protection commitments (as discussed in more

detail below).

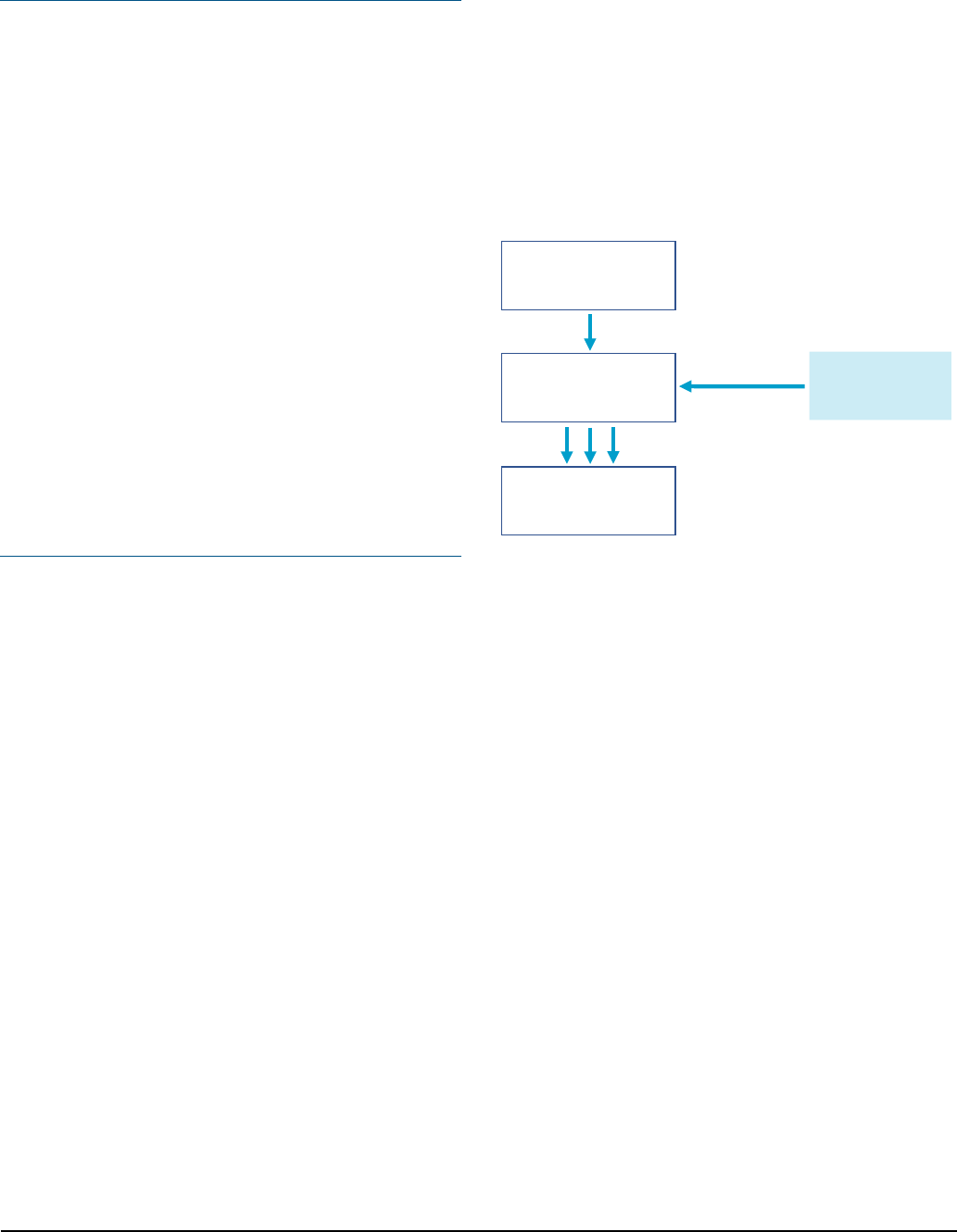

Government of

Belize

DFC Credit Wrap

Financing

Equity Transfer

in 2041

Blue Bonds (Aa2)

Issuer Loan

Blue Loan

Repurchase

Payment

Repayment

Retirement

Insurance Policy

Superbond

Holders

BBIC

(TNC subsidiary)

Parametric Policy

TNC

Endowment

Blue Bond 1. Blue Loan &

Blue Bond

2. Conservation

Funding Agreement

Investors

Credit Suisse

(via Platinum)

Conservation

Fund

Government of

Belize

Program

Activities

Belize Blue Loan/Blue Bond & Conservation Funding Agreement Structure

CS SUD: BI DB CONSION O MIN CONSION | 3

Background

1 For more see: https://www.nature.org/en-us/what-we-do/our-insights/perspectives/an-audacious-plan-to-save-the-worlds-oceans/

2 Source: S&P Capital IQ

TNC is the world’s largest conservation organization

currently working in over 70 countries with a mission to

conserve the lands and waters upon which all life depends.

TNC’s Blue Bonds for Ocean Conservation Strategy works with

countries to refinance a portion of their national debt to

reduce debt burden, use the savings to secure funding for

conservation activities, and allow countries to achieve their

conservation goals.

1

The strategy targets commitments for

600,000 km

2

of new ocean protection and 4 million km

2

under improved ocean management. The strategy also

seeks to leverage approximately USD 40 to 60 million in

donor support to generate an estimated USD 1.6 billion

in marine conservation finance. The strategy consists of

multiple integrated parts:

1. TNC works with countries to identify their conservation

commitment goals including a timebound plan to put

30% of its ocean areas, including coral reefs, seagrass

beds, mangroves, and other important marine habitats,

under protection

2. TNC arranges the debt conversion that refinances

debt on better terms to create savings to convert into

conservation finance and monitors repayments of the

new loan

3. TNC helps countries create a Marine Spatial Plan work-

ing with stakeholders to identify activities that combine

conservation and sustainable economic opportunities

4. TNC works with local stakeholders to lead the design

and establishment of an independent Conservation

Fund to disburse the funding to conservation partners

and programs

The relationship between Belize and TNC has spanned three

decades, including TNC’s first Debt for Nature Swap in 2001

protecting 23,000 acres of forest and the recent purchase of

236,000 acres of the Selva Maya’s tropical forest in north-

western Belize. TNC’s history in Belize is built on strong

partnerships with Government, NGOs, communities, and

the private sector with a shared vision for sustainable man-

agement and protection of the country’s natural resources.

These partnerships include the development of sustainable

fisheries and mariculture programs and innovative financing

mechanisms though carbon development programs.

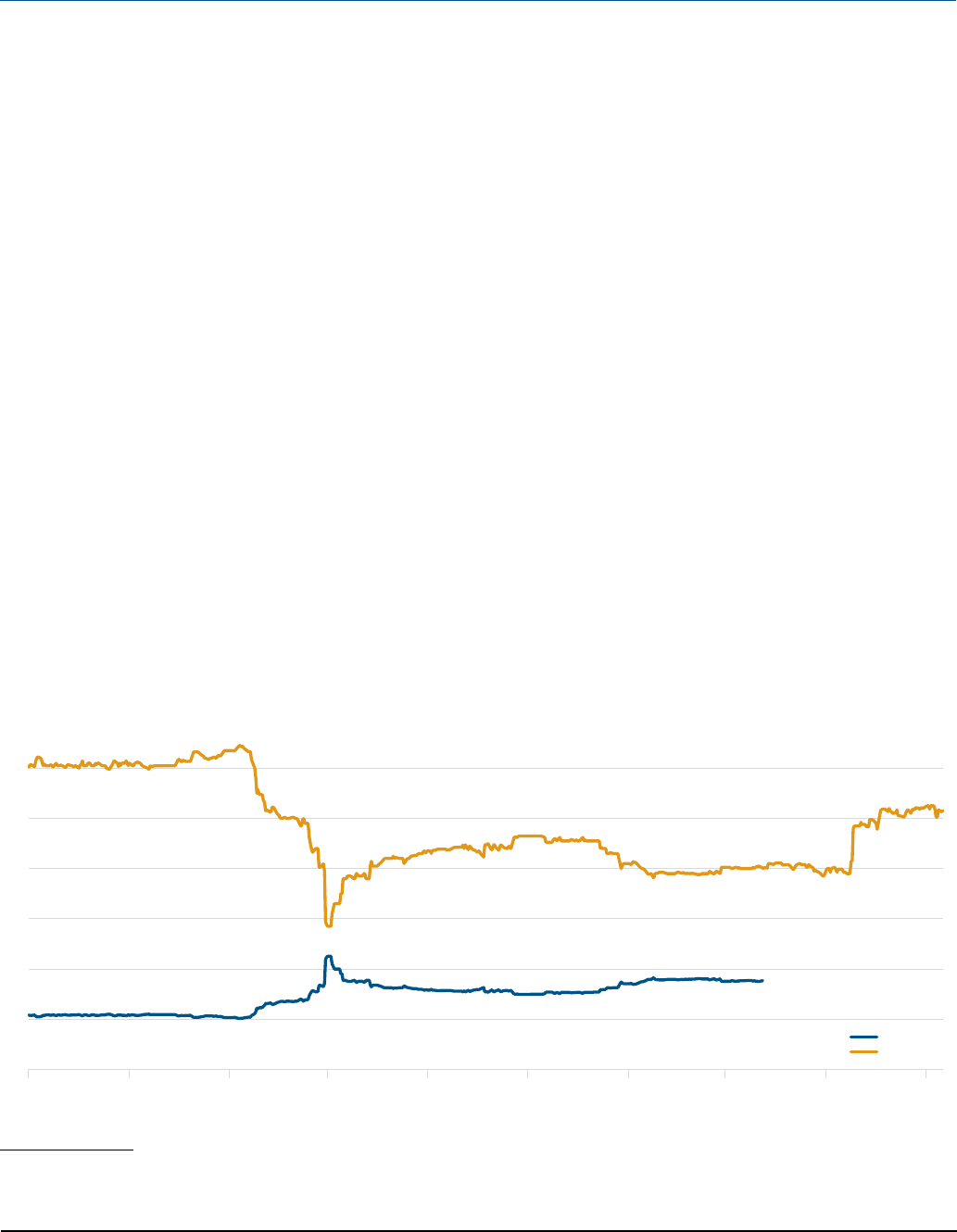

The Belize economy, heavily dependent on tourism and

hard hit by the Covid-19 global slowdown, contracted by

16.7% in 2020 and the debt equaled 133% of GDP. Belize

was in negotiations with bondholders to defer payments on

the Superbond, which was trading between 38-47 cents on

the dollar. Given these factors, the Government of Belize

initially started discussions with TNC on refinancing the

Superbond in mid-2020 but discontinued. After a pause

around the national elections in late 2020, Belize restarted

discussions with TNC and, upon extensive negotiations

with TNC and the external commercial bondholders, the

transaction successfully closed in early November 2021.

Belize Superbond 2034 Historical Price and Yield through Retirement

2

0

10

20

30

40

50

60

70

Aug 19 Nov 19 Feb 20 May 20 Aug-20 Nov 20 Feb 21 May 21 Aug 21 Nov 21

Yield

Price

CS SUD: BI DB CONSION O MIN CONSION | 4

Financial Results of the Debt Conversion

Debt Benefits:

» USD 189 million debt stock reduction: USD 553 million

(Superbond) refinanced into USD 364 million (Blue Loan)

» USD 200 million total debt service reduction over 20

years (USD 53.6 million debt service reduction over

initial five years)

» Avoidance of a USD 58.4 million principal

reinstatement—part of agreement from previous

Superbond restructuring that would add back the

negotiated haircut in a default

» 6.5 year extension of debt tenor; increase in weighted-

average life of 3.7 years

» Standard & Poor’s upgrade of Belize’s unsecured foreign

currency credit rating from Selective Default to B- post

refinancing

Conservation Finance Benefits:

» USD 180 million (estimated) of Conservation Financing

created over 20 years comprised of:

• USD 84 million for conservation finance over 20 years;

USD 4.2 million (annual average)

• USD 23.45 million pre-funded endowment, borrowed

by Belize through the Blue Loan

• USD 71 million in anticipated market return (estimated

at 7% annually) over 20 years

» Creation of an independent Conservation Fund to

manage conservation funding

Conservation Commitments

As part of the transaction, Belize, with the support of TNC,

committed to implement pre-defined ocean conservation

milestones. The milestones are time-bound and delays in

achieving the commitments will result in increased pay-

ments under the Conservation Funding Agreement. The key

conservation commitments are:

» Increase in Biodiversity Protection Zones from 15.9%

to 30% of ocean area by 2026—half in high protection

areas (Replenishment Zones) and half in medium

protection areas (Multi-use Zones)

» Completion of a Marine Spatial Plan by 2026 (initiated

in 2022)

3

For full list see: https://www.nature.org/en-us/about-us/where-we-work/latin-america/belize/belize-blue-bond/

» Protection of the public lands within the Belize Barrier

Reef Reserve System, a UNESCO World Heritage Site, as

mangrove reserves

» Revision and implementation of Belize’s Integrated

Coastal Zone Management Plan to include marine and

coastal biodiversity osets

» Application for three formally designated marine

protected areas as International Union for Conservation

of Nature (IUCN) Green List Areas

» Other (non-legally binding) conservation commitments,

including creation of a national blue carbon policy

framework, regulatory framework for high value,

sustainable aquaculture, mariculture, as well as a

governance framework for domestic and high seas

fisheries consistent with transparent, science based,

socially responsible international best practices

3

Marine Spatial Plan

TNC will facilitate Belize’s undertaking of a stakeholder-

driven Marine Spatial Plan. The plan will determine

where to expand ocean protection and management to

cover 30% of Belize’s oceans and best deliver benefits to

people, livelihoods, and biodiversity. This process involves

stakeholders representing local communities, fishing

associations, tourism businesses and government ocials

and uses a transparent and science-based framework

to guide planning. Stakeholder engagement is critical to

ensure that the Marine Spatial Plan will sustainably support

the country’s economy while protecting marine habitats.

Conservation Fund

TNC will help establish an independent Conservation

Fund in Belize to disburse funding generated through the

Conservation Funding Agreement (and potential future

sources). The funds will go to projects and partners

working in Belize to achieve conservation outcomes that

are in alignment with the conservation commitments and

Belize’s national conservation priorities. Both government

and non-governmental actors, including non-profit

organizations, civil society, academia, and the private sector,

shall be eligible to apply for funding. A funding allocation

will be earmarked for the government in support of the

conservation commitments. The Conservation Fund will be

established in 2022 pursuant to an extensive stakeholder

engagement process coordinated in collaboration with the

Ministry of Blue Economy & Civil Aviation. The fund will

CS SUD: BI DB CONSION O MIN CONSION | 5

have a Board of nine directors appointed from government

and the non-government sectors (academia, fisheries,

tourism, and NGOs) and at all times will be an independent

legal entity with a majority non-government representation.

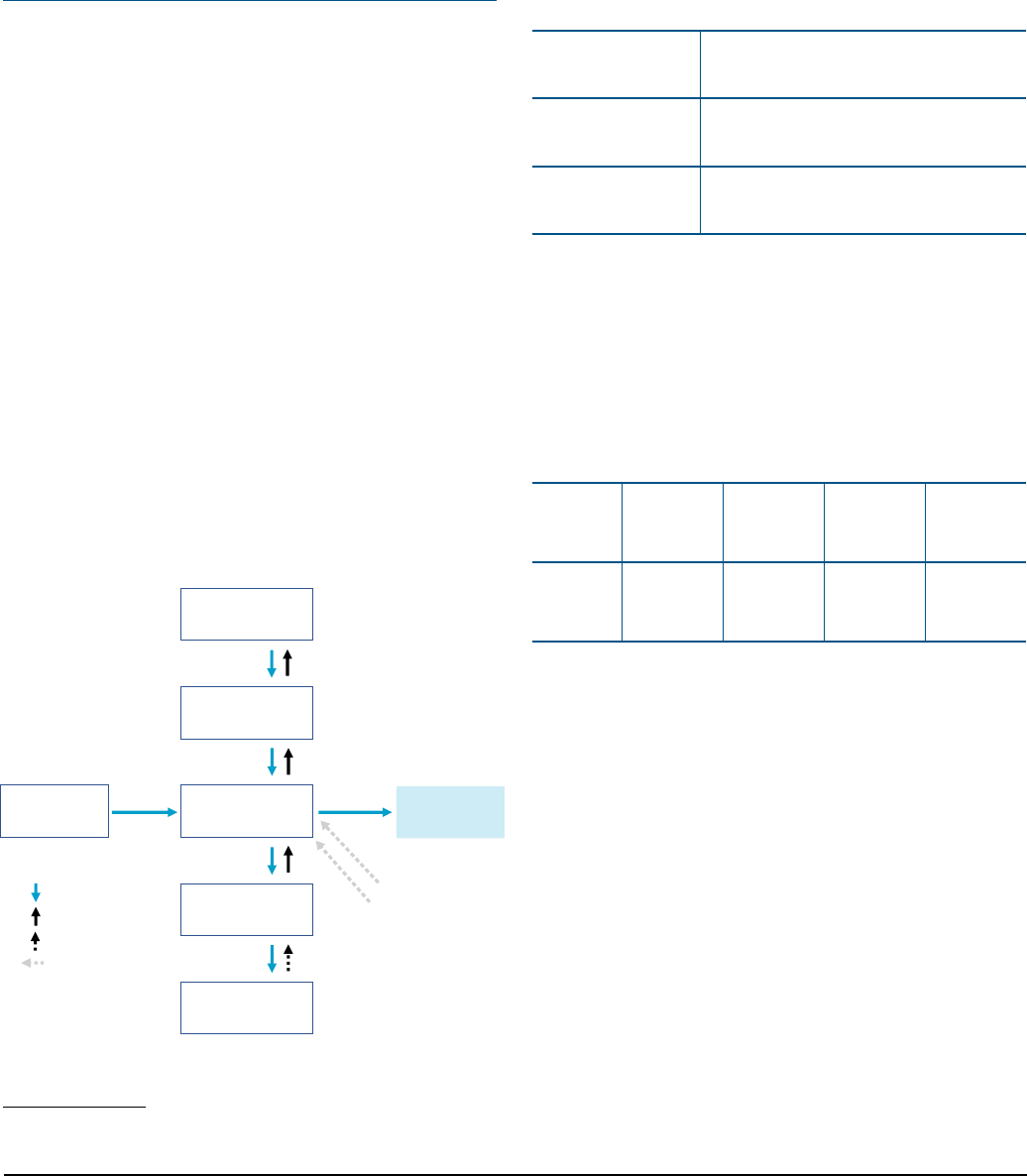

The Transaction Structure

The transaction had two key pillars: 1. the debt conversion

(centered on the Blue Loan) used to finance Belize for the

repurchase and retirement of the Superbond, and 2. the

conservation financing (based on the Conservation Funding

Agreement) committing Belize to long-term conservation

financing to the Conservation Fund and adherence to the con-

servation commitments. The Blue Loan and the Conservation

Funding Agreement have cross-default provisions.

The Debt Conversion

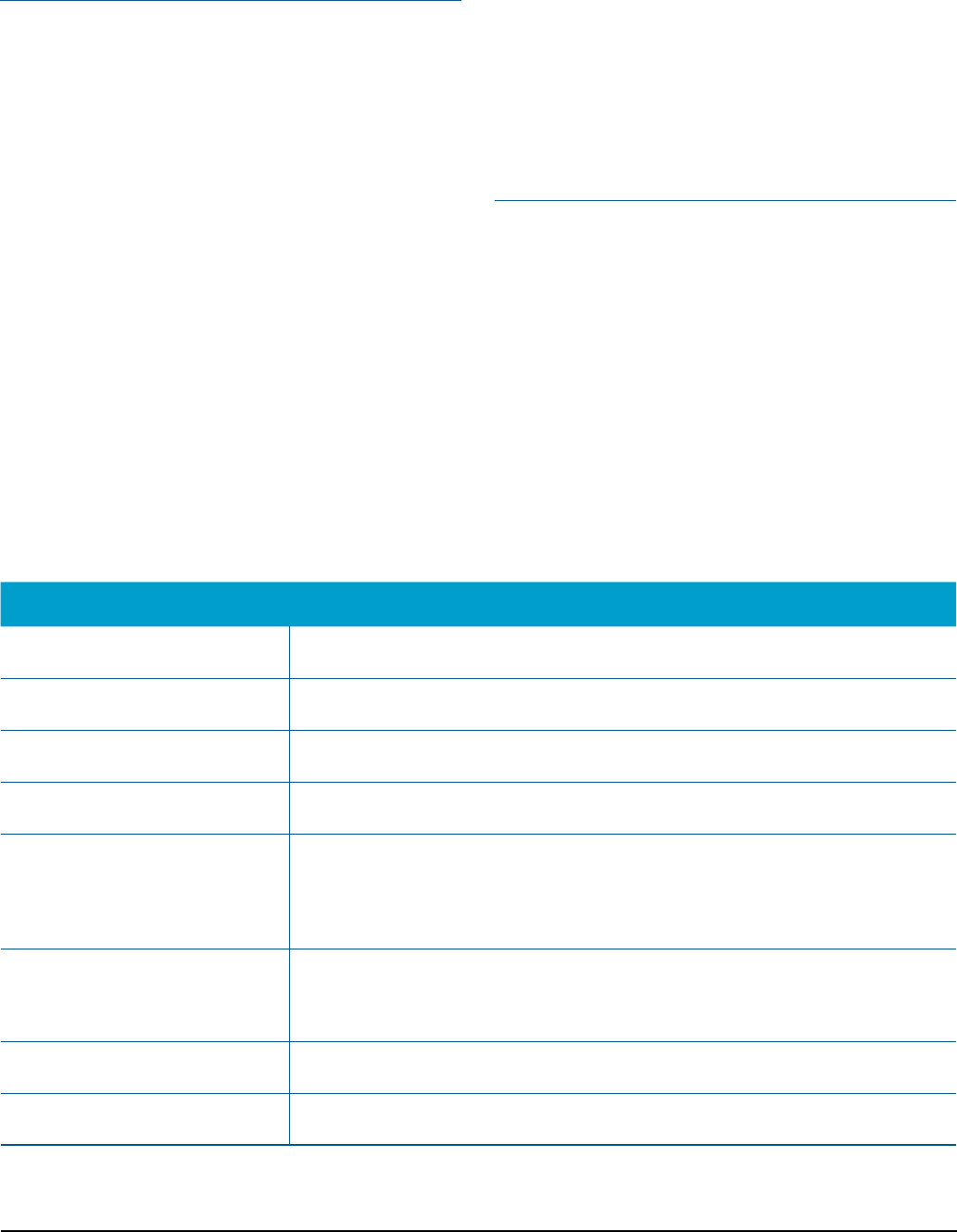

The debt conversion structure is a series of back-to-back

financial transactions, including the Blue Loan and Blue

Bonds, as displayed in the graphic below. To facilitate

the transaction, TNC formed a subsidiary called BBIC (a

Delaware limited liability company) to act as the lender of

record of the Blue Loan. BBIC wrote the Blue Loan to Belize

to finance the purchase and retirement of the Superbond in

full. Credit Suisse fully financed BBIC via the issuance of the

Blue Bonds by a repackaging vehicle (Platinum) which Credit

Suisse syndicated to institutional investors post-closing.

Debt Conversion Transaction Diagram

4 https://www.moodys.com/research/Moodys-assigns-a-definitive-Aa2-rating-to-Platinums-Blue-Bonds--PR_457728

BBIC provided USD 364 million to the Government of Belize

via the Blue Loan with the retirement of the Superbond

as the primary use of funds. In addition, the Blue Loan

financed the Conservation Fund’s initial endowment, a debt

service reserve account, and certain transaction costs.

Components of the $364 million Blue Loan financing:

USD 301 million

Retirement of the $553 million

Superbond at ~55 cents/dollar

USD 24 million

Prefunded Conservation Fund

endowment

USD 39 million

Liquidity reserves, transaction costs,

and original issue discount

The Blue Loan was issued with an original issue discount

and a step-up semi-annual coupon shown in the table below.

The step-up coupon and discount structure reduced the

near-term debt payments to align with Belize’s debt sustain-

ability strategy. The tenor of the amortizing loan is 19 years

with a grace period of principal payments of 10 years.

Blue Loan Step-up Coupon Schedule:

Date

April

2022

April

2023

April

2024

April

2026

onward

Coupon

Rate

3.0% 3.55% 5.15% 6.04%

The DFC political risk insurance covers Belize’s payment of

the Blue Loan to BBIC. BBIC also holds the parametric insur-

ance policy (see below). Credit Suisse solely financed BBIC,

with a loan of USD 364 million, via a repackaging vehicle

(Platinum) which issued RegS/144A Blue Bonds. Due to

the DFC credit enhancement of the Blue Loan, coupled with

the back-to-back legal structure, funded reserve accounts,

and other enhancements, the Blue Bonds received an Aa2

rating from Moody’s Investor Service.

4

Post-closing, Credit

Suisse successfully placed the Blue Bonds with institutional

investors globally. The syndication received high interest

from investors and was multiple times oversubscribed.

TNC supported the transaction through equity funding

to its subsidiary that covered part of the liquidity reserve

requirements. The TNC participation is covered under the

DFC’s Political Risk Insurance policy.

Government of

Belize

DFC Credit Wrap

Financing

Blue Bonds (Aa2)

Issuer Loan

Blue Loan

Repurchase

Payment

Repayment

Retirement

Insurance Policy

Superbond

Holders

BBIC

(TNC subsidiary)

Parametric Policy

TNC

Equity

Endowment

Blue Bond

Investors

Credit Suisse

(via Platinum)

CS SUD: BI DB CONSION O MIN CONSION | 6

Political Risk Insurance

The Blue Loan is covered by a DFC political risk insurance

policy covering “non-payment of an arbitral award” and

“denial of justice”. Belize and TNC agreed to arbitration under

the International Chamber of Commerce’s expedited proce-

dure provision. Belize became a signatory of the New York

Convention in March 2021, which was necessary to ensure

enforceability of an arbitral award. As DFC is the develop-

ment finance institution of the United States government,

the policy is supported by the full faith and credit of the

United States. The DFC policy covers 100% of an arbitration

award arising from loan default and was heavily supported

by private market reinsurers organized by Alliant Insurance

Services. The structure has a 24-month debt service reserve

account, consisting of part cash and part investments, to

ensure Blue Bond interest payments and legal and other fixed

costs will be met during the arbitration process.

The political risk insurance cover, supported by the exten-

sive reserve accounts, facilitated the Moody’s Aa2 rating

for the transaction compared to Belize’s sovereign rating of

Caa3 at the time (a 16 notch rating upgrade).

Parametric Catastrophic Insurance

The Blue Loan structure incorporates the world’s first com-

mercial sovereign debt catastrophe insurance cover. The

Belize economy is highly exposed to economic slowdown

and reduced government revenues resulting from hurri-

canes and large storms. The parametric insurance policy

provides coverage for a Blue Loan debt payment (coupon

and principal) following an eligible hurricane event in Belize.

The payment can be triggered in several ways: 1) based on

the intensity of the hurricane (minimum of Category 3) and

proximity to economic hubs—meaning larger storms can

be further away and still trigger payment; 2) the occurrence

of two hurricanes of any intensity in the same 12-month

period; or, 3) a hurricane of any intensity accompanied

by very heavy rainfall. The policy was designed by Willis

Towers & Watson and underwritten by a subsidiary of

Munich Re. The initial insurance policy covers up to May

2024 (and is expected to be rolled forward over time).

Conservation Funding Agreement

Belize committed to channel a portion of the savings

from the transaction into long-term financing for marine

conservation via the Conservation Funding Agreement.

The 20-year agreement, signed between Belize and TNC,

creates financing to defray the cost of implementing the

conservation commitments. Belize will pay an average of

USD 4.2 million equivalent in local currency per year to the

Conservation Fund. The funds will be disbursed as grants

to government agencies, NGOs, and local businesses and

partners working on marine conservation and related “blue

economy” projects. This agreement more than triples the

pre-transaction government budget allocated to marine

conservation.

Conservation Funding Agreement

The USD 23.5 million pre-funded endowment, capitalized

through the Blue Loan, will ensure funding for conserva-

tion activities after the Conservation Funding Agreement

expires. Assuming a 7% annual return on investment, the

endowment will grow to over USD 90 million by the end

of 20 years. The annual flows plus the ending value of

the endowment create an estimated USD 180 million for

marine conservation over 20 years.

The Conservation Funding Agreement has a cross-de-

fault provision with the Blue Loan. If Belize does not meet

its payment obligations, both the Conservation Funding

Agreement and the Blue Loan will enter into default.

The government’s conservation commitments are covered

in the Conservation Funding Agreement. If Belize does not

achieve a conservation milestones by the agreed date (and

additional grace period), the annual conservation pay-

ment will increase by USD 1.25 million per year for the first

missed milestone and an additional USD 250,000 for each

additional missed milestone.

Conservation

Fund

Government of

Belize

Program

Activities

Endowment

transfer in 2041

CS SUD: BI DB CONSION O MIN CONSION | 7

Innovation

This transaction is a replicable model for achieving con-

servation and climate outputs and creating sustainable

conservation funding. The transaction was innovative in

several ways:

1. Refinancing of Sovereign Commercial Debt at Scale:

The transaction proved that debt conversions for con-

servation and climate can be accomplished targeting

commercial debt at scale. Previous Debt for Nature

Swaps were mostly small (typically less than USD 50

million) and refinanced bilateral (government-to-gov-

ernment) lending. The Belize debt conversion

refinanced external commercial debt—often the most

expensive and burdensome debt for a country due to

higher interest rates. This product allows countries

to take advantage of discounts available in the capital

market and therefore does not require negotiating

write-os from ocial bilateral creditors. This trans-

action adds another tool to the conservation finance

toolbox.

2. Use of Debt Conversion for Conservation to Assist

Debt Sustainability: The IMF stated that the debt

conversion was one of two key reasons Belize made

“significant progress towards restoring debt sustain-

ability in 2021.”

5

While the IMF also stated that Belize’s

debt would remain unsustainable “in the absence of

additional measures”, the debt conversion reduced the

public debt by 12 percent of GDP and helps support the

Belize fiscal strategy, mapped out in its Medium-Term

Recovery Plan, seeking to reduce public debt to 85

percent of GDP in 2025. The conservation flows, which

absent the transaction would have been paid to exter-

nal creditors in USD, will be paid in local currency and

recirculated back into the local economy creating much

needed economic stimulus.

3. Use of Political Risk Insurance: The transaction was

the first structure to utilize the combination of Arbitral

Award Default and Denial of Justice policies from

DFC for environmental protection and conservation

financing.

4. Investor Class Substitution: The DFC credit enhance-

ment facilitated the Aa2 Moody’s credit rating on the

Blue Bonds which allowed Credit Suisse to place the

bonds with institutional investors seeking low risk

assets. The investor market for Aa2 paper, consisting

5 Belize: Sta Concluding Statement of the 2022 Article IV Mission, IMF. February 24, 2022.

6 Belize: Sta Concluding Statement of the 2022 Article IV Mission, IMF. February 24, 2022.

7 University of Cambridge Institute for Sustainability Leadership (CISL, 2021). Risk Sharing in the Climate Emergency: Financial regulation for a

resilient, net zero, just transition. https://www.cisl.cam.ac.uk/news/new-report-calls-risk-sharing-be-expanded-urgently-response-climate-emergency

of global insurance companies, pension funds, high-

net-worth individuals, asset managers, is significantly

larger than the (distressed) emerging market bond

market. This larger investor pool has strong demand

for Environmental, Social, and Governance (ESG) linked

bonds. Moving from distressed high-yield investors

to the Aa2 segment allows for the identification of

investors with the highest ESG appetite to lower the

cost of borrowing, which in turn unlocks more funding

for conservation.

5. New Method of ESG Verification: The involvement

of TNC in multiple aspects of the transaction pro-

vides high-level comfort to Blue Bond investors and

credit enhancers seeking verification of ESG outputs.

Investors require verification that the conservation

promised from Blue Bonds, and similar instruments

such as Green Bonds and Sustainability Linked Bonds,

will be achieved and that the sustainability achieve-

ments will be properly audited and reported. The

involvement of TNC in the project (arranging the debt,

negotiating the conservation commitments, leading the

marine spatial planning, establishing the Conservation

Fund, monitoring and reporting on the conservation

milestone achievements, enforcing any fees on missed

milestones, etc.) for the full 20 years provides a very

high level of comfort that conservation outcomes will

be achieved. Separately, as the structure is based on

existing bondholders’ exit of positions, a mechanism

to acknowledge and certify a seller’s role in an ESG

transaction could increase motivation to participate in

the tender process.

6. Commercial Parametric Insurance: The transaction

introduced the first use of commercial catastrophe

insurance for a sovereign debt issue. Unlike provi-

sions found in some Caribbean sovereign bonds that

allow sovereign borrowers to defer bond payments in

the event of a natural disaster, this policy allows the

government to maintain the original debt repayment

schedule. The parametric insurance directly addresses

the IMF warning that natural disasters present a key

risk to Belize.

6

Moreover, the inclusion of the paramet-

ric cover follows recent market guidance to integrate

climate insurance products into sovereign debt issu-

ances to improve financial management.

7

CS SUD: BI DB CONSION O MIN CONSION | 8

Scalability/Replicability

The TNC debt conversion structure is highly scalable and

replicable. Transaction sizes and overall market are limited

by three criteria:

1. Countries committed to achieving the conservation

outcomes: as the threat of climate change and aware-

ness of the role that natural resources and biodiversity

play in economic growth rapidly increase, most devel-

oping countries will require additional financing for

conservation.

2. Availability and aordability of credit enhancement:

DFC can replicate the insurance structure in other

countries and other bilateral and multilateral develop-

ment finance institutions can consider providing similar

risk mitigation products (e.g., credit guarantees) to do

more deals in more markets.

3. Availability of debt to refinance: while debt conversions

work well with sovereign debt trading at a discount in

the capital markets, they are not exclusively for coun-

tries threatened by high debt distress. Many countries

have high-coupon bonds. Even if these trade at little

to no discount, they can still be refinanced with lower

coupons and longer tenors to create significant funding

for conservation. Many also have commercial bank

loans (or other liabilities) that, while not often traded in

the market, have high interest rates and/or short ten-

ors that may be candidates for refinancing into a lower

interest rate and/or longer tenor loans.

Transaction Participants

This transaction was made possible through the strong

collaboration of many participants. A special thanks is due

to all partner organizations/entities and the many individu-

als who committed their time, energy, and resources to see

this through to fruition.

Philanthropy is instrumental in supporting innovative debt

strategies and allowing TNC to help countries access

millions of dollars in long-term funding for conservation.

Donors who made TNC’s Blue Bonds strategy possi-

ble include: Becht Family Charitable Trust, Oceans 5,

MacKenzie Scott, TED Audacious Project, Je and Laurie

Ubben, and Wyss Foundation.

ROLE ENTITY

Deal Arranger The Nature Conservancy through NatureVest

Debtor Government of Belize

Blue Loan Lender Belize Blue Investment Company, LLC, a limited liability company subsidiary of TNC

Blue Bond Arranger & Funder Credit Suisse International

Political Risk Insurance Provider U.S. International Development Finance Corporation with approximately half of total

exposure reinsured by private insurers: AXA XL, Chubb, Fidelis, Sovereign, and others.

Insurance Broker: Alliant Insurance Services

Parametric Insurance Provider Munich Re (via Great Lakes Insurance SE)

Policy Design & Insurance Broker: Willis Towers Watson

Legal Advisors to TNC Shearman & Sterling; Ropes & Gray; DLA Piper; and Barrow & Co., LLP

Sovereign Debt Advisor to TNC Potomac Group